The Weekly Insight Podcast – The State of the Consumer

Before we dive in this week, we just wanted to say a BIG thank you to everyone who came out and joined us at the Iowa State Fair last weekend! The Insight FairFest event has been a thing for 11 years and this was the very first time we’ve ever had to deal with rain. And yet, despite that, we had our largest crowd ever with nearly 400 people coming out to enjoy the Fair with us! Thank you so much! We can’t wait to do it again next year.

Now let’s get back to business. As we discussed last week, tariffs are on everyone’s mind right now. And – given we’ve never seen tariffs like this in a modern, globalized economy, no one can tell us exactly how this is going to work out. So given that level of uncertainty, we thought we’d take a moment this week to check in on the most important sector of the U.S. economy: consumers.

As you likely know, consumer spending makes up nearly 70% of the U.S. economy. So, if consumers are feeling – and doing – well economically, we can weather a lot of storms. But if consumers are slumping…we better watch out. So, let’s dive in and see what we can discover.

Labor Market

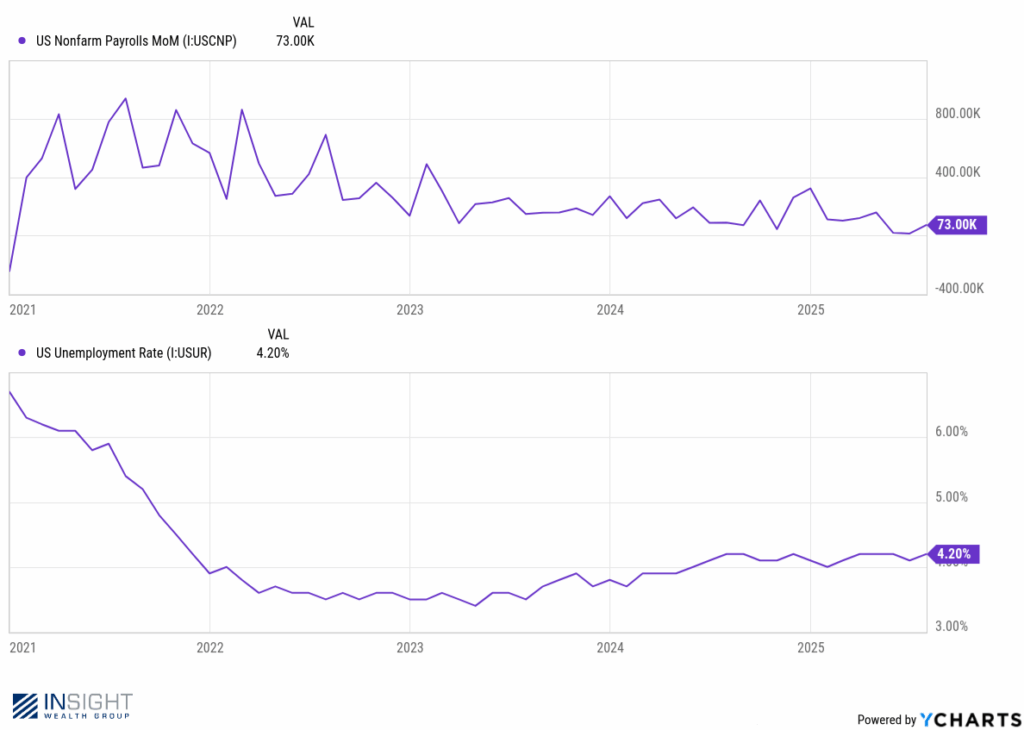

The market slumped a few weeks ago (briefly) after some lackluster July jobs data. And there’s no question the slowdown in hiring is real. But is the employment picture devastating?

Not really. Or at least not yet. Yes, the rate of job creation has slowed. And yes, unemployment has picked up a bit. But none of this is a particularly new trend. Job creation has been slowing since the Fed increased rates in 2022. And that has caused a slow uptick in unemployment. But don’t forget that was the point in raising rates! The labor economy and inflation were both too hot and we needed to cool things down.

Past performance is not indicative of future results.

And more importantly, our unemployment rate is still historically low. We pulled the results of every monthly unemployment report going back to January 1948 (the earliest we could find data). Average unemployment during that 77-year period? 5.67%. The labor market is something we should watch – but it’s not in any sort of crisis.

Consumer Sentiment & Inflation Expectations

We’re math people. Numbers make sense. When you start getting into things like “sentiment” and “expectations” it is a much softer science. But if you’ve been reading these pages for long, you know that we believe markets – and economies – are also experiments in psychology. So, understanding the psychology of consumers is incredibly important.

Consumers have been pounded for years with stories of impending economic doom. And that has only picked up in the media during the current tariff regime. So, what impact has it had on the consumers’ psyche?

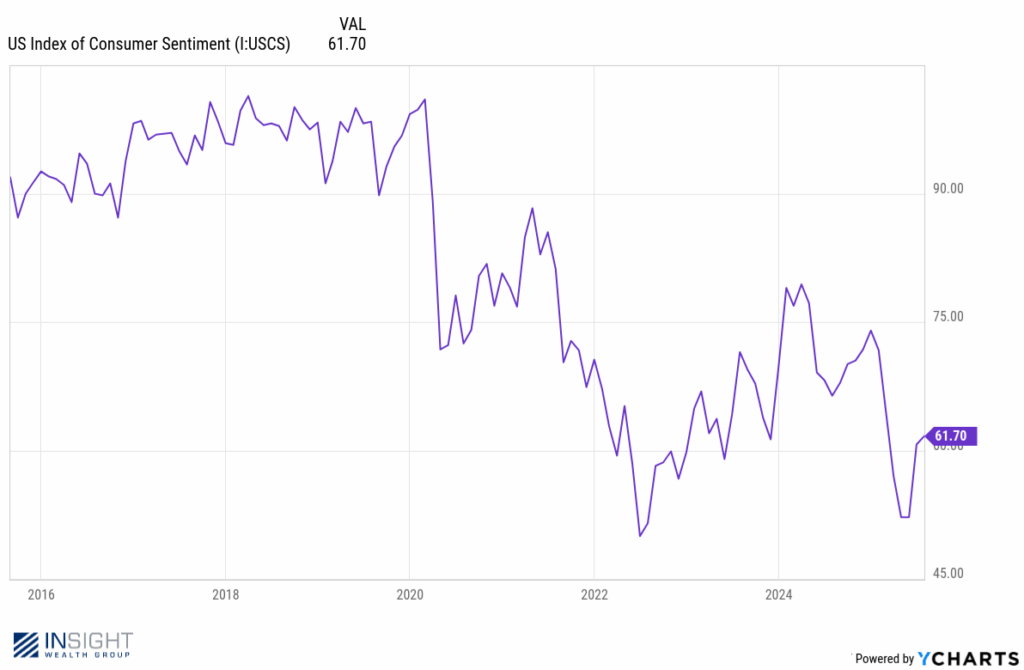

The first place to look is at measures of consumer sentiment. The University of Michigan’s survey on consumer sentiment has the longest data set out there. They’ve been measuring sentiment since 1952. We can see a couple of things from the data.

First, if you look at the chart below (which looks at the last 10 years), you’ll see that consumer sentiment is low, but has, interestingly, been rising for the last two months. But you’ll also note that consumer sentiment has never really recovered from COVID. We’ve never reached our pre-COVID levels of confidence.

Past performance is not indicative of future results.

If we look back on the data to 1952, we find that the long-term average for Consumer Sentiment is 84.98. We’re a long way off that mark. But only once since March of 2020 – over 60 monthly readings of this survey – have we been above that average. In April of 2021, consumer sentiment hit 88.3. By May it was back down to 82.9 and never again achieved those highs. Consumers have been worried for a while. And while tariffs have been the latest fear, they simply got us to lows we experienced during the rate hikes in 2022 and are – at least for now – recovering.

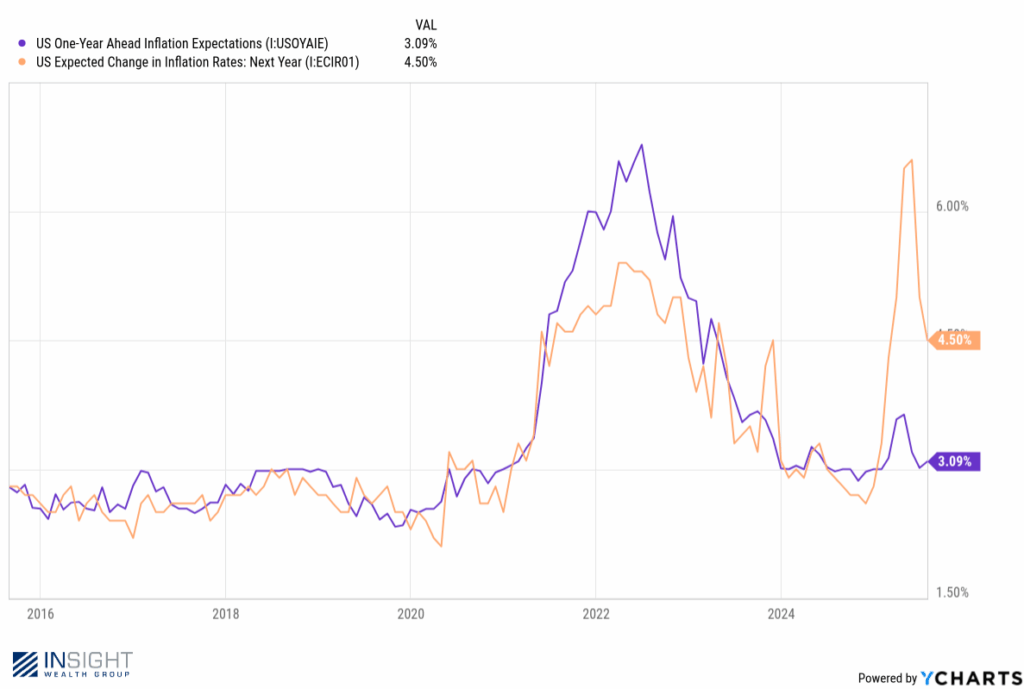

Which then brings us to inflation expectations. Again, this is a bit of a soft science. Researchers ask consumers what they expect inflation to be one year from now. We all know the average consumer isn’t an economist who can predict (accurately) inflation levels. But their belief about future rates will belie their behavior. If they expect sky rocketing inflation, they will adjust their spending habits to prepare for it.

There are two key surveys on this data. The New York Federal Reserve runs one and the University of Michigan runs the other. Both showed spikes earlier this year around “Liberation Day”, but both are currently settling back down. The Michigan survey showed a much more dramatic impact, so we’ll be watching it closely in the next few months.

Past performance is not indicative of future results.

Consumer Credit & Savings

Much is made of the consumers’ use of debt and the implications that it has for the long-term economy. Let’s short circuit the conversation right now by saying this: yes, the American consumer uses too much debt. And, yes, that’s built into the system by the ease through which consumers can access debt. It’s a frustration.

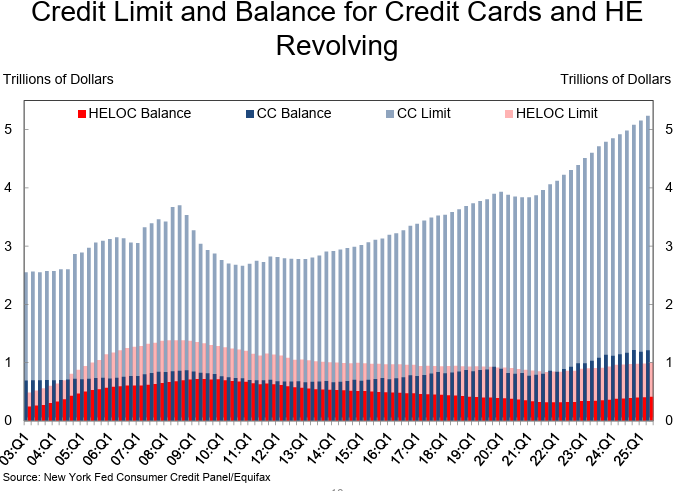

And it is showing up in the balances we see for consumer credit card debt. Total credit card balances reached over $1 trillion for the first time just a few years ago. And the trend is clearly upward. As it has been since 2013. It’s a bit hard to see but look at the dark blue data set in the chart below.

Past performance is not indicative of future results.

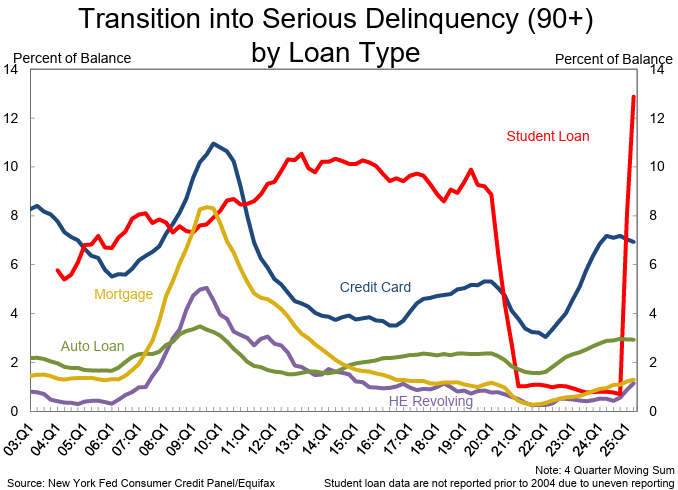

But as much as we’d love to lecture the world on the proper use of debt (pay off your credit cards every month!), what really matters is consumers ability to repay the debt. And delinquencies in all types of loans have been rising. But it’s not a 2025 problem. Delinquencies have been rising since 2022. In fact, less credit card accounts are transitioning into delinquency than they were in Q1 2024. It’s been a slight tick downward, but it’s been happening for more than a year.

Past performance is not indicative of future results.

We’d encourage you to ignore the student loan data in the above chart – that’s simply due to the political changes between Biden-era and Trump-era student loan forgiveness policies.

But also take a look at the mortgage, auto, and home equity loan delinquencies. Yes, we’ve seen a steady post-COVID rise. But we’re nowhere near 2008 level catastrophe. Consumers need to be careful, but they’re not tapped out on credit.

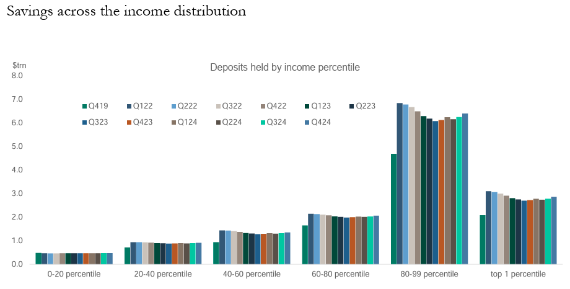

Which brings us, finally, to consumers’ access to cash. We addressed this in 2023 and 2024 when economists were calling for recessions and we just didn’t see it. Let’s check in on the savings balances today.

Source: Apollo

Past performance is not indicative of future results.

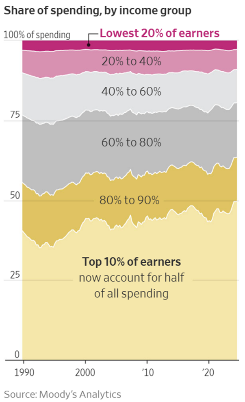

Consumers – all consumers – got a nice bump in their cash balances due to COVID. What’s interesting is that while some of it has been spent down, the top 80% of income earners all have more cash today than they had pre-COVID. That’s especially noticeable in the top 40 percent of income earners in the chart above. And what we know about that top 40 percent of earners is that they make up nearly 80% of all consumer spending. So, if consumer spending makes up 70% of GDP, that means their ability to spend capital impacts fully 56% of our GDP growth. It’s a big deal.

Past performance is not indicative of future results.

This doesn’t solve anything for the bottom 20% of income earners. They have had fairly stable savings balances – which is good – but the impacts of tariffs (and potential inflation) will be felt most in this group. The impact to the economy will be negligible – but the impact to those families has the potential to be significant.

So, what does all of this mean? We don’t know yet what the full impact of tariffs will be. It may be substantial, and it may cause issues in portfolios and the economy. But, at this moment, the strength of the consumer is solid. And that is incredibly important to long-term outcomes.

Sincerely,