The Weekly Insight Podcast – The Two Economies

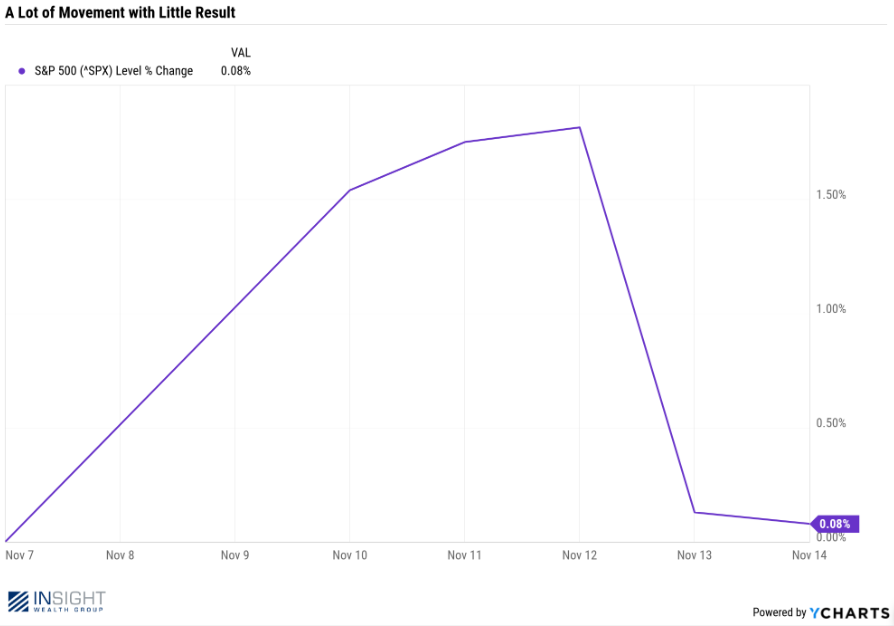

We experienced a choppy market as equities saw a nice pop generated by the end of the government shutdown followed by the market coming to grips with a lower likelihood of a December rate cut by the Fed. The result? A lot of volatility, but very little movement from the end of the previous week to the end of last week.

Past performance is not indicative of future results.

Unsurprisingly, the drop over the last two days of the week generated much more press than the spike in the first three days. The reality is, the market is still focused on a few key issues: tech spending/earnings and Fed policy.

But while that drama dominates the airwaves (more this week – NVDIA’s earnings are Wednesday night!), there is an important thread developing that is worth your attention: the strength of corporate earnings vs. the slowing of the consumer. One is going to win the battle – and the victor will determine whether this bull market is late stage or still has room to grow.

Corporate Strength Continues

As we wrap up earnings season, there is one obvious takeaway: Q3 was good for American companies. With 92% of the S&P 500 having reported, 82% of companies posted a positive earnings surprise and 76% reported a positive revenue surprise.

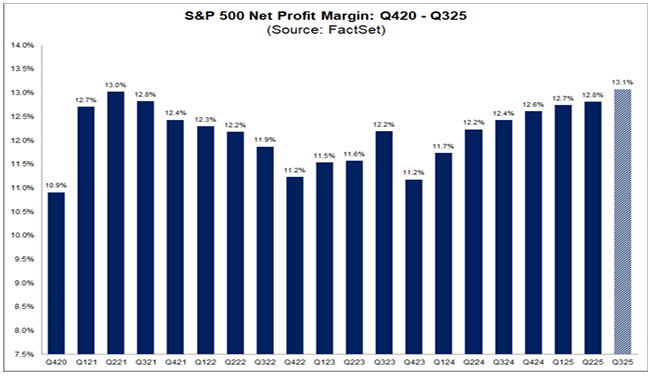

The earnings estimate as of September 30th was 7.9% growth. That would have been a strong quarter in and of itself. The actual number (so far)? 13.1%. And it is not a fluke. If – after the last 8% of companies report – we remain above 10%, it will be the fourth consecutive quarter of double-digit earnings growth.

Given the specter of tariffs, it is no surprise that many were concerned about profitability for companies in this economy. Well, worry no more (at least for now). 13.1% was not just the earnings growth number. 13.1% was also the average net profit of the 460 companies that have already reported earnings. FactSet, an earnings analysis firm we follow, reported this was the highest number in at least 15 years. Why “at least”? They have been tracking this metric for fifteen years and do not have data before that. Simply put, profits are solid and improving.

Past performance is not indicative of future results.

Why is this important? Because corporate profits – historically – have peaked long before the onset of a recession. Even if Q3 was the peak, we have some room to maneuver. (Please note: recessions are the shaded area in the chart below.)

Source: Alpine Macro

Past performance is not indicative of future results.

Is the Consumer Slowing?

This is the fundamental question that vexes the market today. As regular readers know, the consumer is the most important piece of the U.S. economy. Their spending makes up ~70% of Gross Domestic Product. Negative results on this side of the ledger are incredibly impactful.

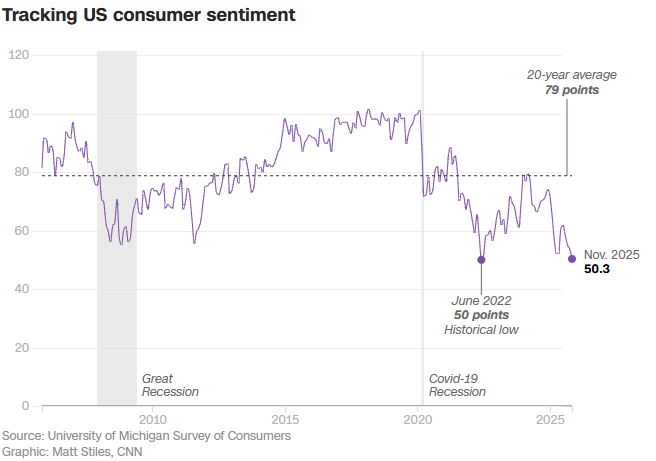

There is no question that consumers do not feel confident about this economy. We can see that data consistently reported via consumer sentiment going back twenty years. The November 2025 data set, which came in at 50.3, was the second most pessimistic during that period. Only in July of 2022 did consumers feel worse about the state of our economy.

Past performance is not indicative of future results.

This also shows up in polling. Simply put, Americans are not excited about this economy. But what about where the rubber meets the road? We hear many stories about debt rising (it always is…), delinquencies rising, etc., etc. What does the data show?

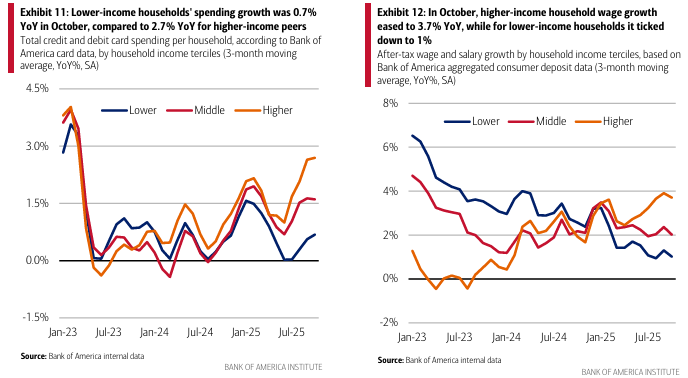

You have heard us say this before – but it is worth reiterating: not all consumers are created equal. This will likely sound crass, but it matters when we are discussing the economy: high income earners are more important to the strength of the economy than low-income earners. Why? Their impact on spending is exponentially higher.

The last few years have been vastly different for these two groups. Low-income earners saw significantly higher wage growth and spending growth as we moved through 2023 and 2024. That has changed dramatically in the last two years. High income wages are growing much faster than low earners. And their spending is following suit.

Past performance is not indicative of future results.

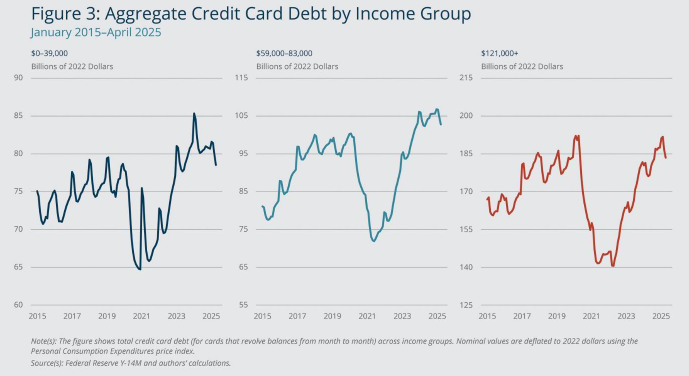

But what about those debt problems? Are they the real thing? Yes and no. Earlier this year we saw credit card debt – across income spectrums – falling from their peak.

Past performance is not indicative of future results.

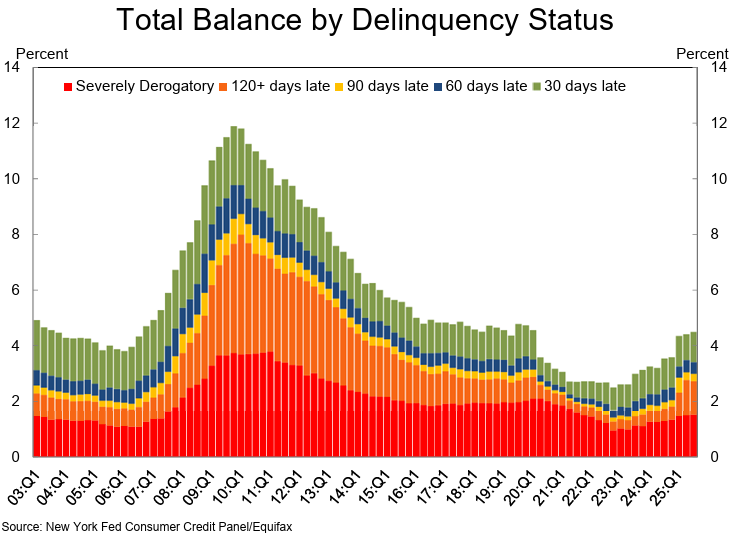

But for some consumers, we are seeing delinquencies rising. We cannot ignore when that starts to happen. Trends do matter – especially if they continue. But where we sit today is…almost exactly where we were pre-pandemic. This is not a catastrophic situation (yet).

Past performance is not indicative of future results.

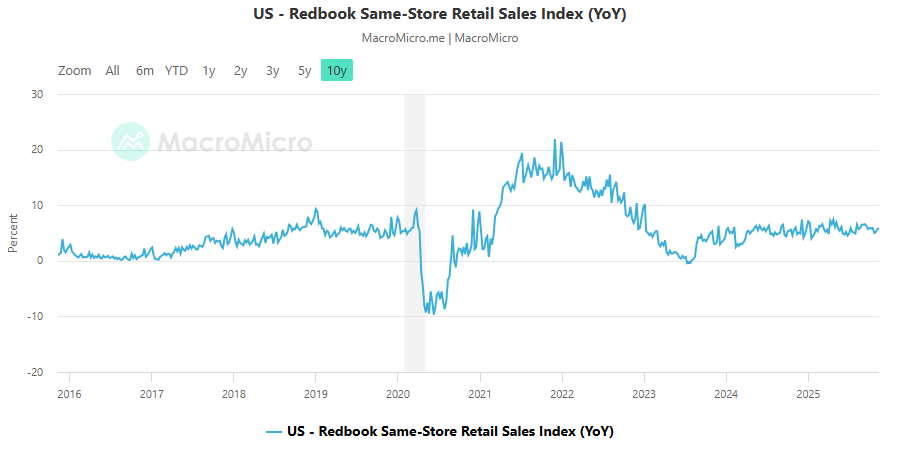

In the end, consumers – despite their frustrations – are still spending. Same store sales figures show that, after a drop in 2023, sales growth has stabilized at a rate remarkably like what we saw pre-pandemic.

Past performance is not indicative of future results.

In the end, anytime the consumer specifically states they are not happy, we must pay attention. But their actions do not yet match their words. Between the outstanding corporate data, and the consistent if not outstanding consumer data, crisis is not around the corner. But the mood is undoubtedly shifting. And that will be something that demands our attention in the coming months.

Sincerely,