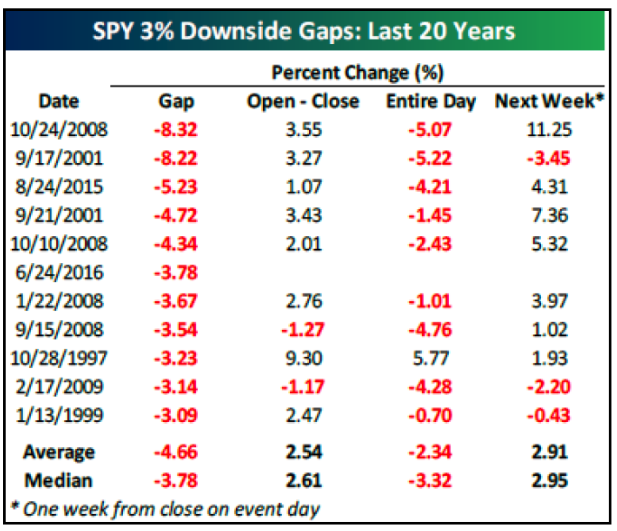

On a dramatic day for the UK, European, and global financial markets, we want to provide our clients with a closer look at the Brexit issue, possible implications, and considerations. Let us start by saying we and the market got the outcome of the Brexit/EU Referendum wrong. We have been closely monitoring currency markets, European equity markets, polls, and betting markets over the past week and we can say they distinctly priced in a ‘remain’ outcome up until late last night when voting results began to roll in. In fact, this is probably the biggest instance of the market being caught leaning in entirely the wrong direction since the original TARP legislation was voted down in September 2008.

Key indicators over the past week reflected the ‘Remain’ sentiment:

Dow Jones Euro Stoxx 50: +7.75%

Currency Shares British Pound Sterling ETF: +4.65%

S&P 500: +1.70%

10yr U.S. Treasury Yield: +4.32%

S&P 500 Volatility Level (VIX): -10.9%

% Likelihood of a “Leave” (Predictit.org) 16.0%

% Likelihood of a “Leave” (NCP poll) 25.2%

% Likelihood of a “Leave” (Bloomberg poll) 43.0%

What just happened?

Much of the world learned last night and early this morning the outcome of the non-binding British referendum on the UK leaving the EU. The results were surprisingly in favor of opting out of the EU by a margin of 52% to 48%. One important word noted above is the ‘non-binding’ nature of this vote. While a British exit is highly likely, it is by no means a certainty. In fact, Germany has already telegraphed the idea of an ‘associate’ membership for the UK in the EU.

As indicated above, we would indeed categorize the outcome as surprising based on most market based indicators leading up to the vote. The process from here forward is a bit unclear at this time. Scotland and Northern Ireland voted strongly to ‘remain’ while England and Wales voted to ‘leave’. Politicians in Scotland and Ireland have already indicated they will be agitating for fresh referendums on their place in the UK with a strong desire to remain in the EU. British Prime Minister David Cameron has indicated he will be stepping down and handing the transition to his successor. According to Article 50 of the Lisbon Treaty, the nation seeking secession will have two years from the time Article 50 is formally invoked to negotiate terms of withdrawal. This is an onerous task for Britain and the first time the process has ever been undertaken.

What happens next and what are the regional consequences?

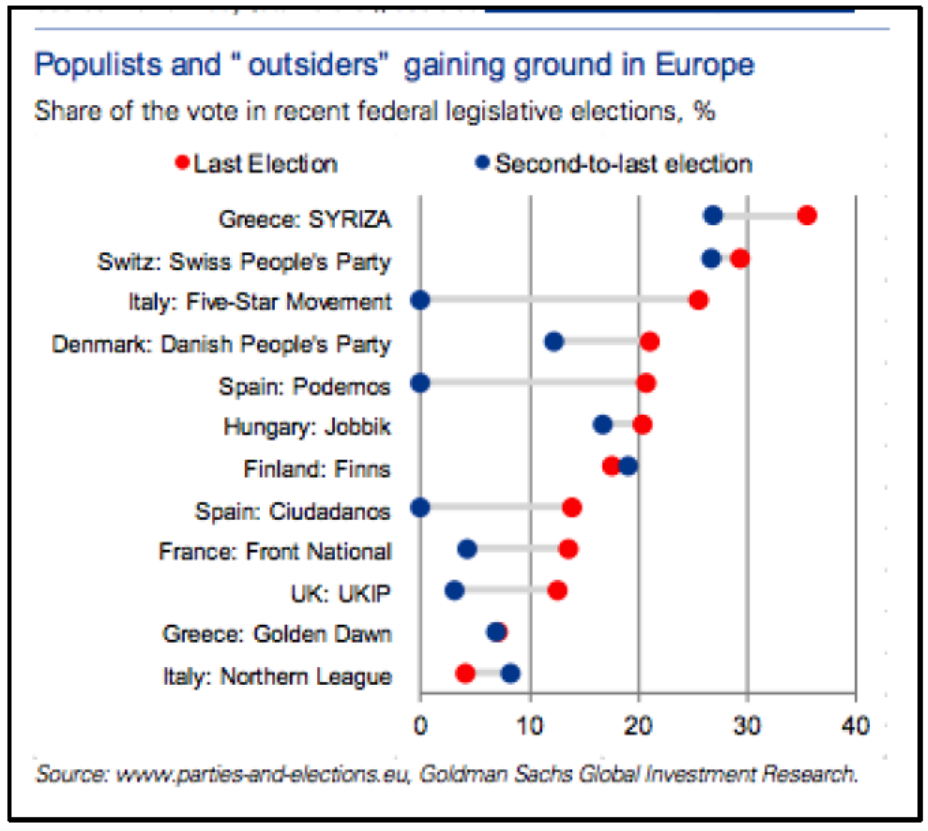

Uncertainty will continue with the possibility of further referendums. You can expect a significant amount of political jockeying in the coming weeks and months as things unfold. The UK will work to calm markets and advocate for a slow and orderly process of withdrawal. Meanwhile, the EU will press for a swift resolution and would probably like to see financial market and economic stress be rather pronounced for the UK with the hope of extinguishing momentum in right wing populist movements currently taking hold in Italy, Spain, and France. We will be closely monitoring economic, political, and financial market developments as things unfold.

UK Consequences:

Economic consequences for the UK will undoubtedly be negative in the short and medium term. Damage to business confidence, a dramatic fall in the Pound, and general uncertainty may well lead to recession for the UK. We expect UK inflation and capital outflows to increase materially which may force the BOE to hike rates. 43% of UK exports are with EU member nations so the uncertainly surrounding trade agreements with UK end markets are significant. Additionally, The UK is currently running a 4.3% current account deficit, which is the largest of any advanced economy, so watching gilts (British government bonds) will be an important marker as well.

European Consequences:

Beyond the tasks at hand of facilitating the withdrawal and re-negotiating a multitude of agreements with the UK (trade, labor, immigration, etc.), Europe’s eyes will now turn to the dynamic political frameworks taking shape in Italy, Spain, and France. The EU will likely strike a hard line in UK negotiations in an effort to fight the risk of ‘exit contagion’. Elections and governing coalitions across Europe are weighing very much the same populist sentiments that took hold in the UK. The economic reaction to Brexit will factor largely as other countries weigh the costs of exit. France in particular would expect even more severe economic consequences than what likely is in store for the UK.

It should be noted that this is highly unlikely to mean the EU is falling apart. In 1973 there were six countries in the EU. That number grew to 12 in 1986, 15 in 1995, 25 in 2004, 27 in 2007, and 28 in 2013. The departure of its third largest member and 13% of the overall population is significant but not the end of the Union. Europe’s handling of the UK exit and the resulting UK implications will factor largely in whether follow on movements gather steam or fizzle out from here forward.

U.S. Consequences:

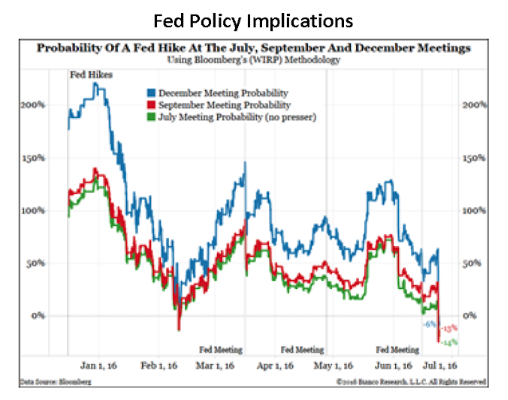

U.S. economic and financial market implications seem to be somewhat insulated at this stage. U.S. equity futures were off over 5% last night but opened much less extreme this morning, down -2.3% as of now, a relatively small amount given the 3.2% gain the S&P 500 had registered over the prior 30 days. U.S. Treasury bonds have been a significant beneficiary of the outcome as yields have plummeted across the curve.

What to do from here?

In short, STAY CALM. This is not being priced in as a cataclysmic event here in the immediate aftermath. Volatility currently in the markets is lower than that of what we experienced in 2007, 2008, 2011, 2015, and 2016. Spreads in the high yield and investment grade bond market have increased but are not sending serious warning signals. The market was clearly not pricing this in but due to the drawn out nature of this referendum and the follow on consequences, investors have time to carefully evaluate implications and make judicious decisions as they see fit.

We are evaluating shorter term contrarian opportunities as well as tactical intermediate term implications as they pertain to reductions in international equity exposure, profit taking in safe haven bonds, and evaluating foreign currency exposures.

Below you will find a collection of charts we have sourced that provide meaningful perspectives to the current state of the financial markets as well as some anecdotal political color.

As always, if you have any questions, or would like to discuss this in more detail, please don’t hesitate to contact your financial advisor directly at (800) 380-9032. This will certainly be a topic of conversation in your next appointment, but we’ll also be reaching out directly if there are any changes that need to be made in your current portfolio as markets continue to process the Brexit referendum.