The Weekly Insight Podcast – One Big Beautiful Podcast

We hope this finds everyone well rested after a wonderful celebration of our Nation’s independence. Our country has been at this project for 249 years. We’ve gotten a lot right – and a lot wrong – over that nearly quarter millennia. But the truth is, this idea of representative democracy is still in its infancy. As we look to what should be an amazing celebration of the 250th anniversary of the Declaration of Independence next year, hopefully we can remember that what brings us together is far more important than what divides us these days!

But – speaking of things that divide us! – we need to talk about the One Big Beautiful Bill (OBBB) that passed through Congress and was signed by President Trump last week. The very narrow passage of the bill tells us that this legislation was polarizing. Fans of President Trump loved it. Detractors despised it. We’ll remind you that – when it comes to your wealth – we don’t care which side wins. But we do care how this legislation will impact you. So, this week, we wanted to pull out some important pieces of the bill and explain exactly how they impact you.

Tax Rates

The conversation around this legislation all started with the desire of President Trump and the Republicans to make permanent the 2017 Tax Cut and Jobs Act (TCJA). This signature tax legislation from the first Trump term was set to expire this year meaning tax rates would go back up to their pre-2017 levels.

That is, however, a bit of an over-broad description of the goals. Yes, they wanted to make some things permanent. There were others that they wanted to change and adjust from the previous legislation. We’ll get into several of them in a bit.

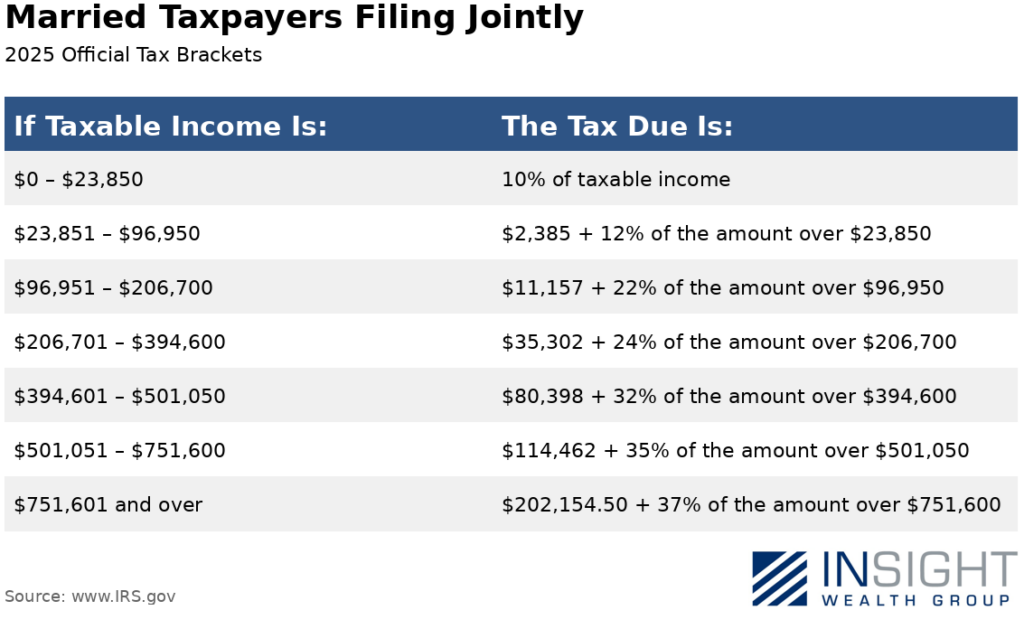

But the big hurdle was making the existing tax rates permanent. That was accomplished. For reference, we’ve listed the 2025 tax brackets for taxpayers who file jointly. (We’ve utilized the married filing jointly information throughout the memo. However, we’re happy to provide details for other filing statuses as needed.) Remember – the rates are now permanent, but the dollar figures in the brackets will be adjusted annually for inflation.

Past performance is not indicative of future results

We’d also add that “permanent” is a very…impermanent…word in Washington, D.C. There is no legislation that is passed that can’t be amended with future legislation. But this bill means these rates won’t just magically expire as they were going to this year. Congress must proactively vote to change them.

SALT Deductions

State and Local Tax Deduction Limits (SALT) were one of the key pieces in getting the 2017 TCJA passed. The theory was these limits closed a loophole and helped offset the tax cuts in the original bill. In reality, there was also a belief by Republicans that higher tax blue states benefited from the old unlimited SALT deductions. And there was a belief by Democrats that Republicans were targeting their constituents to help pay for the tax cuts. Both were largely correct.

We must remember that – even in big blue states like California and New York – there are Republican members of Congress. And given the OBBB passed by just four votes in the House and one in the Senate, those members had some bargaining power. And they wanted SALT deductions back for their constituents.

The result was a middle ground of sorts. But it’s likely to impact many of our clients. The simple version is this: those making less than $500,000 per year will be able to take up to a $40,000 SALT deduction. Once you clear that $500,000 level, the SALT deduction phases out (rather quickly) back to $10,000 per year.

This is, however, a non-permanent part of the bill. It expires in 2028, and the SALT deduction will revert to $10,000 per year for all taxpayers unless new legislation is passed to extend or make permanent the new levels.

Qualified Business Income

Many of our clients are business owners. And many own those businesses through “Pass Through Entities”. The TCJA created a 20% deduction for pass through entity income that was a huge win for business owners. That was made permanent under the new law.

There was one limitation on the QBI deduction back in 2017: Specialized Service Trades or Businesses (SSTBs). By definition, SSTBs are businesses that provide services such as health, law, accounting, etc. They have – since 2017 – qualified for a much more limited QBI deduction (up to $100,000 per household). That limitation still exists, but the limit has been raised to $150,000 per household.

Temporary Tax Savings for Seniors

The bill included an additional $6,000 deduction for seniors meant to offset the taxes created by Social Security earnings. This deduction phases out above $150,000 in income for those married filing jointly, and it expires in 2028. But at its current levels, the Council of Economic Advisors estimates this would allow 88% of seniors to claim the deduction.

Changes for Auto Buyers

The government has historically used tax policy to try to drive consumers in its preferred direction. In recent years, that direction has been toward clean energy, electric vehicles, etc., etc. The winds (pun intended!) are changing. No longer are credits for wind and solar projects going forward. Any project started after June 2026 will not be eligible. And credits for the purchase of an electric vehicle will be phased out by September 2025.

But that doesn’t mean Washington wants you to stop buying cars. They just want you to buy different cars. The EV credits were replaced by a $10,000 per year deduction in auto loan interest for cars assembled in the United States. For someone in the 22% income tax bracket, that’s a $2,200 dollar savings – per year – between an American assembled Cadillac and a German assembled Mercedes Benz. That can move consumer behavior.

Raising the Debt Ceiling

This isn’t an item that will impact you (directly), but it is one that takes a bit of uncertainty out of the stock market. For years, we’ve been fighting the annual (or sometimes more than annual) battle around the debt ceiling. Frequently the economy was held hostage by the risk of a “government shutdown” while Congress debated the level of the debt ceiling.

The OBBB took the debt ceiling and increased it by $5 trillion. Sadly, this isn’t a permanent solution. The U.S. national debt is increasing by roughly $1 trillion every 100 days which means this bought us about 17 months without a debt ceiling discussion. But at least it means we won’t be having this fight again in September.

Is This Good Legislation?

There is a LOT more to this bill. At 897 pages, we haven’t read the whole thing. Which probably puts us in the same boat as most members of Congress. We’ll be parsing this out for a while as folks find new gems hidden throughout the bill.

But the question of “good” or “bad” legislation likely depends upon your political persuasion. What we must all admit this bill doesn’t do, however, is address our national debt. And our national debt – in our opinion – is the big long-term issue for our country. And neither party seems very focused on resolving it.

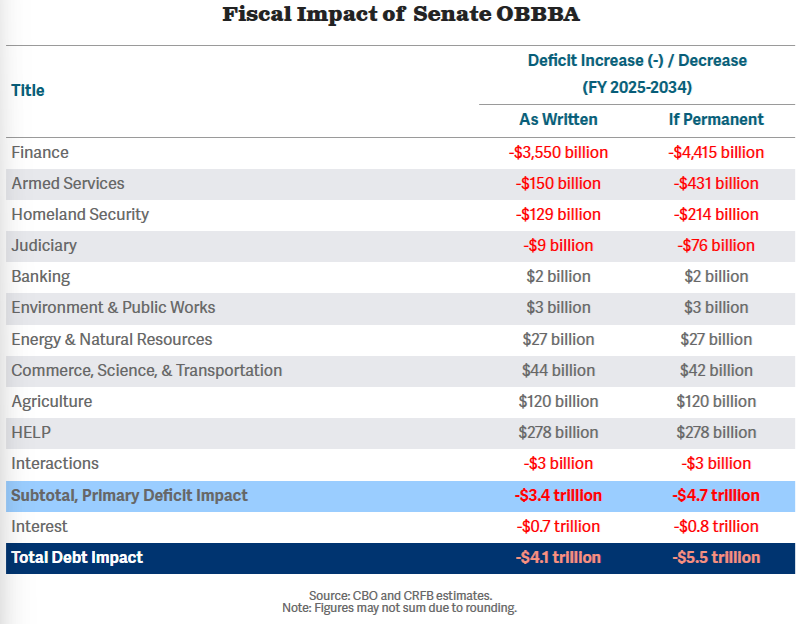

According to the non-partisan Committee for a Responsible Federal Budget, the final bill will add an additional $4.1 trillion to the national debt over the next 10 years. And that’s as the bill is written today. If the non-permanent provisions were to become permanent (i.e., SALT deduction limits), that number rises to $5.5 trillion.

Past performance is not indicative of future results

That means there is still much work to do in Washington. But at least – for the time being – we know what the rules will be. That will be beneficial for markets – and your portfolio.

Sincerely,