The Weekly Insight Podcast – What’s Different About Tariffs Today?

Editor’s Note: Next week the Weekly Insight Memo will be replaced by a new Quarterly Newsletter highlighting important items from all Insight Companies. The Weekly Insight Memo will return the following week!

Treasury Secretary Scott Bessent did an interview on July 1st with Bloomberg TV. At the time he was asked about the plan to release Fannie Mae and Freddie Mac from conservatorship. His response was this:

“I can tell you that we have been busy with peace deals, trade deals, and tax deals. (The) tax deal (will be) done on July 4th, a trade deal wrapping up mid-summer. And then we will focus on Fannie and Freddie”.

To those investors with significant exposure to Fannie and Freddie (many of our clients) this was great news. But Secretary Bessent very subtly also laid out the timeline for the rest of this summer.

First, he was convinced we’d have a tax deal (the Big Beautiful Bill) on July 4th. The President signed it on…July 4th. His next point was about trade deals being made later this summer. A good portion of the market looked past this point. But boy-oh-boy, was he spot on.

The Big Beautiful Bill passed and was signed by President Trump on Friday. Last Monday, the White House came out firing on tariffs. Here’s what we’ve seen so far:

- A new 35% tariff on all Canadian imports

- A 50% tariff on all Brazilian imports

- A 50% tariff on all imports of copper

- An extensive list of countries – including allies like Japan and South Korea – received letters outlining new tariffs from 25% – 50%.

- An additional 30% tariff on Mexico and the European Union announced over the weekend.

All of these tariffs are set to take effect on August 1st. And it is a big escalation of the tariff discussion. But the market’s reaction has been…muted.

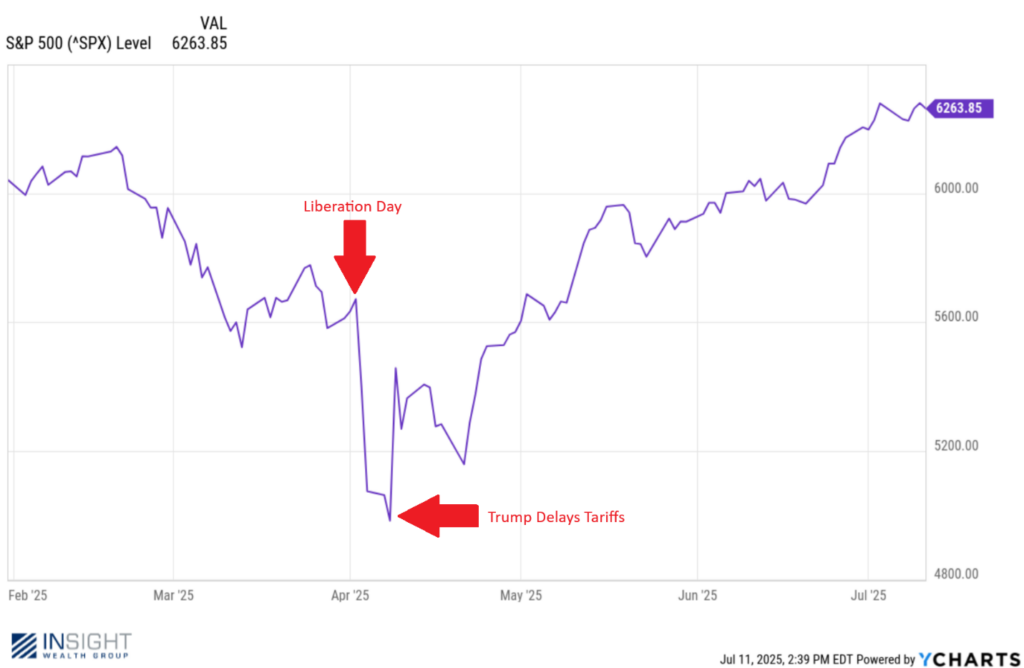

Take for example, the first time we went through this process. The stock market started correcting early in Trump’s 2nd term, eventually pulling back more than 20% peak to trough. But the worst of it happened from “Liberation Day” on April 2nd, until Trump announced delays on tariffs on April 9th.

Past performance is not indicative of future results.

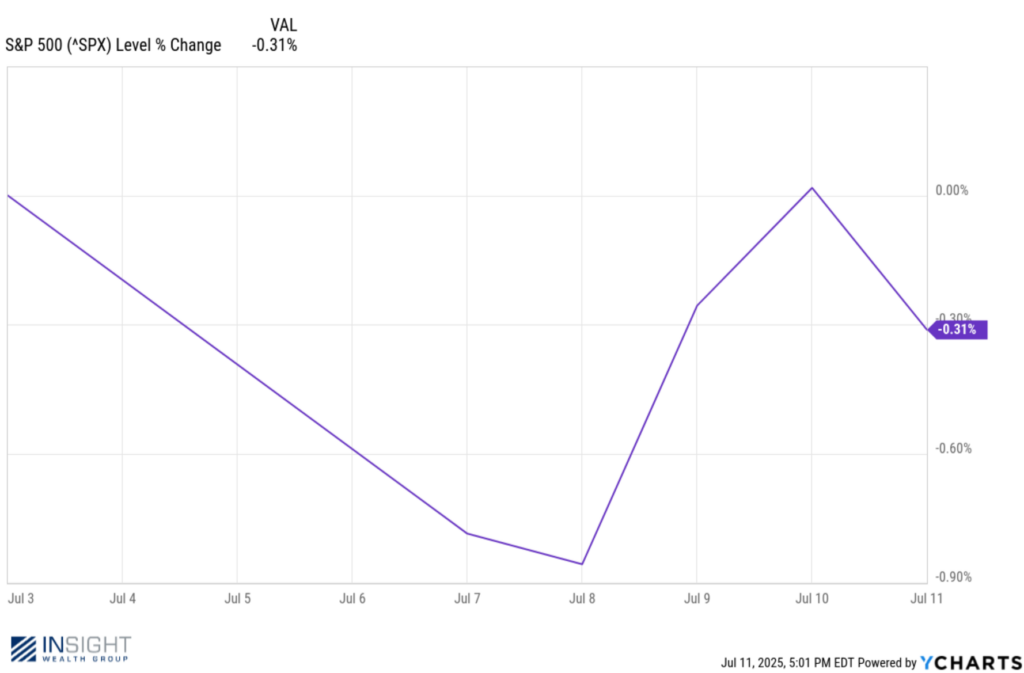

If last Monday – the start of the new tariff blitz – is the equivalent of the next “Liberation Day”, then the market reacted much, much differently. It closed the week down just 0.31% from last week’s close.

Past performance is not indicative of future results.

So, what gives? Why doesn’t the market care about tariffs anymore? It comes down to one simple theory: Wall Street just thinks this is a negotiating tactic. They look at the action out of Washington and think we will back off from tariffs before any big implementation.

Will we? Or does President Trump intend to follow through? It’s hard to say. But sometimes perception matters more than reality. And Wall Street’s perception today is that Trump uses tariffs as a bargaining tool and won’t actually go all the way with implementation.

And so, the market continues to hang in there despite aggressive new tariff news. It’s vastly different than what we saw just three months ago when the market – especially the bond market – was signaling that tariffs would be disastrous for our economy. Because they are convinced this is all a bargaining tactic and he won’t do anything that would seriously impact the U.S. economy.

That’s great. We love the optimism. And we hope it’s true. But optimism and hope have never been the recipe for sustainable portfolios. We need something a bit more solid than that. And the enduring question remains: what happens if he really means it?? What happens if the delays end and the tariffs begin? How will markets respond?

Thankfully, the market has given us a rather good blueprint which was laid out clearly in the first chart we included in today’s memo. A 20% peak-to-trough correction would be the base case if Trump goes all in on tariffs.

But that’s where things become interesting for our clients and their portfolios. We all experienced the correction earlier this year together. While every client’s experience is different, our core strategies saw pullbacks significantly less than the broader market. And that has led to year-to-date performance which is quite good.

Why that worked comes back to a conversation that started in these pages in the second half of last year: taking a significant amount of risk off the table in portfolios and putting those assets into short-term, interest-bearing instruments. That decision has been a boon to portfolios.

But it also begs the question: when do we put our foot back on the gas? When do we take those “risk off” positions and put them back into the market? The market’s insistence that tariffs aren’t really going to happen means we wait. For now.

If the market is correct and tariffs are just a negotiating tactic, portfolios have proven they have the juice to participate in the upside potential. Will we catch all of the upside? Maybe. Maybe not. But given our advantage so far this year, we have room to work.

But if the market is wrong, and Trump really does lean hard into tariffs, we’ve seen how our portfolios perform in that environment. Taking a bit of our potential upside off the table to protect against what we must assume is at least possible on tariffs is a trade we’re happy to make.

Of course, this is an extremely broad overview of our portfolio positioning. Every client is different. So, if you have any specific questions or needs regarding your personal portfolio, we encourage you to give us a call. We’d love to catch up and discuss how your portfolio is performing in this environment.

Sincerely,