Last week, we used the “tornado” analogy to describe what we believed was happening in the market (i.e. we were in phase 2: “We’re alive!”, but had yet to climb out of the basement to realize how bad the damage was). That argument still stands as we exit a week with volatile, but largely positive returns in the stock market. We wanted to spend a little time this week discussing what getting this economy back to work might look like and why – while we are long-term optimists – there is still a rocky road to recovery.

The Politics

As with everything in this world, we cannot ignore the politics of the virus and recovery. If you would have asked us the worst possible year for a pandemic to take place, we undoubtedly would have said “a Presidential Election year!”. But here we are.

There is no question it is in President Trump’s interest to get this economy up and running as quickly as possible before the election. His #1 selling point before all of this happened was the strength of the economy – something for which he certainly deserves some credit.

If you look back to his victory in 2016, it was made possible largely by working class people in Rust Belt (think Pennsylvania, Ohio, Michigan, and Wisconsin). Sadly, those are exactly the people hurt worst by having the economy shut down. Getting them back to work quickly makes it much more likely their support will carry on into November.

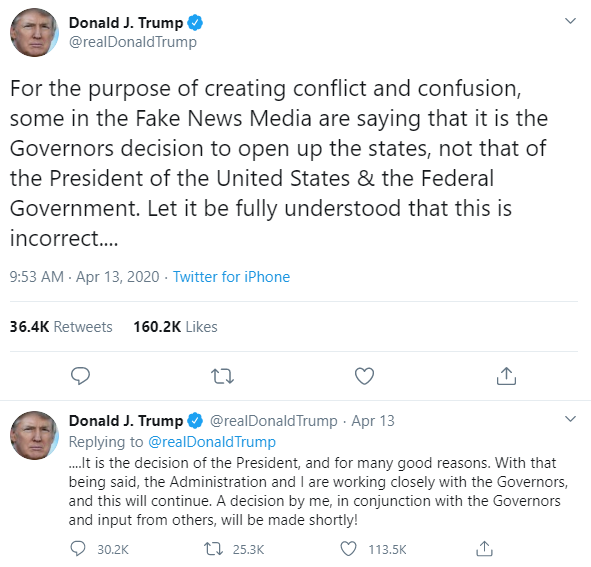

The question becomes, however, whether or not the states are going to fall in line with President Trump in this effort. On April 13th, the President Tweeted the following:

While there is no question the President has enormous power invested in the office, Governors and local officials are going to have a significant say in exactly how this economy gets back on its feet. Hopefully, the Federal, state, and local officials can get on the same page and develop a plan that has the backing of the people on the ground who will implement it.

Beating the Virus Still #1

While opening the economy is vitally important, it frankly does not really matter if it is “open” if no one is using it. One of the big concerns we have is how willing people are going to be to participate in the economy if they do not have confidence doing so is safe.

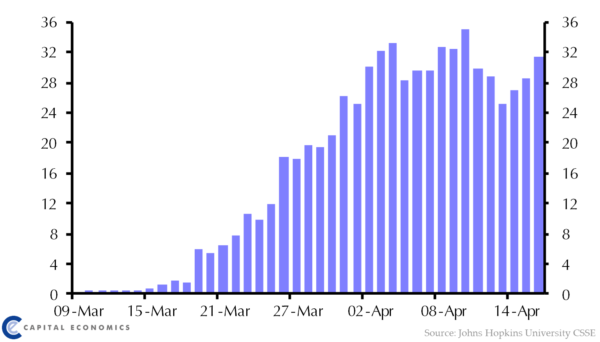

The first step in that process is “beating” the virus. While it will not ever be beaten completely – at least not until we have a vaccine – we must be able to demonstrate to citizens that the risk is significantly reduced through “flattening the curve”. That just started to happen last week as you can see by the chart below.

But while we have seemingly “peaked”, we have not yet seen a precipitous decline in the number of cases. Hopefully, the next few weeks – before the government’s May 1st goal – we will see this number decline.

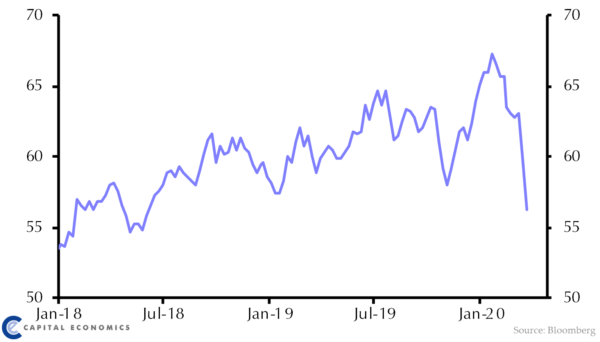

We would anticipate a drop in cases would go hand-in-hand with growth in consumer confidence. As we all know, consumer spending is 70% of our economy. So, if the consumer does not have the confidence to spend (or even visit stores), opening the economy is going to be tough.

The good news is we are moving the ball forward scientifically, even if it will never be as quickly as we would all hope. Moderna is in clinical trials for a vaccine. Cleveland’s MetroHealth Medical Center has developed a test that delivers results in 2 hours. Multiple hospitals and medical facilities are working on antibody testing. And just last week the results of a test on Remdisivir (a drug known to work on SARS) leaked that showed it had some positive results with patients. More work is certainly needed, but the quicker we can create the ability to test and treat, the quicker we can get the economy up and running again.

The China Example

China, unlike the United States, is not bothered by pesky things like democracy and separation of powers. In some way, it makes responding to a crisis like this much easier. The boss makes a decision, and everyone falls in line…or else.

So, while it is simpler to execute a lockdown strategy or a restart of the economy in China than it is here, the China example is one we should continue to look to as they went through this process first. And the good news is their example is optimistic.

It goes without saying we view every number that comes out of China with a bit of skepticism. But there are some things we can know that give us hope. For example, Apple has announced they have reopened 100% of their retail stores in China. Starbucks has opened 94% of their retail locations. Neither of these data points are in doubt.

While we do not trust the initial infection data from China (there were likely significantly more cases than reported), we can’t question the fact that they have seen a precipitous drop in cases and have kept new infections limited.

And probably more importantly, we can see the economy is starting to work again as passenger traffic is at 90% of its 2019 level (up from 40%), coal consumption is nearly back to normal (up from 60% of normal) and daily property sales in their 30 largest cities are now at 75% of normal (up from 0% in February).

It has taken basically two months from the worst of the China epidemic to get to this point. If we accept that last week was the peak of cases in the United States, then we should expect a similar time period (at a minimum) for our recovery as well.

Getting People Back to Work

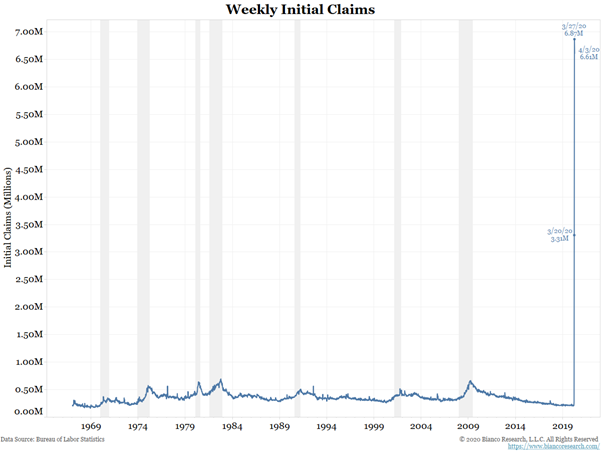

As you can see from the chart below, we have never experienced such rapid unemployment. So, to say we have policy or economic expertise on exactly how to ramp things back up just simply is not true.

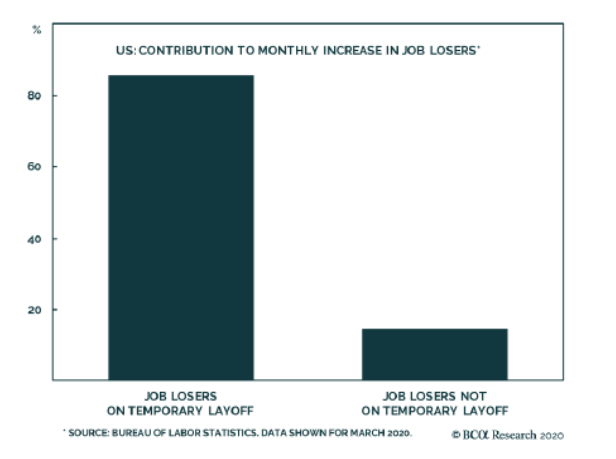

The good news – if there is any – about this massive level of unemployment is the “type” of unemployment it is. As you may be aware, when someone files for unemployment they note whether they are on “temporary layoff” or “permanent layoff”. Over 80% of filers have noted they are under the temporary category.

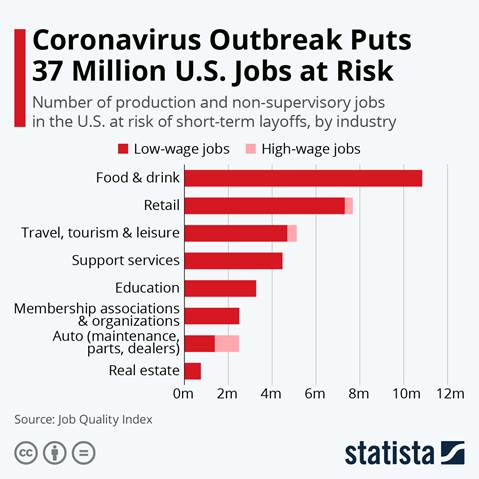

Unsurprisingly, the jobs at risk in this downturn are primarily service sector jobs and, notably, primarily “low-wage” jobs.

The good news is these jobs will not require retraining once the economy restarts. The question, however, is how quickly all of these may get back up and running. For example, let’s say you have two restaurants across the street from each other prior to the pandemic. If only one of the two reopens after the lockdowns conclude, that is probably good news for the surviving restaurant. They are likely to see increased business as they pick up traffic from their former competitor. They would likely rehire all their staff and may pick up some extra help to deal with the new traffic – but there is no way they are going to hire everyone that was working across the street. Some of those people are going to have a hard time finding new work.

That is why the fiscal programs Congress passed in the CARES Act are important. First, the increased unemployment (amounting to nearly $50,000/year) lasts for six months from filing. If you come back to the two-month recovery in China, that buys our newly unemployed some additional time to find new work.

Second, the Payroll Protection Program (PPP) and other business lending programs are vitally important to making sure businesses can make it to reopening. As you may have heard, the PPP program ran out of funding this week, having burned through $349 billion in just over two weeks. It is our understanding that Congress is working to vote on a PPP-2 program later this week which should provide additional funding.

Finally, don’t forget that the amount of support for the economy is massive. Depending on how you calculate it, support from Congress and the Fed could equate to 30-50% of normal GDP. It is not chump change.

What Does All of this Mean for Portfolios?

We are starting to see a glimmer of light through the tunnel right now. There is no question about that. New cases are flattening out. New treatments are being identified. And we are at least having the conversation about how to get this economy up off the mat.

But everything we just discussed tells us we still have a long road ahead of us. The China example says at least two months until this economy looks recognizable. Probably longer until it is running at full steam. All of which leaves us with the opinion there will be more volatility – and more downside – ahead of us in the stock market. While we would love to see a “V”-shaped recovery, we have to assume it looks more like a “W”. So, we are still standing pat and looking for opportunities down the road. When that strategy changes, you will be the first to know.

Sincerely,