The Weekly Insight Podcast – Eyes on the Bond Market

So much ink is spilled each week (including in these pages) on the equity markets. And for good reason. The strength – or weakness – of the equity markets can have a significant impact on the financial wherewithal of investors worldwide.

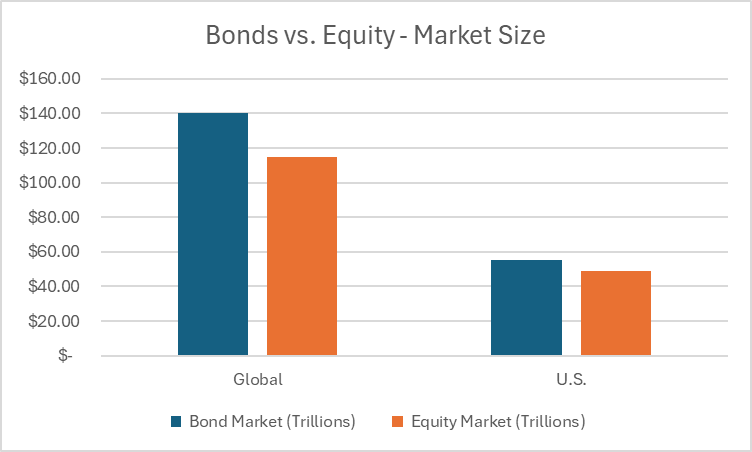

But the conversation about the bond market is often much more muted. And that’s a little backwards when you consider that both globally and in the United States the bond market is actually bigger than the stock market!

Past performance is not indicative of future results.

The truth is, we don’t hear about the bond market until things start to get weird. For example, it was the bond market’s wild swings in April (during the “Liberation Day” correction) that caused the Administration to change course. The weakness bonds were showing at the time signaled far greater problems that had the potential to drive equities into a ditch.

Part of the reason bonds are often overlooked is the nature of the instruments. They can be confusing. It can be difficult to comprehend that when rates go up, the value of a bond you hold often goes down. The inverse relationship makes things…confusing.

But the bond market is a particularly important indicator of what’s going on in the economy and how institutional money is feeling about the state of the world. As such, it’s important for us to understand it and how it may impact your portfolio. And right now – while things aren’t getting “weird” – there are a few things worth us devoting our attention.

High Yield Spread

One of the best ways to understand how much risk the bond market sees is to look at the high yield spread. But what does that mean?

First, let’s define “high yield bonds.” High yield bonds are bonds issued by companies with lower than “investment grade” credit ratings. This means bonds below BBB- using the Standard & Poor’s measurement or Baa3 using Moody’s. Simply put, these are bonds with a higher risk of default than some of the world’s most stable companies. As such, high yield bonds demand a higher interest rate than those of investment grade companies.

The “spread” we’re discussing is the difference between the average yield of a high yield bond and the current yield of 10-year treasuries.

Why is this important? By measuring against a “constant” like the 10-year treasury, we can begin to build a picture of how much risk bond investors are seeing in the economy. If they see significant risk on the horizon – which would cause more defaults for below investment grade companies – they are going to demand higher yields to invest in those projects. The spread gives us a useful way to track this sentiment.

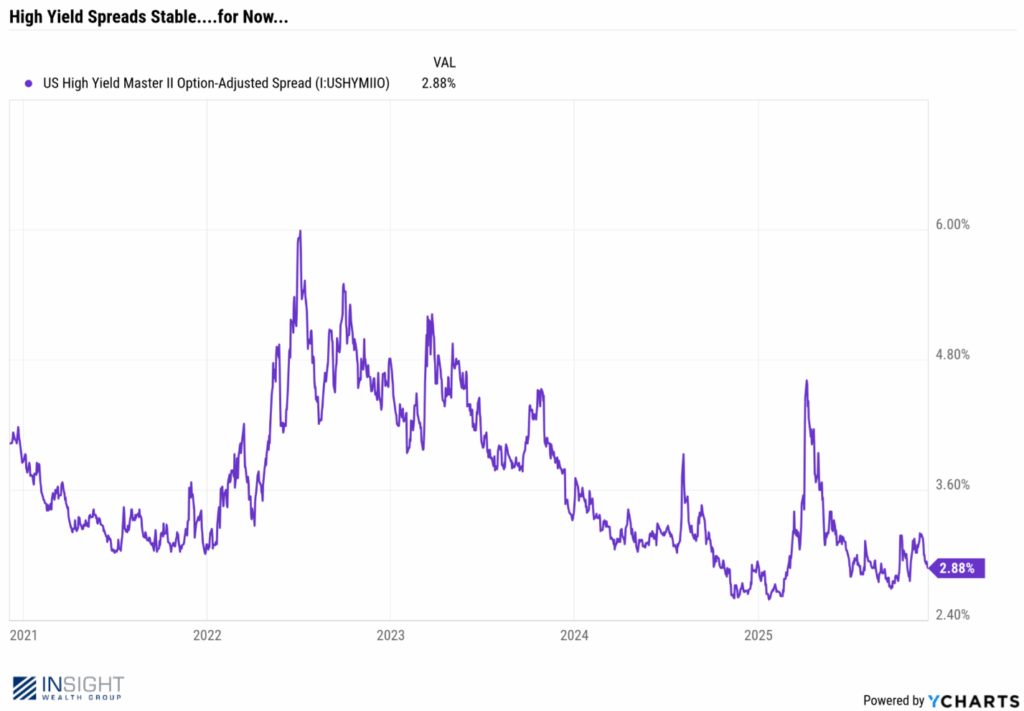

Here’s the high-yield spread over the last five years:

Past performance is not indicative of future results.

What can we take away from this data? A couple of points:

- The long-term average of the spread (going back to 1996) is 5.22%. Since the current spread is just 55% of that average, it is safe to say the bond market views the current economic environment positively.

- But not as positively as it viewed things at the beginning of the year. The spread is now 11% higher than it was in January.

- Spikes in the spread can happen quickly. The spike in the first half of 2025 was tied directly to the tariff discussion, and it is what sent equity markets into a tizzy.

For those who are questioning the future direction of the economy, the bond market’s answer is right here in this data. And, as of today, it remains positive.

10-Year Volatility

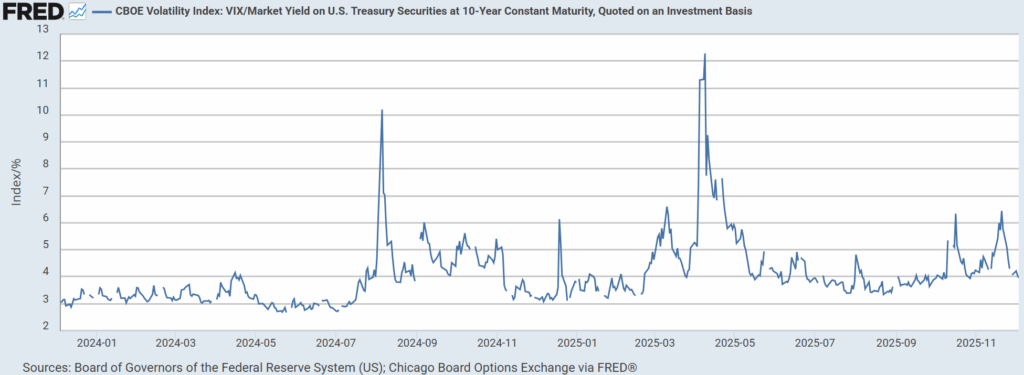

Another place to look for where the bond market is pointing is to look at the volatility around the pricing for 10-year Treasuries. And again, there is a good measure for this, the CBOE Volatility Index for 10-year Treasuries. Here is over the last two years:

Past performance is not indicative of future results.

As you can see, since the second half of 2024, it’s been a more volatile ride. We’ve seen five spikes above a level of six since that time:

- August 2024: U.S. credit rating downgrade

- December 2024: Fed Meeting (“No more cuts”)

- March 2025: Fed Meeting (“Still no more cuts”)

- April 2025: Liberation Day/Tariff Drama

- October 2025: Fed Meeting (“A cut…but don’t expect more”)

- November 2025: What will the Fed do?

In the last few weeks things have settled back down. But we’ve seen two notable spikes in the last sixty days. And a Fed meeting is on the way.

December Fed Meeting

Which gets us to the Fed meeting. The ultimate setter of rates is about to weigh in again in just over a week. We’ve talked this to death over the last year, so we’ll hit the high points. Just a quick reminder over where we’ve been in the last 60 days:

- The Fed cut rates to 3.75% – 4.00% in October. But at the time Chairman Powell was clear that we shouldn’t count on another rate cut in December.

- The market didn’t listen, and for weeks after had the probability of a December rate cut at, or near, 100%.

- In November, the market found some religion and the odds for another cut dropped well below 50%.

- Today they’re back up to nearly 90%.

So, what happened in the last few weeks? A number of Fed Governors – including traditionally hawkish John Williams – have come out in favor of a cut in December. Is it a known majority of the board? No. But it’s enough to get the drift that they’re laying out breadcrumbs for the market to follow.

We’ll obviously know more in ten days. But a rate cut would undoubtedly keep the high yield spread calm. Will it do the same for volatility in the 10-year? It didn’t happen in October. But maybe a second cut is enough for the market to understand the Fed means it this time.

Sincerely,