The Weekly Insight Podcast – The Dollar Trilemma (And Why Precious Metals Just Tanked)

EDITOR’S NOTE: Due to travel next week, there will be no Weekly Insight Memo or Podcast on February 16th. We’ll be back with you on February 23rd. See you soon!

The last ten days was an utterly wild time in financial markets. The good news? Insight portfolios were unaffected as all our core strategies held up nicely. The Dow did the same last week (+1.43%). But a lot of things didn’t fare as well. The S&P, Nasdaq, Gold, Silver, Bitcoin… All had a very rough time.

In some ways it is all related. In other ways not. Yes, we continued to see pain in the tech market – similar to what we discussed last week. This time, however, the real suffering focused on software names. The “SaaSpocalypse” (Software-as-a-Service Apocalypse) is what they’re calling it. Companies like ServiceNow (down 28% YTD), Salesforce (down 26%), Intuit (down 34%) and others felt the brunt last week. Why? Investors are starting to realize AI will eventually do the job these companies are doing at a fraction of the cost. How those companies adapt will determine their future.

But the new story is fundamentally much more important: why did precious metals tank (along with Bitcoin)? And what does it mean for the future?

The Setup

Before we can understand what happened, we must understand what got us there in the first place. As with all market stories, it revolves around fear and greed. But there is a big dose of world domination thrown into the mix.

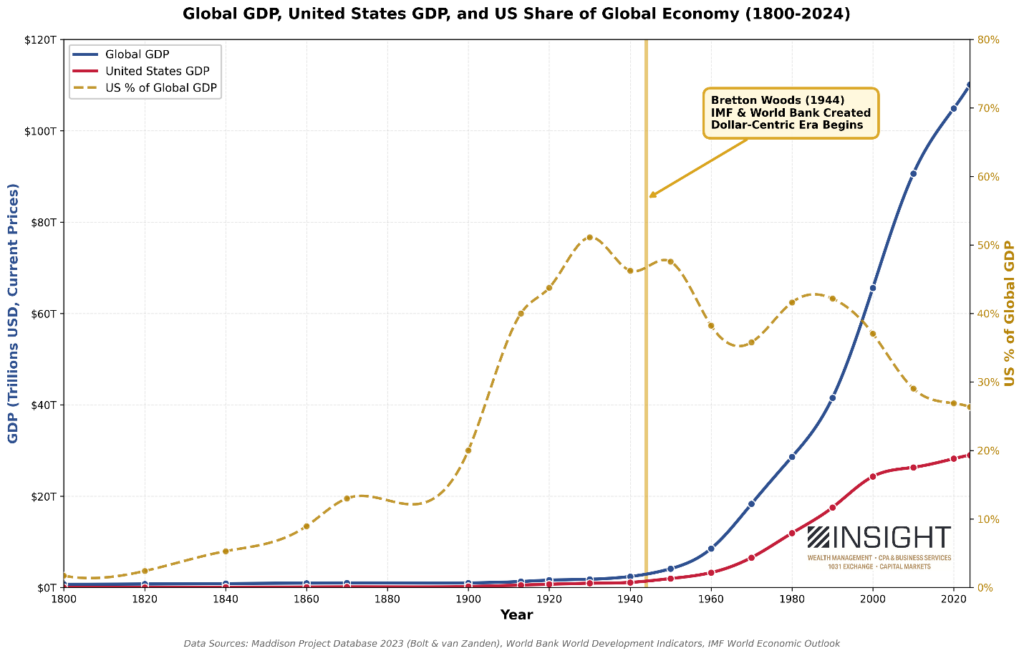

Everyone knows and agrees that the United States is – and has been for 80 years – the dominant global economic power. That was established and maintained through a strategy of globalization that we largely controlled – one that both enriched America and created a global middle class.

Past performance is not indicative of future results.

As you can see from the chart above, something particularly important happened in 1944. Forty-four countries met in the mountains of New Hampshire at the Bretton Woods conference. They devised a new system to end currency wars and make global trade the new driver of growth.

At that point, the United States represented nearly 47% of global GDP – an unprecedented concentration of economic power. That gave credence to the one thing Bretton Woods needed to make the new system work: a stable U.S. dollar.

They pegged the dollar to gold at $35 per ounce. As gold prices moved, so would the value of the dollar. Other countries’ currencies would then be pegged to the dollar. They would no longer be allowed to manipulate their currencies (a problem throughout the world in the first half of the 20th century). And they created the International Monetary Fund (and World Bank)– headed by the United States – to monitor and incentivize compliance.

The results were phenomenal. Yes – the U.S.’s percentage of world GDP fell (now sitting at 26% of global GDP), but we were now owning a smaller piece of a MUCH larger pie. And since the entire system was based on the dollar, the dollar became the world’s reserve currency.

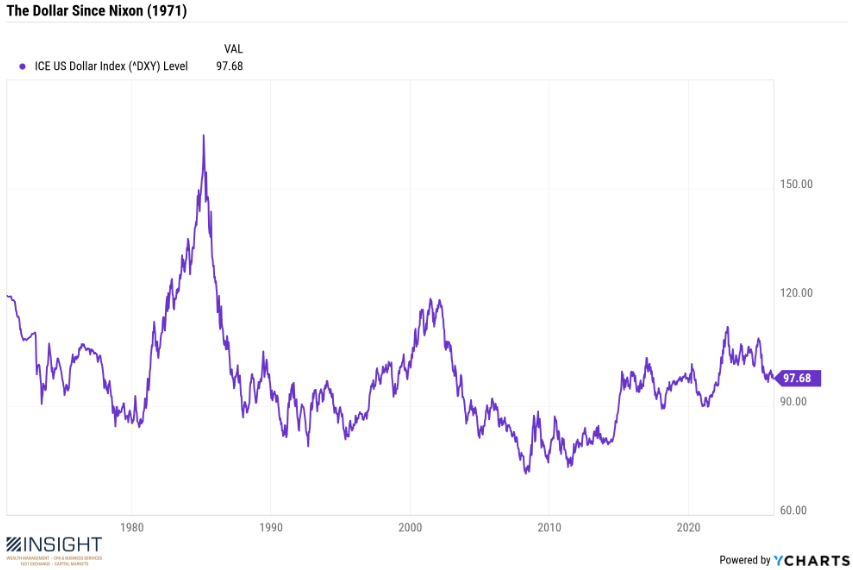

Flash forward to 1971. While the system was working, it wasn’t entirely fair to the United States. As our trade deficit ballooned and liabilities increased, the dollar began to devalue compared to gold (sound familiar?). And so, President Nixon ended the “gold standard,” effectively ending the Bretton Woods era.

But many of the good things from Bretton Woods continued. The dollar remained the world’s reserve currency. Global trade continued to bloom. The U.S. economy continued to grow. And while the gold standard went away, the idea of a strong dollar continued in the new central bank driven world economic order.

But the ride hasn’t always been easy or stable. It was in early 2008 – toward the beginning of the Great Financial Crisis – that the dollar’s value bottomed. And over the next 15 years, bankers and policy makers worked to re-strengthen it.

Past performance is not indicative of future results.

A New Path? The Impossible Trilemma

The dollar is stronger now than it was in 2008. But that doesn’t align with current policy direction. We’re trying to solve three problems right now:

1. Promoting manufacturing and exports (the end of globalization)

Successfully doing so will require not a strong dollar – but a weak one. President Trump has been clear on this. When asked about the dollar decline on January 27th he responded, “I think it’s great.”.

2. Maintaining reserve currency status

Being the reserve currency of the world has HUGE advantages. Currently, the U.S. dollar makes up 59% of global currency reserves and 89% of financial transactions are done in the dollar. That is the foundation of U.S. fiscal dominance and provides one particular “exorbitant privilege”: we can borrow at artificially low interest rates compared to much of the rest of the world.

3. Manage a $40 trillion debt burden.

It’s no secret the U.S. federal debt is ballooning. It’s nearly $40 trillion today and sits at 100% of GDP and rising. There are two escape routes: grow our way out of it or inflate our way out of it. But a strong dollar makes exports harder (limits growth) and a weak dollar risks reserve status.

Here’s the problem: you can’t do all three. Until last week, it seemed the Administration was picking #1 and #3. And markets responded to it.

From Currency Hedge to Speculation

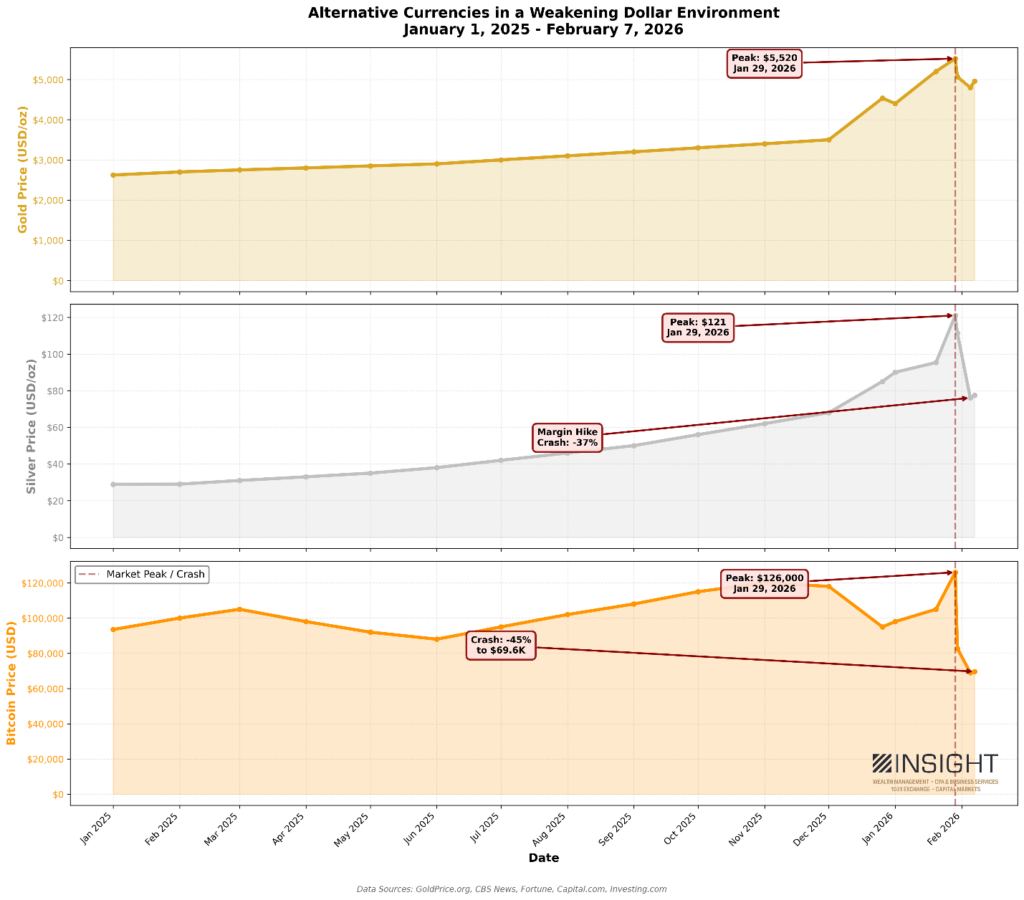

We can all agree there’s no room for nuance in the world today. And so, when it became clear the Administration was intending to attack the debt burden through a growth strategy based on exports (tariffs) and a weaker dollar, the market responded boldly.

What started as steady and sustained growth in assets like gold, silver, and Bitcoin, soon did what every accelerating market does: the crowd joined in and began driving things to prices never seen before. All three assets hit all-time highs on January 29th. And all three have struggled since. Gold’s plunge was better than the rest but still was off more than 10%. For silver and Bitcoin, it was a bloodbath.

Past performance is not indicative of future results.

What Happened? And What Does It Mean?

The first thing we must understand is that the valuations we were seeing on all three assets were not based in fact. This was speculation. Speculation (well-grounded in Presidential rhetoric) around the debasement of the dollar. Speculation about technology. And most importantly, this was fear. Plain and simple.

And anytime we have something like this (on either the fear or greed side of the ledger), reversion to the mean is guaranteed. We saw that last week.

But there are two things worth noting about what happened.

First, this was a mechanical collapse of the market – particularly severe in silver – triggered by exchange margin policy. Between December 26 and February 6, the Chicago Mercantile Exchange (CME) raised margin requirements for precious metals futures six times. The critical change came on January 13 when the CME switched from a fixed-dollar margin to a percentage-based requirement tied to the underlying asset price.

Under this system, as gold and silver prices skyrocketed through January, margin requirements increased in lockstep. By the time we got to January 29th, traders holding futures contracts suddenly had to post substantially more capital (cash) simply because the price had risen. Those unable to meet those requirements were forced to liquidate.

Selling begat selling. As prices fell, more margin calls stacked up on their losses, creating a cascading liquidation cycle. This had nothing to do with the use case for precious metals and everything to do with market mechanics.

The CME would tell you it is a risk mitigation tool to cover an increasingly speculative market. Others will see a forced retraction in the market. It’s worth noting that the banks that set CME policy are also some of the very banks who were short silver and gold contracts heading into the collapse.

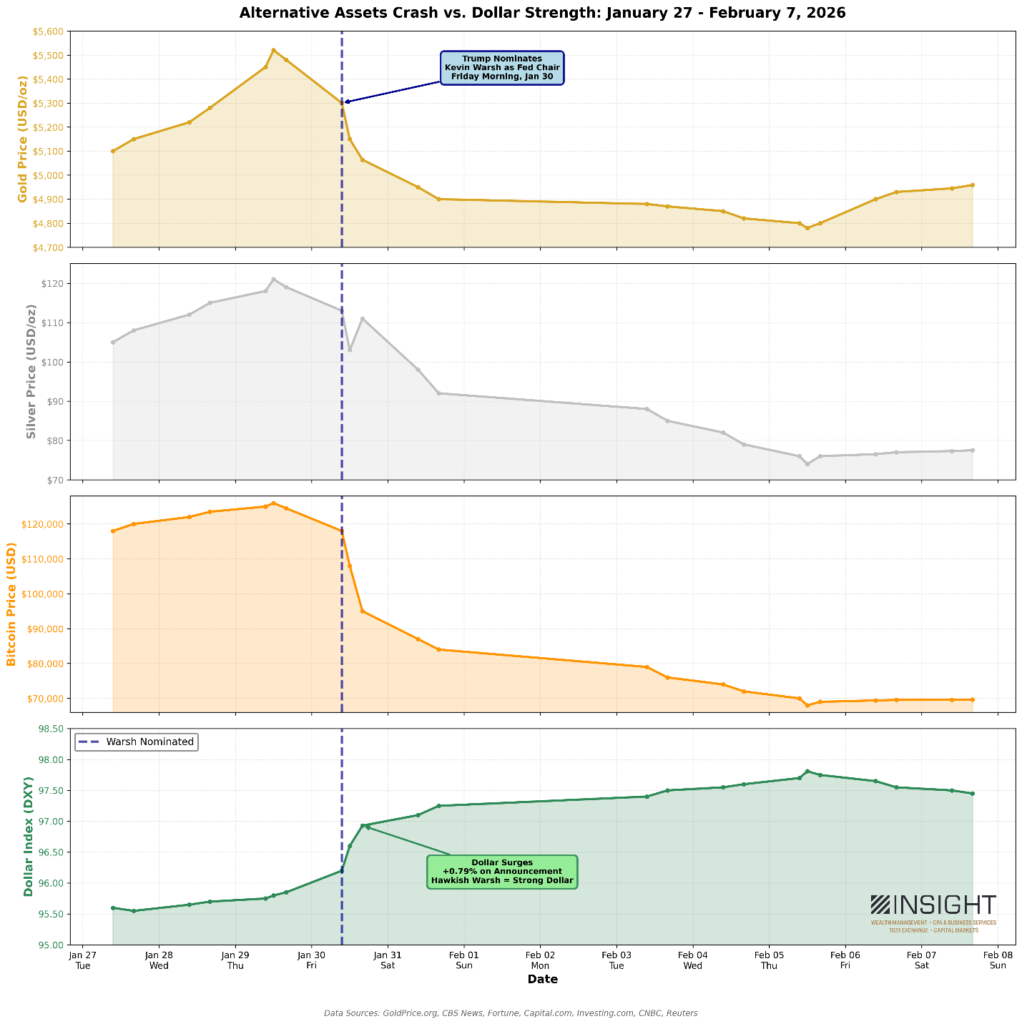

But while the market mechanics may have started things, it was a move from the White House that really got the ball rolling. Early on the morning of January 30th, President Trump announced his pick for the next Chairman of the Federal Reserve: Kevin Warsh.

Warsh was not the consensus pick. While he’s taken some more dovish positions in the past few months, his background as a previous Fed governor and in the private sector doesn’t show a weak dollar leaning. It screams strong dollar hawk.

How? He proved his bona fides as an inflation hawk during a previous term at the Fed (2006 – 2011). Since, he’s warned that large-scale asset purchases and near-zero rates risked “distorting markets and undermining long-term price stability.” He’s advocated for shrinking the Fed balance sheet and called for “regime change” at the Fed over loose monetary policy.

Simply put, this is a strong dollar economist. Which is why Investment News called his nomination a “somewhat hawkish surprise” and Bloomberg said Warsh is “likely to resist balance-sheet expansion which will support the dollar.”

And so, the dollar debasement trade became much less of a certainty and much more of a question mark. The dollar index (DXY) surged 0.79% immediately following the announcement – its strongest single-day move in months. The inverse relationship was unmistakable: as the dollar strengthened on expectations of hawkish Fed policy, dollar-denominated alternatives crashed in lockstep. Both retail and institutional traders who had positioned for dollar debasement – some on legitimate policy analysis, others on pure speculation – got caught in a violent repricing.

Past performance is not indicative of future results.

So, is that it? Are we done with the last twelve months of weak dollar policy prescriptions and back to the ways of old?

No. The trilemma remains unresolved, and that’s the critical point. The Administration still needs export competitiveness and debt manageability. Warsh’s nomination suggests they won’t sacrifice reserve currency status to get there—but that means the underlying pressures haven’t disappeared.

What changed last week wasn’t the fundamentals – massive debt burden, de-dollarization pressures, foreign central bank diversification from dollars into gold. What changed was positioning. Speculative excess was flushed out through a combination of margin mechanics and shifting Fed expectations. The leveraged futures traders who drove prices to irrational levels are gone. The problems remain.

Markets reminded us of a valuable lesson: chasing narratives rather than fundamentals destroys returns. We’ve seen it repeatedly over the last several years – panic selling during temporary volatility that reversed within days. We’re seeing it again. Discipline will always win.

The key variable to watch: will the Administration attempt to override Warsh’s hawkish history once he’s confirmed in May? Powell has resisted those pressures. The question is whether Warsh will maintain his long-held positions or shift to the Administrations preferred path of rate cuts and dollar weakness. That answer will determine whether the trilemma tilts toward strong-dollar orthodoxy or weak-dollar populism.

The impossible trilemma will continue to give us volatility. But volatility creates opportunity for disciplined investors who understand the difference between short-term positioning and long-term structural shifts.

Sincerely,