The Weekly Insight Podcast – The 24-Hour Market Cycle

In politics, they often talk about the 24-hour news cycle. The gist goes something like this: a bad story comes out for you. If it gets oxygen – or you give it oxygen – it could last for some time and be a drag on your goals. But if it doesn’t – and you can simply ignore it – there will be something worse for the news to talk about in a day or two and the story will go away on its own.

It’s an adept reading of the society we live in today: people are wildly distracted by all of the information being blasted at them. If you just allow the cycle to happen, people will move on to the next salacious issue. It’s a bit like Obi Wan Kenobi in the first (or was it fourth?) Star Wars film:

Obi-Wan had The Force. In today’s society, the “force” is information (or a flood of it).

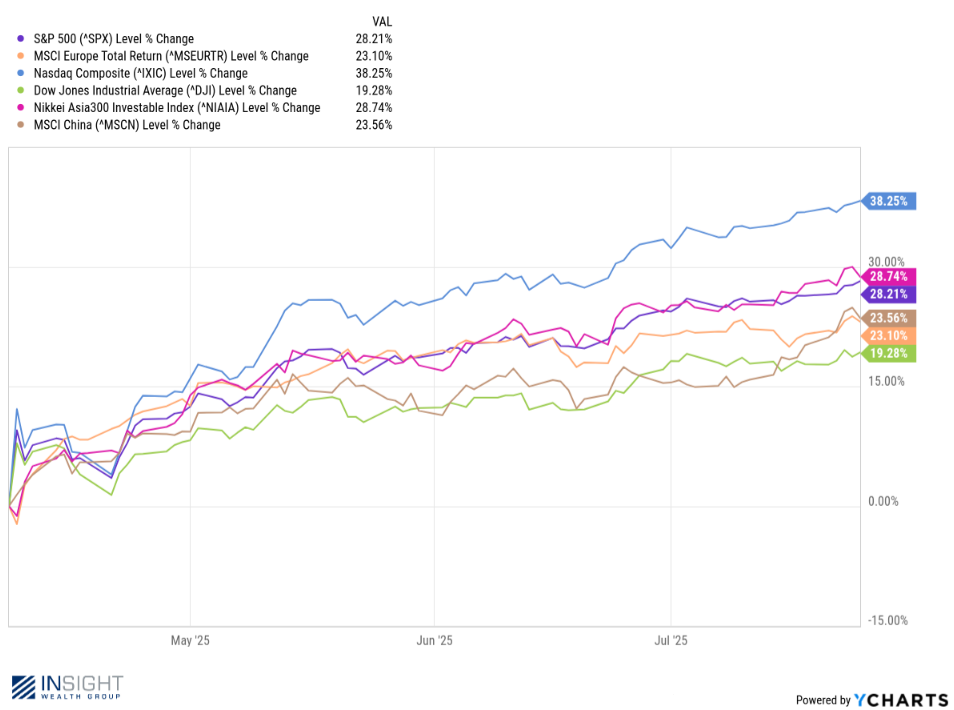

Which brings us to the market. There is no question we’ve been on a good run. Since President Trump broke from his Liberation Day approach on April 9th, we’ve had a significant rally in equities. Markets worldwide have been on a heck of a run.

Past performance is not indicative of future results.

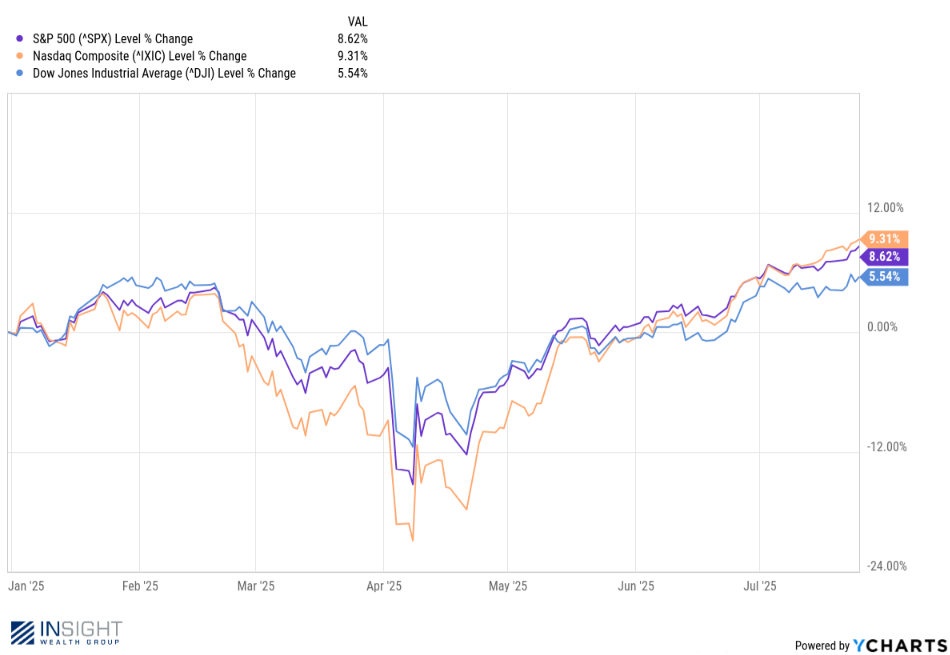

The year-over-year chart for U.S. markets doesn’t look quite as “hot”, but it has still been a tremendous first half of the year. And that is showing up in client portfolios.

Past performance is not indicative of future results.

The last two weeks have shown there is good reason for this. Economic data continues to come in fairly strong.

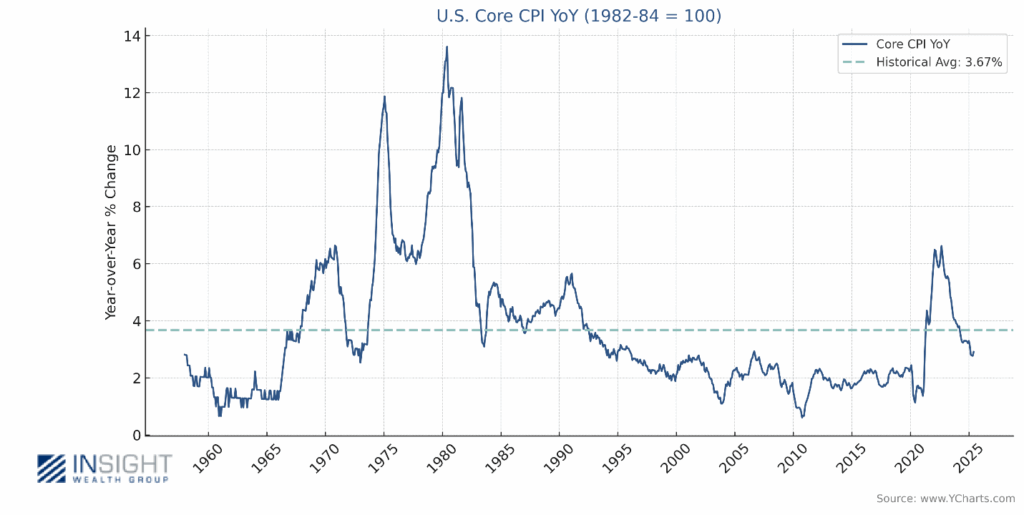

For example, we got the June CPI data. As expected, it had climbed (likely due to tariffs). But the result wasn’t terrifying. Yes, Core CPI climbed from 2.7% to 2.9% annualized. But that was below the 3.0% expectation. And it still remains well below the long-term historical average of 3.67%. This is not an inflationary environment.

Past performance is not indicative of future results.

Jobless claims have also remained fairly low. And more importantly, they’ve been below the expectation. Retail sales have picked up. They grew 0.6% in June after dropping 0.9% in May. Housing starts did the same, growing 4.6% in June after falling by 9.7% in May. And consumers’ one-year expectations for inflation – a great predictor of inflation – fell more than 10% in early July from 5.0% to 4.4%.

All-in-all, the economic news is bullish. And there is a particularly good chance the run will continue on Monday. Over the weekend, President Trump announced a new trade deal with the European Union. The full details aren’t yet available, but it sounds like it will be a much more agreeable 15% tariff, which the market will favor over the threatened 30% tariff. This follows the announcement of the Japan trade deal late last week. And the rumor mill is now saying the deadline for the China deal will be extended. This is more clarity for the market and will likely be a boon to equities.

But that brings us back to the 24-hour news cycle. Much like in politics, there is a 24-hour market cycle. Good news certainly lifts the markets. But it only lasts as long as the good news continues. And there is reason to believe the market is getting a bit stretched at these levels.

Over the weekend, Alli Canal from Yahoo Finance put out a piece about the “euphoria” hitting the market today. (You can read the article here.) Upon first read, our thought was “Euphoria? What?”. Yes – we’re a bit jaded. It’s been a wonderful year, but it hasn’t been without its stresses.

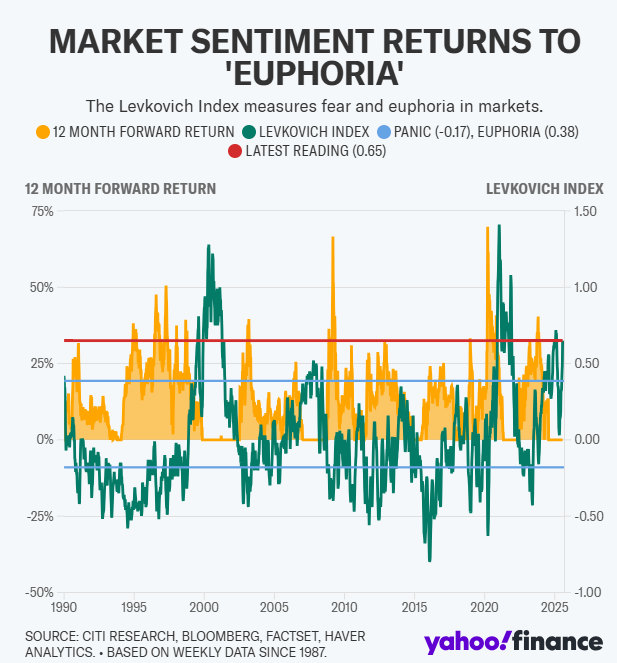

But the point of her piece was this: with equities up as much as they have been, when do we become concerned about the downside? And she’s not wrong. She cites Citi’s Levkovich Index which measures fear and euphoria in the market. As you can see from the chart below, we’re at pretty elevated levels of euphoria today and buyers should want exactly the opposite.

Past performance is not indicative of future results.

But as CitiGroup’s Drew Pettit notes in the article, “Bull markets don’t die of old age. There has to be a catalyst”.

So, what is that catalyst? It could be any number of things. But the most likely thing this week is the Fed Meeting. What will Jerome Powell and company say? And how will they impact the 24-hour market cycle?

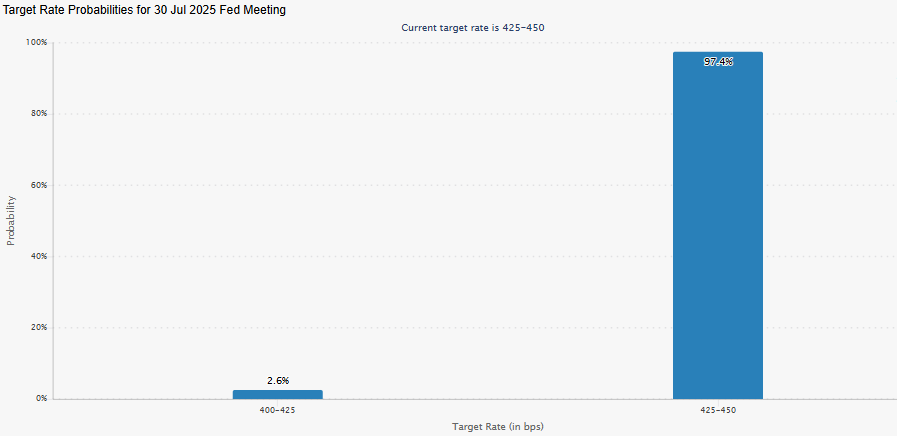

We all know Chairman Powell isn’t the stock market’s best friend. His pronouncements tend to create downward pressure on the market. But the good news is, no one is expecting good news from Chairman Powell this week. The market is currently putting 97.4% odds on the Fed doing nothing this week with rate cuts.

Source: www.CMEGroup.com

Past performance is not indicative of future results.

Where Powell could either confirm the bull market sentiment or severely test the 24-hour market cycle is with his projections for the future. The market isn’t asking for much. It’s currently pricing in two rate cuts this year and three next year. That would bring the Federal Funds Rate down to neutral – 3.0% – meaning the Fed won’t be leaning on the economy to slow it down.

Will it happen? We’ll see. Just remember: the good news on Monday could be quickly forgotten by Wednesday afternoon when Powell speaks. But the 24-hour cycle works both ways. Powell’s pronouncements from the podium could be quickly forgotten by new trade deals, positive earnings results, or continued demonstrations of economic strength. That’s why we don’t bet too heavily on the outcome of any of these issues.

Sincerely,