The Weekly Insight Podcast – The Enduring Strength of America

Those of you who have been following these pages for a while have probably noticed a few trends:

- We’re not huge fans of the “talking heads” who spew some version of “The world’s going to end!” or “Things only ever look up!”. It’s our opinion that things are never nearly as bad – or as good – as they would like you to believe.

- Public policy matters. But only so much as it helps set the rules of the game. Markets are neither conservative nor liberal. They’re capitalistic. And they will take advantage of whatever rules are placed in front of them. Understanding those rules today – and where they may be in the future – is important.

- 99% of what matters in a portfolio – when you’re looking over a long period of time – is about the “big trends”. Economic expansion vs. contraction (recession). Understanding the business cycle. Paying attention to earnings. These aren’t sexy topics – but they solve for almost all of the long-term outcomes.

Which is why the events of the last week – and the upcoming celebration of the birth of America – got us thinking.

If you’ll recall our comments from last week’s memo, they were largely focused around the threat that Iran could close the Straits of Hormuz. When looking at it from the “big picture” basis of the economy, it would undoubtedly be recessionary.

We thought about it as investors in the U.S. and global economy. But we didn’t think about it from “big picture” perspective of the leadership in Iran. When you put that framework on it, it shifts slightly. Yes, closing the Strait would be a wonderful way to exact revenge against the United States. But it’s also a terrific way to make sure you end up without a country to govern. It turns out, that’s what the Ayatollah was thinking. Our “big picture” and his were vastly different.

But it also seems like our big picture here at home has become a bit clouded. And for good reason. This nation is in a bit of a…feisty… place right now. And that shows up in our conversations with clients. We have clients from all over this great nation with widely diverse viewpoints on what direction this nation should move.

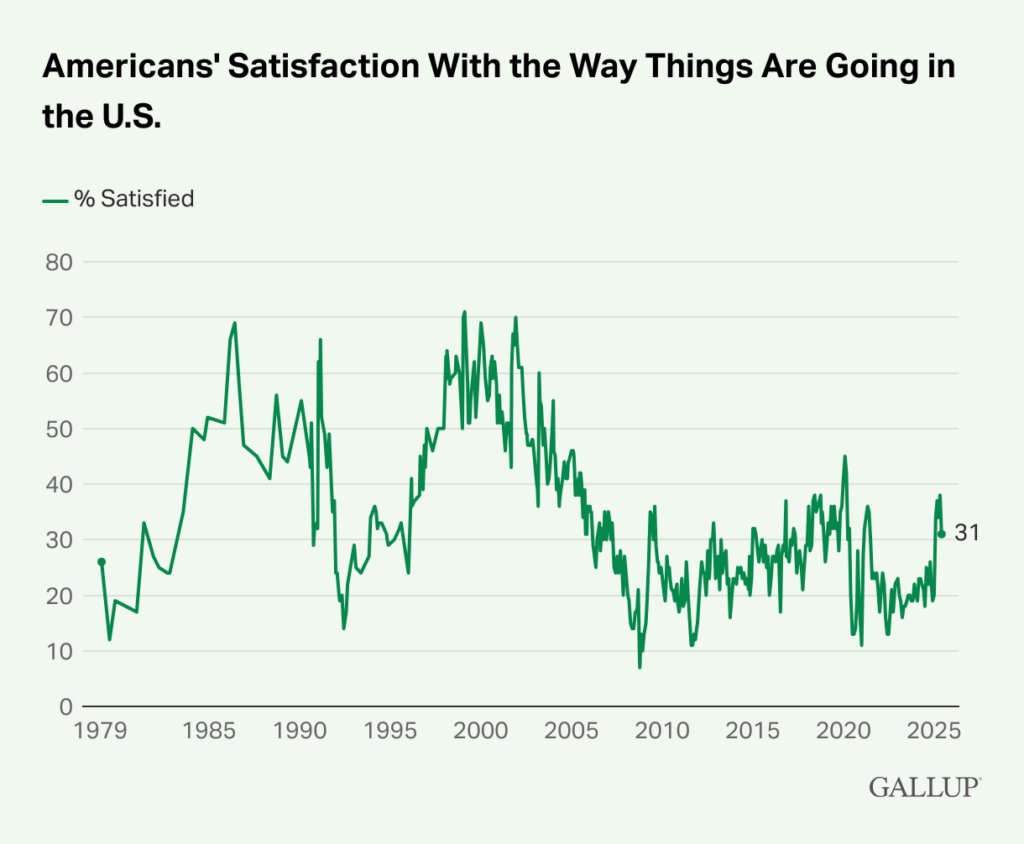

And this trend isn’t new. Gallup has been asking Americans for over 40 years a simple question: “In general, are you satisfied or dissatisfied with the way things are going in the United States at this time?”.

It should be no surprise that, in times of economic woe, the answer has always trended toward “dissatisfied”. But in it typically didn’t stay there. That is, until the 2008 Great Financial Crisis. Satisfaction – which in past good economic times has gotten as high as 70% – hasn’t been the majority opinion in this country ever since the mid-2000s.

Source: News.Gallup.com

Past performance is not indicative of future results.

Of course, there have been bad moments in the last 17 years (COVID being the lowlight), but it’s actually been a remarkably peaceful – and economically successful – time. And yet we’re all as frustrated – or dissatisfied – with our country as we’ve been in our worst moments.

So, here’s the message we’d like you to hear from us during the week of Independence Day: don’t bet against the U.S.A.!

Is this just nationalistic 4th of July mumbo jumbo from Insight? Not at all. No matter how patriotic we may feel when the fireworks are exploding on Friday night, this is just cold, hard commerce. And we’re not the only ones who feel this way. Take it from Warren Buffett. As he said several years ago:

“In its brief 232 years of existence, there has been no incubator for unleashing human potential like America. Despite some severe interruptions, our country’s economic progress has been breathtaking. Our wavering conclusion: Never bet against America”.

We agree. And there are “big trends” that back this feeling up. Take for example:

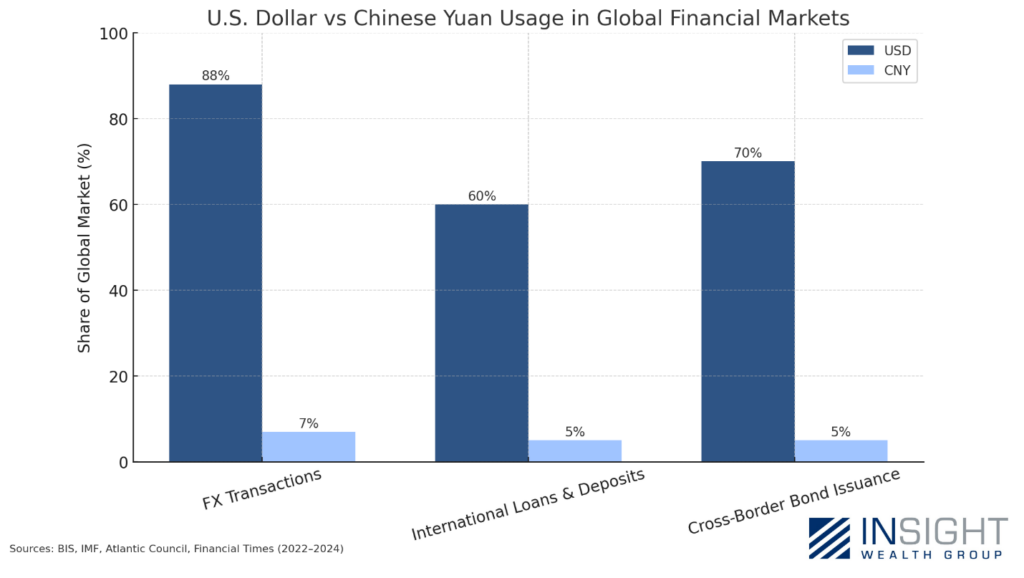

1. Global Financial Dominance

More than once, we’ve heard the concern from investors that the U.S. may lose its status as the “world’s reserve currency”. The specific concern is that China may catch up to us. Bluntly, you don’t have to worry about that. At least not for ia long, long time. Even after all of China’s economic growth, no one trusts them to execute financial transactions. But they predominantly trust us (despite our many flaws).

Past performance is not indicative of future results.

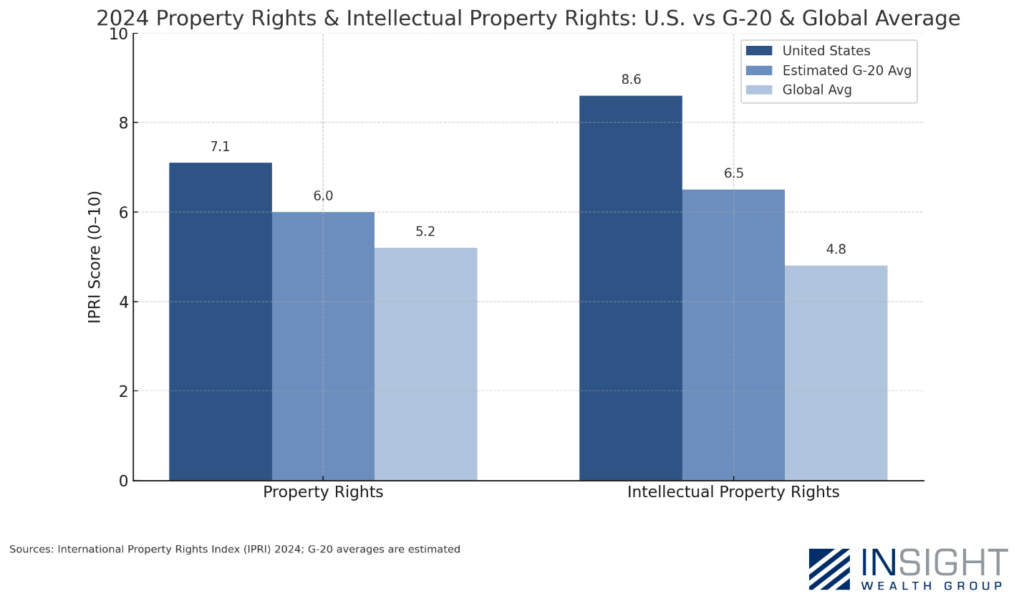

2. Rule of Law and Property Rights

Citizens may not be loving our legal and political system in the United States today, but it’s still one of the best in the world – especially when it comes to reinforcing our economic strength. This is one of the key reasons nations want to use the dollar to facilitate transactions. But it’s also one of the key reasons Americans of all classes have been able to build wealth unlike anywhere else in the world.

Property rights and intellectual property rights have given people – not just corporations – the ability to build real wealth. And by the international measures of both, the U.S. is far ahead of the rest of the world.

Past performance is not indicative of future results.

3. Energy & Food

There’s a line that goes something like this:

“Hard times create strong people. Strong people create good times. Good times create weak people. Weak people create hard times”.

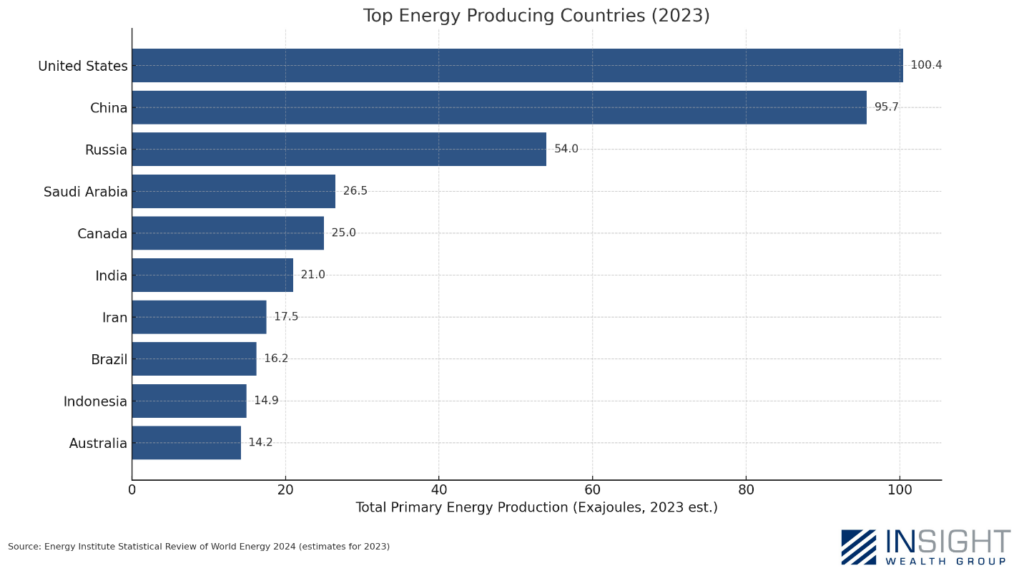

Whether you believe in the cycle or not, the truth is there will always be challenging times that exist in this world. And the U.S. won’t be immune to them. But we will have the natural resources to survive them.

Today the United States is the world’s largest producer of energy. The next closest – China – is producing energy for a population over 4 times our size.

Past performance is not indicative of future results.

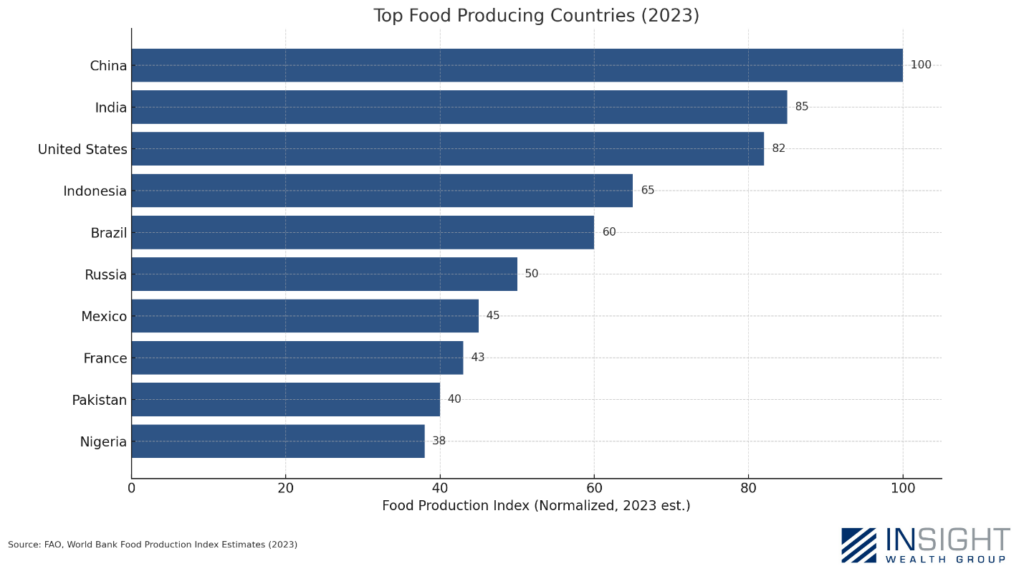

And the results are similar for food. While we’re not the largest producer of food anymore (we come in 3rd), we’re doing so for a population a fraction the size of the leaders.

Past performance is not indicative of future results.

4. Geographic Safety

This one is obvious when you look at a map, but it became a much bigger deal recently. Imagine living in Iran or Israel, where your nearest enemy is…close. And able to launch missiles and war planes against you on a whim.

We don’t have that problem. Our nearest neighbors to the east and west are thousands of miles away. And our neighbors to the north and south are both friendly and much more reliant on us than we are on them.

But we got one other reminder when we sent warplanes from Missouri, all the way around the world to Iran and back, to bomb their nuclear facilities. No one else in the world has the ability to do something like that. So, while we’ll always have enemies who try to nibble at the edges, we can go about our commerce – and lives – unmolested.

Simply put, for all there is to complain about (and we can all find a lot!), let’s take a moment this week to be grateful for the nation we call home – and the time we’re alive. The institutional foundations of this nation – started by some incredibly wise men 249 years ago this week – have blessed us all in ways we can never truly appreciate.

Sincerely,