As we write these memos, they are starting to become a strange marker in the passage of time as we deal with the impacts of COVID-19 on our nation and the world. This week marks the eighth week in a row we’ve sent one of these updates. In a way, the first memo seems like it was written just yesterday. In another way it seems as though it was sent a lifetime ago. We’re certain you feel the same way. This hasn’t been easy on families financially, for sure, but it is also a stressful time for many other reasons. We hope, as families across the world have been celebrating Easter and Passover during the last week, you were able to take some time to relax, reflect, and connect with your loved ones.

As we dig in for another week, we wanted to relay a metaphor about this crisis that was told to us by a client this week (thanks, John!). It is one of the most apt we have heard when you consider how the market is reacting to the virus. We’ll try to paraphrase it as best we can:

“This is like when a tornado is coming for your home. Your first reaction is fear and panic as you race to your basement unsure whether you will live or die. Your second reaction, as you realize the twister has passed is euphoria as you realize “I’m still alive!”. Your third reaction, however, happens when you walk up the broken stairs from your basement, open the door, and realize all of the work you have ahead of you.”

This last week, it seems the market has reached the “Euphoria” phase of the twister metaphor. It didn’t seem that anything could derail the positive days in the market. Even Thursday (the last trading day of the week due to Good Friday), after the worst jobs report in the history of jobs reports – with more than 6.6 million people signing up for unemployment – the market was up nearly 1.5%. For the shortened week, the market was up more than 12%.

Please don’t misinterpret what we’re about to say, because we LOVE it when the market goes up. But we think it’s important for you to understand that the market is likely to have a few jitters when it climbs out of the basement and sees what shutting down the economy for a few months looks like.

What’s Everyone So Happy About?

First let’s discuss what had the market so excited last week. As we discussed in our last memo, the Fed and Congress did a decent job of putting a backstop on the economy (for now) – making sure people would be able to put a roof over their head and a meal in their belly. The next big risk was/is the headline risk of the virus itself. How bad would it get and when would it peak?

Just over a week ago, President Trump stood at the podium in the James Brady Press Briefing Room and announced, solemnly, that the United States may face deaths in the range of 100,000 – 200,000 citizens. While various models – including the IHME data we’ve sent you a few times now – were saying that, it was the first time the leader of the free world admitted it. The stock market didn’t like it.

But, since the end of last week, the model projections have begun to change. It’s important to note here that is not to say the models were wrong initially (it’s hard to say at this point) but is likely the impact of social distancing across the country in “flattening the curve”.

What a week ago was an expectation of well over 100,000 deaths, is now an expectation of just over 60,000 deaths. The peak, which was supposed to happen on April 15th nationwide, has been pushed back to April 11th (since passed), so we’ll see if that ends up being the case.

Frankly, that was the first bit of good news the market has had in a while. Then, when combined with the announcement of additional support from the Federal Reserve on Thursday and Administration officials starting to discuss putting the nation back to work “before Memorial Day”, the stock market just couldn’t help itself.

Additionally, the market was excitedly anticipating the news out of the OPEC+ negotiations that started Thursday. The process was choppy and took a little longer than expected. But the result was a historic deal to slash output by 9.7 million barrels a day. This should firm up oil pricing over the long-term and be beneficial to North American energy producers and our energy holdings in portfolios.

But, Insight, Isn’t That Good News?

Undoubtedly. The more lives we can protect right now the better. That must be the priority. And the second priority – getting our economy back up and running – is getting nearer by the day. We’re actually very optimistic over the long term. It’s the next few weeks and months of which we need to be careful.

First – while the peak of daily cases of COVID-19 has supposedly happened, we still have a long way to go to be past the disease. So far, nearly 22,000 Americans have died of COVID-19. If the estimate is 60,000, we still have a long and painful road ahead of us. Additionally, passing the peak doesn’t mean we get to forget all the new social distancing rules and throw the economy back into high gear. There is significant risk of secondary outbreak and we expect ongoing restrictions on the economy. We will get back to “normal” or some semblance of it. But that’s not going to happen quickly.

Secondly, the damage to the economy is done (and continuing to be done). But it’s not yet showing up in most economic reports or company balance sheets. There are still substantial unknowns.

Lies, D$%n Lies, and Statistics

We’ve talked before about how fundamentally wrong the “this time it’s different” thinking is when it comes to investing.Whenever the world is saying “it can’t get better” or “it can’t get worse”, our instinct must be to expect that sentiment to be wrong.

But in one sense, this time it is different. It’s different because there are no models or past experience on which to base so many of the expectations we’re seeing in the media today. There are good ideas and best guesses, but we don’t yet have hard facts.

The clearest example of this is the moving and shifting models on rates of infection both in the U.S. and around the world. Part of that is because changing behavior shifts model expectations. But another part is we have never had a worldwide pandemic of this level in a world now so easily connected and with such freedom of movement.

Another important example is the forecasts we are seeing for the impact this disease and the subsequent social distancing shutdown is having on the economy – primarily in the form of GDP forecasts. As our colleague Phil Kosmala at Taiber Kosmala & Associates told us this week in a discussion of GDP: “Firms that forecast (GDP) change the forecast CONSTANTLY. It is a useless exercise in futility as everyone changes their moving targets. The only thing that matters is where consensus is and if there is a surprise.” Essentially, if the world believes GDP is going to be down 20% in Q2, but it’s only down 18%, that is good news to the market. Beating the mark is much more important than having a good mark.

As Phil points out, there are wildly different views on what GDP this quarter and this year will look like. The variance is based on two key factors: 1) how deep will the drop in GDP be in Q2; 2) how quickly will the economy recover in Q3 and Q4. For example, Goldman Sachs is showing -30% right now in Q2, but aggressively positive (double digits) in Q3 and Q4 resulting in a net positive GDP for the year. Other firms, like Capital Economics, are showing a much lower impact in Q2 (-12%), but much slower recovery in Q3 and Q4, resulting in a net negative GDP for the year. Who will be right? There is quite literally no way to know. But the uncertainty will continue to breed volatility and justifies taking a cautious approach.

Q1 Earnings Start This Week

We are now entering “earnings report season” which will continue for the next several weeks. This will be one of the first times in this crisis that publicly traded companies will be forced to go on the record and discuss the impact of COVID-19 on their business. We don’t expect the impact to show up much in the Q1 data. Additionally, there will likely be many companies that suspend their official forecasts for Q2 because they lack complete data on the impact of the virus.

Earnings are an important piece of our ongoing analysis of the market and portfolios. Because they can be so fluid, they offer some visibility into how the market is reacting in these situations. For example, the S&P 500 is now trading at an 18.81X multiple of forward P/E. We’ve discussed in the past how if you take the FAANGs out of the mix that number comes down dramatically. And we’ve also discussed how anything below roughly 19X today is a discount in this time of low inflation.

What this level also tells us is that the market is working in future earnings expectations into its pricing. The question remains what earnings are going to look like. We all know that companies love to play the game of “under promise and overachieve”, so we would anticipate significantly bearish talk from companies over the next few weeks. That has the potential to add additional volatility to the market.

What Does This Recovery Look Like?

While we just got done talking about all the risks in the market today, it’s important to remember the significant work that has been done by the Federal Reserve and Congress to support the market and the economy. Again, last week, the Fed stepped in with an additional massive support system for the bond market, reconfirming our position that the initial phases of this recovery will benefit the bond market first.

Many of you have asked the question: What shape will this recovery take? The most common “shapes” people talk about are:

- “V” Recovery: Quick drop, quick recovery

- “U” Recovery: Longer, drawn out recovery

- “L” Recovery: Quick drop with no recovery (i.e. a depressed market for years)

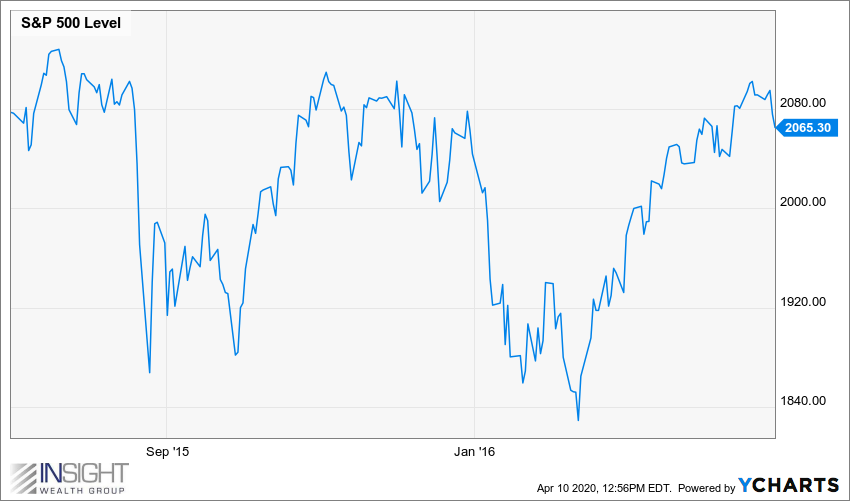

The one no one talks about – yet is actually very common – is the “W” recovery. Look at this example from 2015 – 2016:

Past performance is not indicative of future results

We suspect, given the vast number of unknowns remaining for the virus and the economy, this might be what our recovery looks like. And in this scenario, we are just in the second leg. The third leg is the one where real opportunity exists and where we can look to get more aggressive with portfolios. The good news is – if we’re wrong – we’re in for a very quick recovery. While it is unlikely, we don’t think anyone would complain.

What Happened in Portfolios This Week?

The week was resoundingly positive in portfolios. While we refuse get too excited, it was nice to see several important positions in our portfolios substantially outperform the market. This was especially true in positions that suffered more on the way down – including our energy positions.

From an allocation perspective, we continue to hold our ground at this point. All managed strategies performed significantly well this week, and we wait out the dip coming from the 3rd leg of the “W”. Again – if we’re wrong – it’s a good thing. If we’re right, we are well positioned to pounce and take advantage of the continued dislocation. And this time – thanks to Congress and the Fed – we have a pretty solid backstop in place.

Normally we’d end a note following a holiday weekend with a comment about cherishing your family time together. But since we’re all getting more family time than we bargained for, we’ll let that one rest for this year! We hope you’re doing well, staying healthy and staying six feet away!

Sincerely,