The Weekly Insight Podcast – CPI’s Oft-Forgotten Cousin

In the long running discussion of tariffs, the standard argument against them is they are going to drive up costs for consumers. We addressed this a few weeks ago (here) and the simple truth is…it’s not that simple. Is it likely consumer costs go up? Of course. It’s also likely that corporate earnings are impacted and that companies find other – creative – ways to deal with the rising costs of selling goods in the United States. Birkenstock, for example, has announced they are raising prices worldwide to limit the impact to U.S. consumers.

But rising costs to consumers – the engine behind 70% of our GDP – is the biggest concern in the marketplace. And we got a big update on that last week with the July CPI numbers being released. Of course there was a lot of noise surrounding the news. The headlines varied depending upon your interpretation.

There was this from Fox Business:

And this from NPR:

Of course, as is usual, the true story of the latest CPI report is much more nuanced. Did inflation go up? No. But core inflation did. Was it because of tariffs? Maybe. This week we are going to dive into the report and see what we can learn about the economy and how it is responding to tariffs.

Overall CPI (All Items)

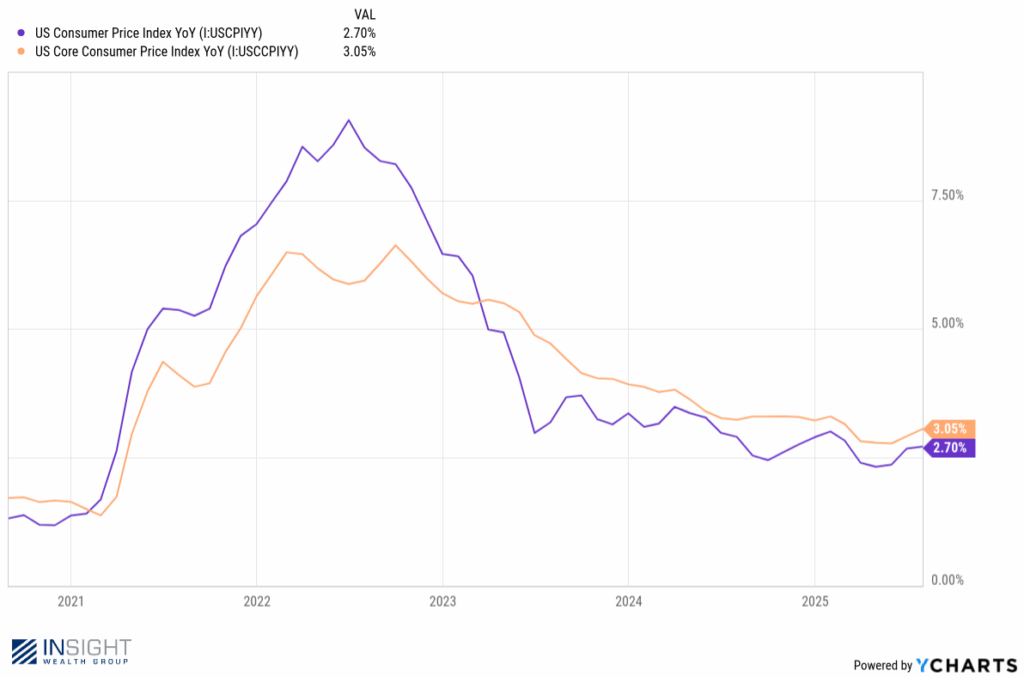

If you’ve read any of our old commentary on inflation over the years, you know there are two ways consumer inflation is measured: “All Items” CPI and “Core” CPI. The primary distinction between the two is Core excludes the impact of changes in food and energy. The theory is that those prices can be moved by things unrelated to the general economy (i.e., weather, war, etc.) and so the impact of “Core” inflation is deemed more important to the measurement of the overall economy.

But when it comes to people’s pocketbooks, all items inflation is particularly important. It is estimated that the average American spends 5.6% of their income on energy and 10.6% of their income on food. Those numbers are even higher for folks in the lower income tiers. So, any significant inflation – or lack thereof – in those two categories has a meaningful impact on household spending. As such, all items remains an important measurement.

And that’s where we get the “Inflation Cools” headline from FoxBusiness. It is absolutely true that all items inflation actually slowed last month. In June it grew at 0.3% month-over-month. In July it grew at 0.2%, which was perfectly in line with expectations. The year-over-year all items CPI remained at 2.7% which was actually below the expectation of 2.8%.

The reason behind this? There was a significant drop in the price of gasoline as prices fell 1.1% in July. In terms of what people felt, July was a rather good month for inflation.

Core CPI

Core CPI was a slightly different story. And this is where the negative headlines come in. While everyone expected Core to grow, it grew a bit more than expected. It came in with year-over-year results of 3.1% vs. 3.0% expected and was the highest we’ve seen in five months.

Is this catastrophic? Absolutely not. For those expecting tariffs to have an impact, however, it provided ammunition.

The funny thing was, the inflation we saw in Core CPI actually came from the “services” sectors of CPI, not the “things”. The biggest driver was shelter, which will be a common refrain to regular readers. Shelter CPI is the largest component of Core CPI, making up over 40% of the total. And it grew at an annual rate of 3.7%.

Closely behind were medical care (3.5%) and airline fares (4.0%). When you get to actual “things” (i.e., furnishings, vehicles, etc.) inflation remains particularly muted. Interestingly enough, these are the areas that tariffs should be impacting the most!

In the end, Core CPI is higher. All Items CPI isn’t (yet), but has been trending that way. Neither number is particularly elevated at this time. It is something to watch, but not something that should cause undue panic. In fact, both are lower than they were at the end of last year.

Past performance is not indicative of future results.

CPI’s Oft-Forgotten Cousin: PPI

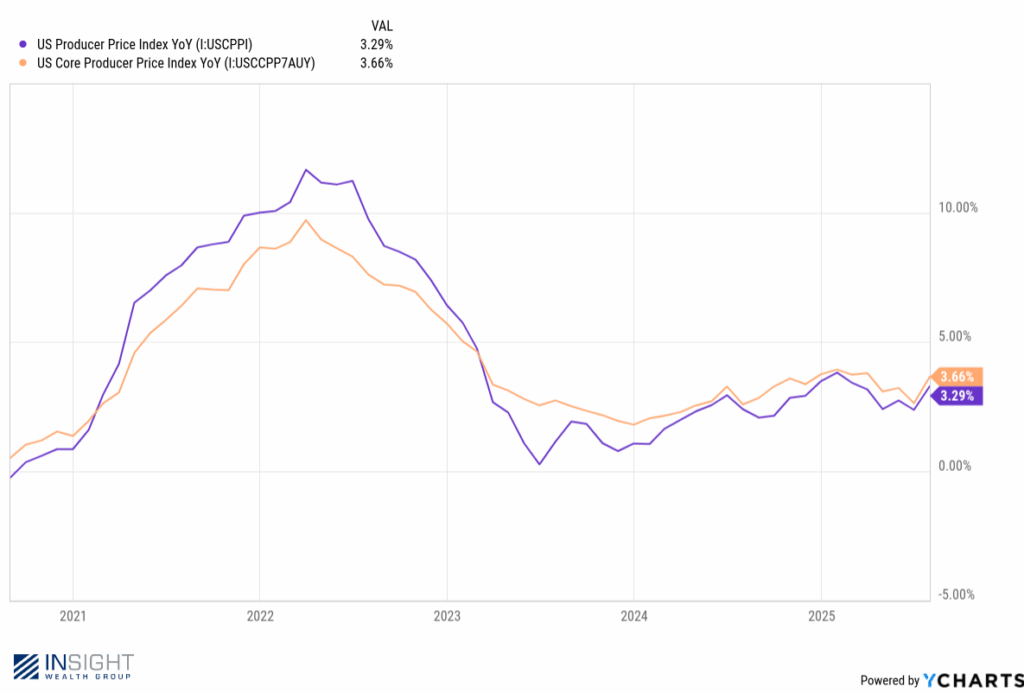

The media spends a lot of time talking about Consumer Price Inflation. And for good reason – the impacts on consumers are really what is most important to the economy. But that isn’t where inflation starts. Inflation starts with the companies that are making and importing goods: the Producers.

And economists measure Producer Price Inflation as well. It tends to be a leading indicator of where inflation is going. Take, for example, the peak of inflation that we saw in 2022. The rise in PPI started several months before the rise in consumer prices. And the peak happened in February of 2022. CPI didn’t peak until June of 2022, and Core CPI peaked in September of the same year. It took six months for the impacts to be felt amongst consumers.

Which is why another report this week – much less reported on – is just as important as what we saw with CPI. Year-over-year PPI jumped from 2.37% to 3.29%, nearly a full 1%. And Core PPI jumped even more, going from 2.63% to 3.66%. That is a notable move.

Past performance is not indicative of future results.

But, yet again, it shouldn’t be panic inducing. Much like CPI, this still leaves us below the levels we saw at the beginning of the year. And we don’t know how long the appetite of companies to “eat the tariffs” (as President Trump has suggested to Wal-Mart) will last. Frankly, we don’t even know if the tariffs will remain in effect.

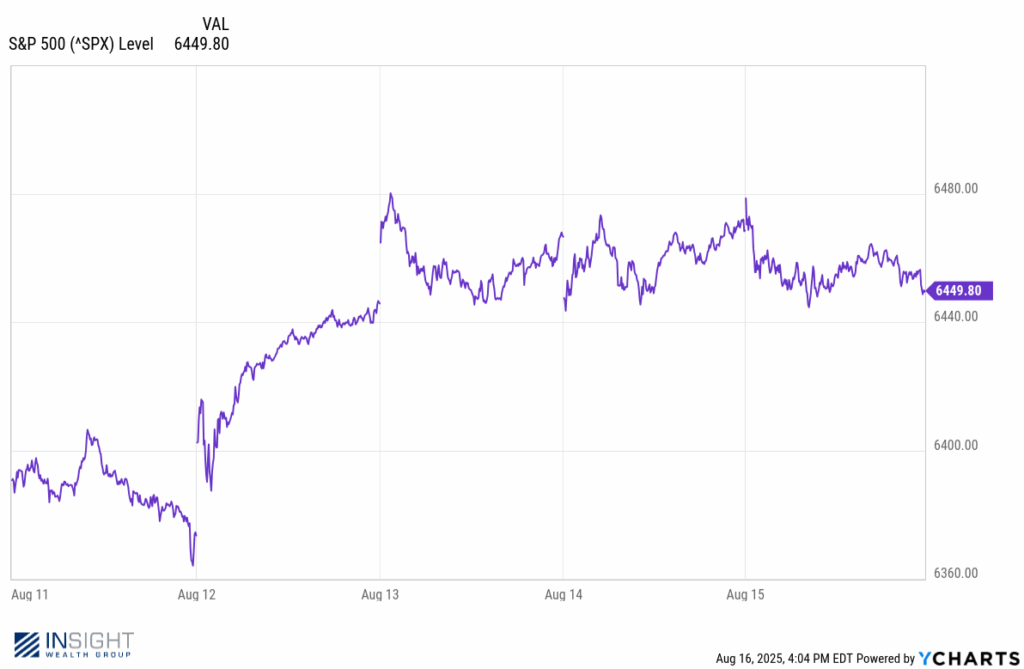

The market shrugged off this report on Friday morning and ended the week just off the new all-time high in the market set on Wednesday morning.

Past performance is not indicative of future results.

Given the information we have today – especially about consumers – that is probably an appropriate response. But it’s yet another reminder that we need to navigate these waters carefully as we begin to understand what this new framework for the world economy means for portfolios.

Sincerely,