The Weekly Insight Podcast – Don’t Get Too Excited (About Rate Cuts)

Powell and the Fed made their pronouncement from the Capitol on Wednesday. We’re sure we’re not breaking any news when we tell you the long-awaited rate cut has arrived. For the first time in nearly a year, the Fed cut rates by 0.25% lowering the Federal Funds rate to a range 4.00 – 4.25%.

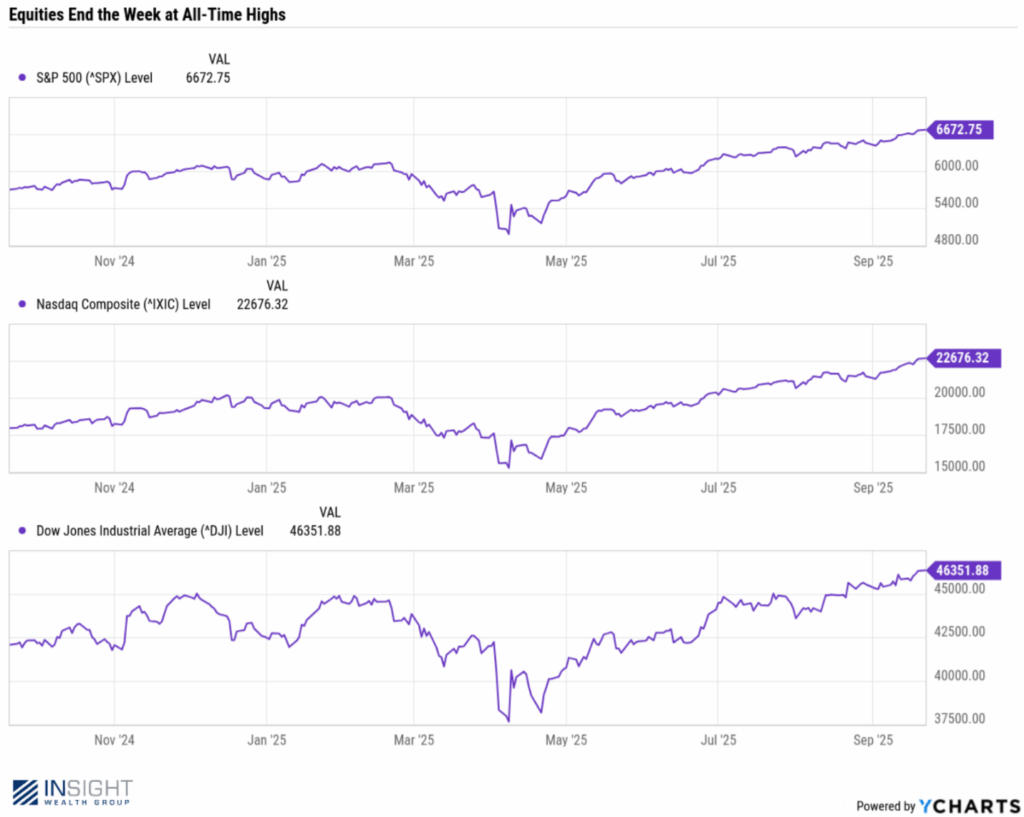

And unlike many times when Powell takes the podium, the news was very well received by the market. All three major U.S. equity indices ended the week at all-time highs. Not a bad week, given the circumstances.

Past performance is not indicative of future results.

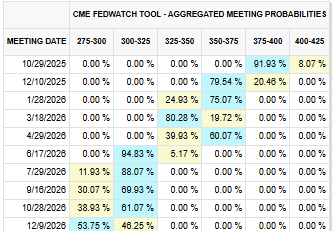

The market didn’t just rally to highs. It also seems very convinced this is just the start of the Fed’s rate cutting strategy. Not only is it now pricing in two more rate cuts this year. It’s also expecting the Fed to get rates down to – or below – 3.00% by the end of next year. If the market is to be believed – the rate cutting game is on. And it’s running full steam.

Source: CME FedWatch Tool

To which we would say…not so fast. Powell most certainly indicated it was time for a cut. And he delivered one. But their projections for the future were….hazy.

We’ve talked for weeks about the dual mandate the Fed has. Keep inflation low and employment high. But they only have one tool – interest rates – to manage them. Cutting rates is good for jobs, but bad for inflation. Raising rates is the opposite. It puts them in a tough situation as Powell noted:

“When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate. With downside risk to employment having increased, the balance of risks has shifted accordingly.”

This month, jobs were the priority, and it necessitated a rate cut. Powell called it a “risk management cut”. The implication is there wasn’t much clarity, so it’s better to manage the risk of unemployment than to do nothing.

The question then becomes which risk will raise its head more in the coming weeks and months? If it’s jobs, expect more rate cuts. If it’s inflation, don’t expect Powell and the Fed to cut much in the coming months. So, which is it?

The Case for Employment

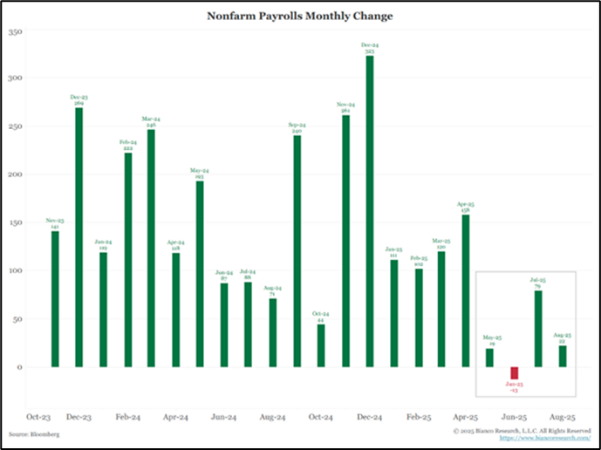

We’ve been addressing the labor economy in these pages for quite some time. Simply put, job growth has slowed. There are no ifs, ands, or buts about it.

Past performance is not indicative of future results.

But slowing and contraction are two different things. Of course, the Fed should address it. But we also know that the unemployment rate isn’t actually rising substantively. It’s been in a range of 4.0% – 4.3% since May of 2024. When you consider the long-term average (since 1948) is 5.67%, that’s not a horrible number.

And while hiring has slowed, we haven’t seen massive layoffs yet. If we do – before the end of the year – we absolutely agree the Fed will cut rates more this year. But there’s a lot of data to show those types of layoffs are unlikely.

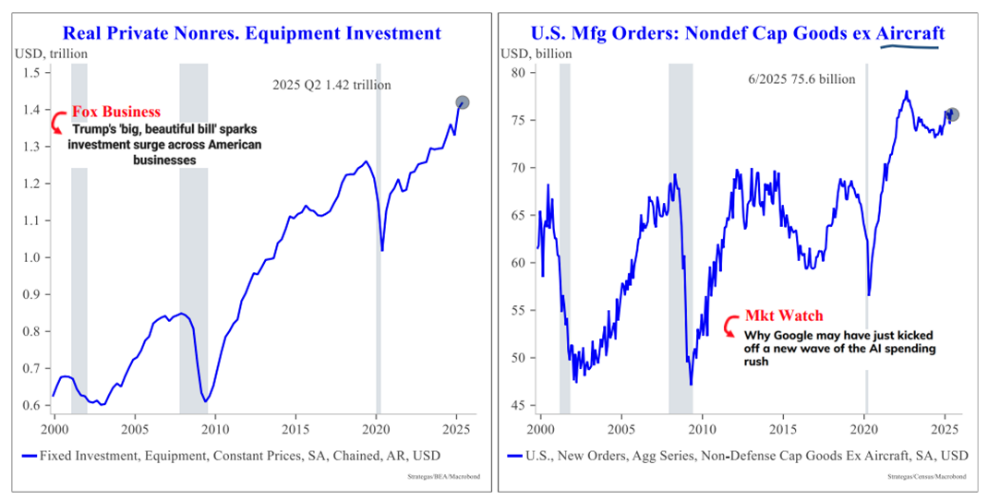

First, businesses are spending money right now. The Big, Beautiful Bill passed earlier this year did a lot for businesses. It made Section 199A pass-through entity deductions permanent, it brought back 100% first-year bonus depreciation and expensing of research costs, and it reduced the limitation on business interest deductions. All were incentives for companies to spend. And all signs point to it working.

Source: Stragegas

Past performance is not indicative of future results.

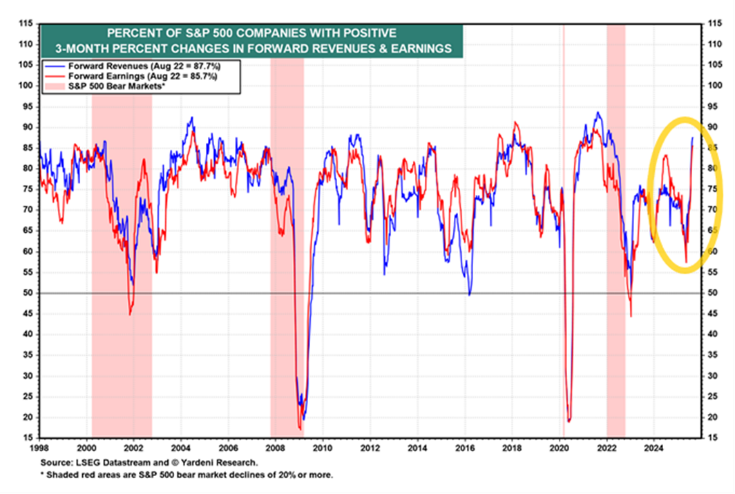

Not only are they spending money. They’re making it, too. Profit margins are improving and the forward guidance being provided by companies is improving along with them.

Past performance is not indicative of future results.

Generally speaking – when companies are making and spending more money – they are typically hiring. But even if they aren’t, that data makes the loss of a large number of jobs unlikely. The Fed has reason to focus on this issue, but it doesn’t seem like it’s on a path to get out of control.

The Case for Inflation

We all know the inflation story. It’s starting to pick back up and the implementation of tariffs isn’t going to help things.

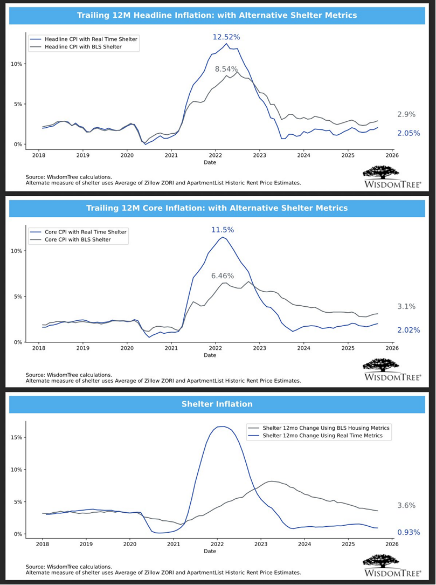

The first thing we’d note is that inflation really isn’t that bad! You’ve heard us talk in detail in the past about how bad the data set is which the Bureau of Labor Statistics uses to calculate inflation. Their overuse of an unbelievably bad calculator for shelter costs has caused wild over estimations of what inflation actually is.

According to the BLS, shelter inflation right now (over 40% of the Core CPI calculation!) is 3.1% per year. The problem is, there’s real-time data available to us from the likes of Zillow and ApartmentList.com. And what their actual hard data shows us is that shelter inflation is closer to 0.93% per year. That over 2% swing in 40% of the calculation has an enormous impact on the real inflation number. It’s actually much closer to the Fed’s target of 2% than it is to the 3.1% we’re seeing in public reports.

Past performance is not indicative of future results.

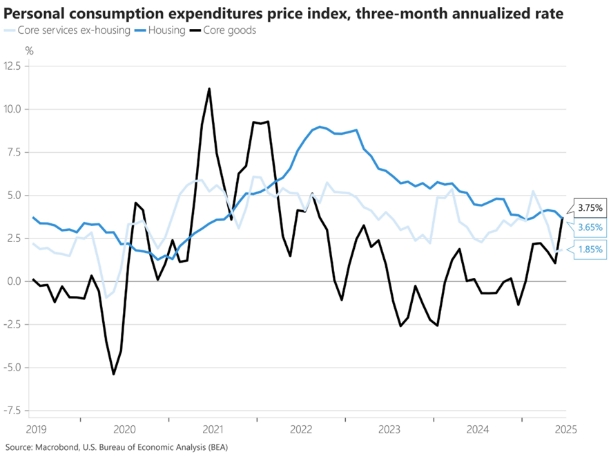

But…and this is a big but… goods inflation is rising. No matter which calculation you utilize. And in the last three months the rate of change has been dramatic. And it shows no sign of slowing.

Past performance is not indicative of future results.

What Does This Mean for Rates?

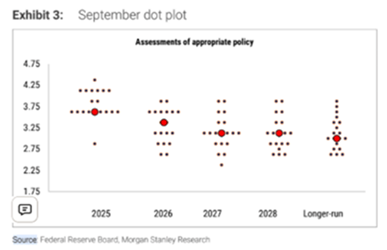

Wednesday’s Fed meeting was one of the four times each year that we get a Summary of Economic Projections (SEP) from the Fed. The SEP should never be used for guidance on the future. It’s just an indication of how the Fed sees the world today.

But there was one interesting thing from the SEP this week: a wild dispersion in future expectations. We’re not sure we’ve ever seen such disagreement on what will happen this year and next.

Past performance is not indicative of future results.

What does this all mean? It’s simple: if we start to see layoffs, the Fed will probably meet the expectations of the market and cut rates twice before the end of the year. But we don’t see a high likelihood of that happening. If, instead, the labor market stabilizes, we would anticipate the Fed shifting its focus back to inflation. And that means rates aren’t going to be making a fast move towards three percent. No matter how bad the market wants it to do so.

Sincerely,