The Weekly Insight Podcast – Financial Stoicism

For as long as man has existed, we have been trying to wrap our heads around a moral framework through which to see the world. Religions have filled this role for many. Non-religious philosophies for others. It is undoubtedly certain that no method has led to a perfect human. We still have a long way to go.

Around 300 B.C. a Greek Philosopher, Zeno of Citium, began teaching a philosophy that focused on ethics, logic, and physics. It emphasized virtue and reason as its core tenants. He began teaching it at a place called The Painted Porch or – in Greek – Stoa Poikile. And thus came the name for the philosophy: stoicism.

Stoicism’s most famous adherent was Marcus Aurelius who, nearly 480 years later, wrote extensively about it in his Meditations.

We are not philosophy students at Insight – so we’d encourage you to explore this topic yourself. But if you quizzed us about what Aurelius had to say about stoicism, it would be this:

- The only thing you can control is yourself. External events are outside of your control.

- Do not allow yourself to be shaken by others or things outside of your control.

- Focus entirely on acting with virtue personally, without care for how others or the world behaves.

We’re certainly not here to give lectures on virtue in a financial memo! But as we think about the last week – and frankly the last few years – in the market, Aurelius’ stoic ideals keep popping up. Let’s look at last week as an example.

A Saturday Social Media Storm

We’re not breaking news when we say last week had much…drama. In fact, it started before the week even kicked off.

As you know, there has been much discussion around the fate of Greenland. We could debate the purpose and need for the drama at hand – but as Aurelius says, it is outside of our control (we’re going to keep coming back to this!).

The debate kicked into high gear a week ago Saturday. President Trump took to Truth Social with a lengthy post on the Greenland issue. In it, he identified the issue as a key matter of U.S. national security as “China and Russia want Greenland, and there is not a thing Denmark can do about it.” He goes on to lay out that eight European countries have sent troops to Greenland, which he noted is a “very dangerous game.”

He concluded the post by noting the action he would be taking: a 10% tariff on all eight countries with troops in Greenland which would rise to 25% on June 1st and would be in place “until such time as a Deal is reached for the Complete and Total purchase of Greenland.”

The European response was not muted. And a war of words ensued over the next few days. With the markets closed on Monday for MLK Day, the focus was on the back and forth.

48 Hours of Volatility

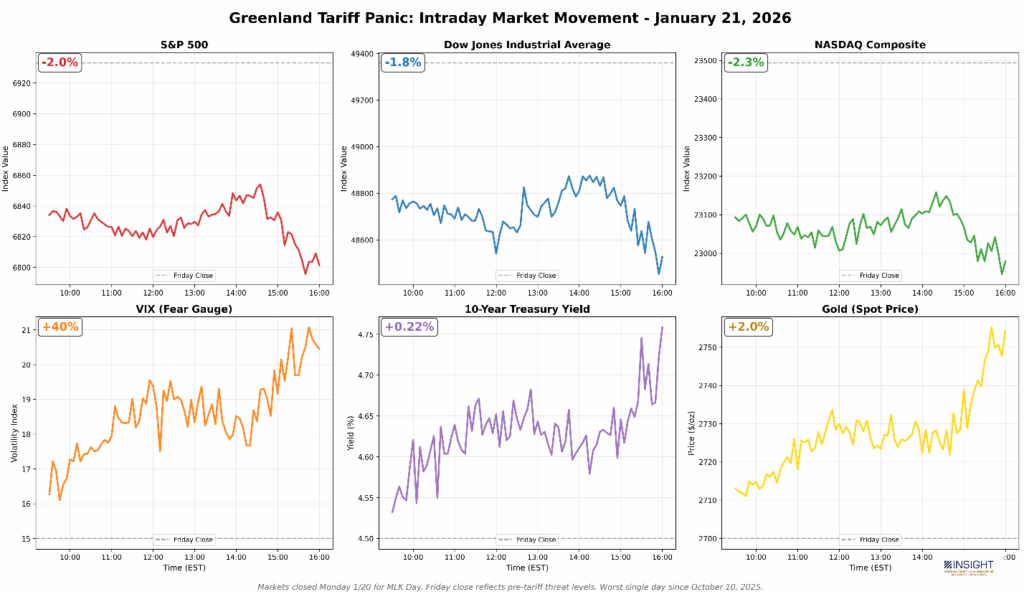

And then the markets opened on Tuesday. The S&P 500 opened down 1.4%. The Dow and NASDAQ were down 1.2% and 1.7%, respectively. And the day didn’t get better.

President Trump – asked whether he’d consider using the military in Greenland – answered “You’ll find out.” Markets continued their downward slide, ending the day down 2.0% in the S&P. The VIX – the standard fear gauge – spiked to 21, up nearly 40%. Treasury yields jumped. Gold spiked. As one article stated, the “Sell America” trade was on. $1.2 trillion in value was lost in just the S&P 500.

Past performance is not indicative of future results.

The drama on Wednesday continued well before markets opened. President Trump gave a speech in Davos at 11:00AM Swiss time (5:00AM EST). In it, he continued his demands on Greenland, stating “I am seeking immediate negotiations to once again discuss the acquisition of Greenland by the United States.”

But he also brought down the temperature of the discussion, noting about military action “But I won’t do that. That’s probably the biggest statement I made, because people thought I would use force, but I don’t have to use force. I don’t want to use force. I won’t use force.”

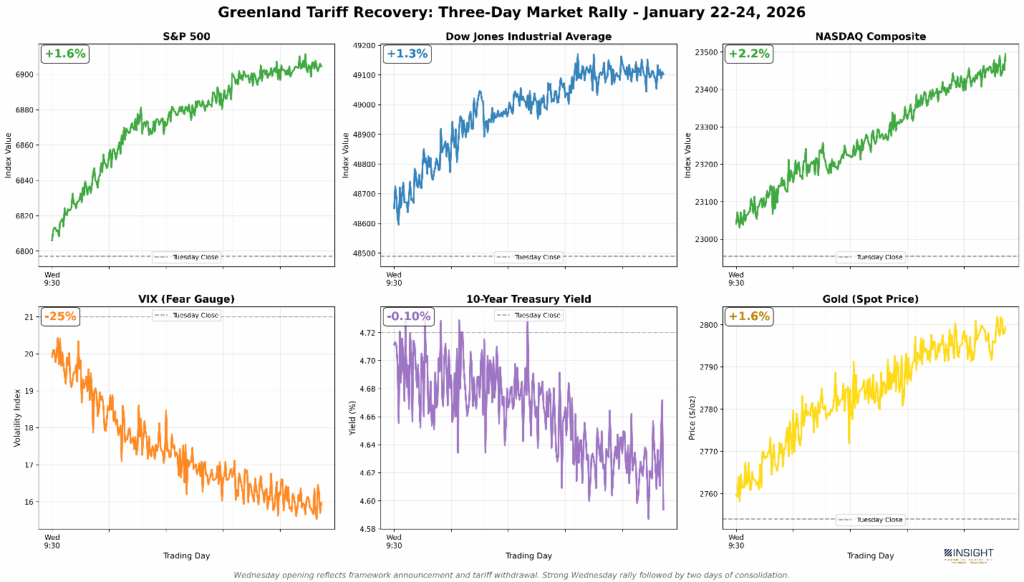

Markets started to calm. And the rest of the day brought more good news. Early in the afternoon, Trump announced a framework of an agreement on Greenland and stated, “I will not be imposing the Tariffs that were scheduled to go into effect on February 1st.”

Shortly after, he jumped on CNBC and confirmed the deal (yet to be disclosed) was on, suggesting it would give the U.S. access to mineral rights and the ability to place a Golden Dome missile defense system in Greenland.

And the markets ended the week rallying back and recovered nearly all the losses from the initial news.

Past performance is not indicative of future results.

A Stoic Response to The Volatility

If Marcus Aurelius were a wealth manager in 2026, his response to last week would be something like:

“You cannot control markets, only your response to them.”

And he’d be correct. This is something that Insight and our clients have worked hard toward understanding over the last several years. There have been constant examples of this same trend: COVID, Fed policy debates, Russia’s invasion of Ukraine. In every single one of these moments, many investors hit the panic button. You did not. And neither did we.

Tuesday’s panic selling wasn’t caused by tariff threats. Those are just external events, totally outside the control of investors, big or small. The panic was caused by investors’ judgement about those threats and their decision to act on emotion. The problem was investors letting their fear dictate their actions.

Aurelius once said “You have power over your mind – not outside events. Realize this, and you will find strength.”

Or better put for today’s situation: Trump will tweet. Nations will disagree. Markets will swing. Headlines with scream. But your discipline? Your process? Your ability to recognize patterns and not panic-sell? That’s entirely yours.

Nothing that happened last week changed fundamentals of the market or the economy. It did not shift earnings (we’re going to dive into that next week!). It did not create or eliminate jobs. Those are the things we can manage around.

But it served as an excellent reminder that the market is the ultimate Stoic teacher. It constantly reminds us that we control only one thing: how we respond. So, when the next 48-hour crisis emerges (and it will), remember: stay disciplined, recognize the pattern, and let others panic-sell while fundamentals remain unchanged.

Sincerely,