The Weekly Insight Podcast – 1973 Redux?

It was a big weekend on the international stage. You should all be up to speed by now – but just to recap – President Trump initiated a strike utilizing B-2 stealth bombers armed with bunker busting bombs and Tomahawk cruise missiles launched from submarines to attack Iran’s nuclear weapons program.

Conflict in the Middle East is nothing new. The leadership in Iran – both the Ayatollah who overthrew the Shah in 1979 and his successor who still rules the country – have been clear in their “Death to America” propaganda. In response, we have been engaged in a quiet war against Iran and its proxies for decades. But it has heated up in recent years. President Trump nullified President Obama’s Iran nuclear deal and killed the head of the Qud’s Force, General Soleimani. Iran attempted to hire assassins in the United States to kill President Trump and other American leaders and also utilized their proxy militias to launch a deadly attack against Israel.

After the strike, the rhetoric escalated significantly. Iran announced that the U.S. had now crossed a “red line”. The Russians, specifically former Russian President Dimitri Medvedev, announced that “a number of countries are ready to directly supply Iran with their own nuclear warheads”. We’d call that wildly unlikely, but it hits the point: the global political climate is on edge right now.

It is often at these moments that we get asked an important question: what have you done – or are you doing – to protect our portfolios in this time of conflict? And what could the conflict mean for the state of the world economy and markets? They’re important questions. Let’s dive into them.

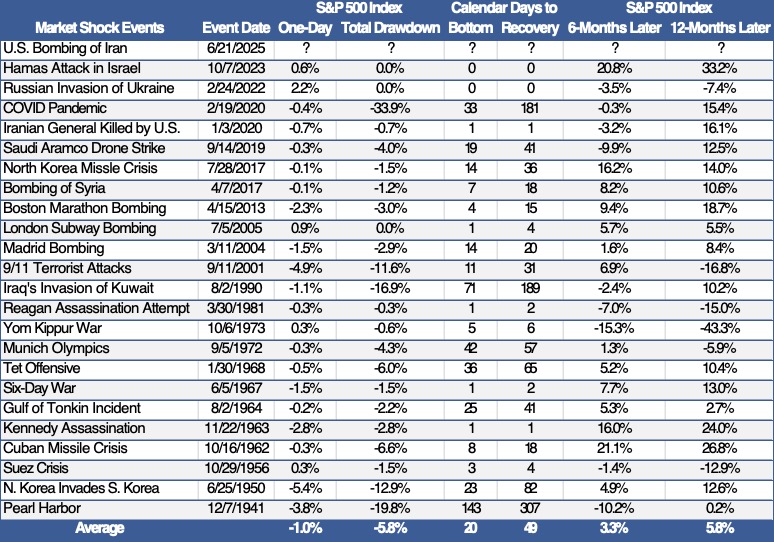

First, let’s start broadly. The stock market doesn’t particularly care about war or crisis. It cares about earnings and profit margins. And while significant incidents or crises can create a lot of volatility up front, long-term returns tend not to be impacted.

Past performance is not indicative of future results.

But if you look at that data from the chart above very closely, you’ll see one significant outlier:

Past performance is not indicative of future results.

Let’s be clear – the market didn’t care about the Yom Kippur war. What it did care about, however, was the oil embargo that OPEC placed on the United States in response. The embargo was done in retaliation for the U.S. decision to re-supply the Israeli military during the war and was done primarily to gain leverage in the peace negotiations.

By the time the embargo was lifted just five-months later, oil had skyrocketed from $3/barrel to nearly $12/barrel. And U.S. foreign policy hasn’t been the same since. All of our interventionist activities in the Middle East for the last 50 years have been focused on ensuring we are never again pushed to economic crisis by totalitarian governments with their fingers on the oil spigot.

Which brings us to where we are today: the question isn’t one of a war between Israel and Iran. It’s a question of oil. And what Iran can do to bring the global economy to a halt to protect the Ayatollah’s regime.

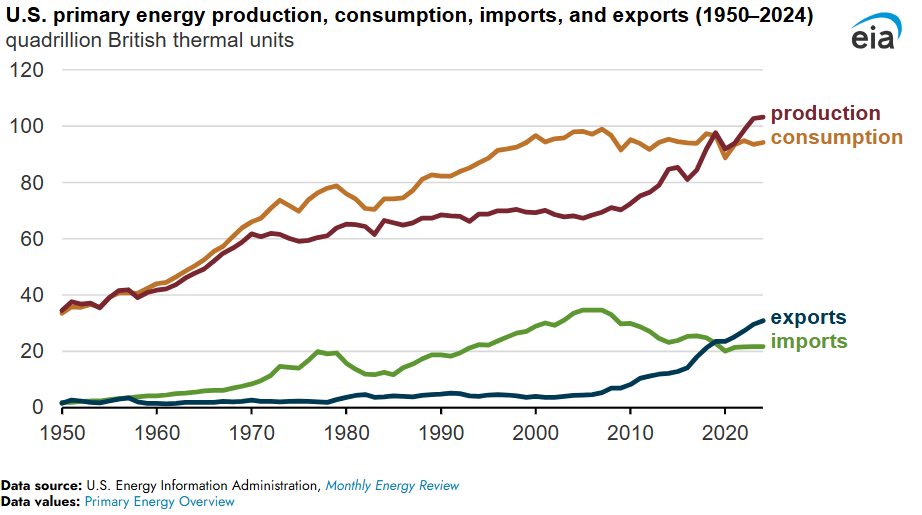

The good news is the United States is no longer dependent upon foreign oil to supply our economy. In 1973, we consumed 17.31 million barrels of oil per day and produced just 10.95 million barrels. That meant fully 37% of our oil had to be imported – mostly from the Middle East.

Much has changed since then. Our consumption of energy – while it has grown – has grown much slower than pre-1973. And our production has skyrocketed. The United States is now a net-exporter of energy.

Past performance is not indicative of future results.

But Iran still has one – unbelievably valuable – macro-economic tool: the Strait of Hormuz.

We’ve talked about this in these pages before. But let’s do a quick recap. The Strait of Hormuz is a stretch of ocean that serves as the funnel between the Persian Gulf and the Indian Ocean. It is a choke point through which fully 20% of the world’s oil production flows every single day. At its narrowest point, it is just 20-miles across.

On Sunday, the Iranian Parliament voted to close the Strait. That is not a final decision – that will be made the Ayatollah and his Supreme Council. As of the time this was being written, the decision was expected sometime on Sunday night.

Let’s be clear: the Strait is not Iran’s to close. Yes, they form the northern shore of the Strait. But it is international water and is patrolled regularly by the United States Navy and the navies of our allies. But it would not be difficult for Iranian naval vessels to harass commercial shipping to a level that companies would be unwilling to send their people and their valuable cargo through the Strait.

So, what does this mean for markets? The price of oil would likely skyrocket. Many predictions put it at or above $100 per barrel. But didn’t we just say the U.S. doesn’t need oil? Yes – but we live in a global economy. Lack of supply elsewhere will drive prices higher here.

$100 oil would be fully 33% higher than our current price (roughly $75/barrel). That’s not a 300%+ spike like we saw in 1973 – but it’s significant. Given the importance of energy to pretty much everything else in the economy, it’s the kind of move that can cause a recession.

So, what does that mean for portfolios at Insight? First, we’re extremely glad we have an overweight to energy in our portfolios. That has been a position we’ve held fast since COVID and while it has been accretive to portfolios, it will be particularly handy now.

The other point is we still remain defensive across all of our core strategies. We hold more cash or cash equivalents today than at any time in our firm’s history. If a recession is what we must endure, then we will at least have the capital to take advantage of it. These moments of reset have historically turned into tremendous moments of opportunity.

But what do we do now? What action should we take today? This is often hard to swallow – but the answer is nothing. First, panicking has never been a worthwhile endeavor in markets. Second, it’s the work done in portfolios days, weeks, and months before these events happen that matter. We’re prepared – and we’ll act when we need to. But now we must see how these events play out. And pray for those directly impacted.

Sincerely,