The Weekly Insight Podcast – One-Handed Economists

President Harry Truman once famously asked his advisors for a “one-handed economist”. When, dumbfounded, they asked him what he meant, he stated that every economist he spoke to said “on the one hand, this. On the other hand…”. He desperately wanted someone who could give him certainty.

That’s been the story of economics for a long, long time. It has long been a study of theories but has had a harder time dealing in immutable facts. Take physics. In physics we had certain theories – like gravity – that are no longer considered theories. In fact, the official name for our understanding of gravity is “Newton’s Law of Universal Gravitation”. It’s not a theory, it’s a law. And it doesn’t apply in some places or situations, but universally.

There is no such certainty in economics. One need only to pull up the Wikipedia page for “History of Economic Thought” (you can find it here) to see just how widespread the theories are today on how markets and economies work. To suggest there are well defined “universal laws” is a fallacy.

Which is why we find it interesting (funny, even?) when we hear the absolute certainty that exists from economists and market prognosticators in Washington and the financial media.

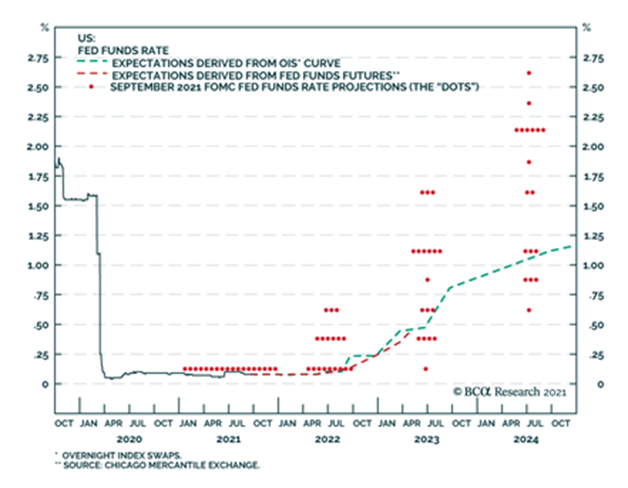

Let’s look at a couple of past examples. First, the Fed. You are all familiar with our discussion of the Fed’s Summary of Economic Projections and why it shouldn’t be a forecasting tool. But this is stunning when you look at it. Below is a summary of the Fed’s “Dot Plot” along with market expectations for rates in September 2021. At the time, the vast majority of the FOMC expected rates in 2022 to be at or below 0.50%. And they expected them to rise as high as 2.00 – 2.25% by the end of 2024. The market was even more conservative, with rates expected to be below 1.25% by 2024.

Source: BCA Research

Past performance is not indicative of future results.

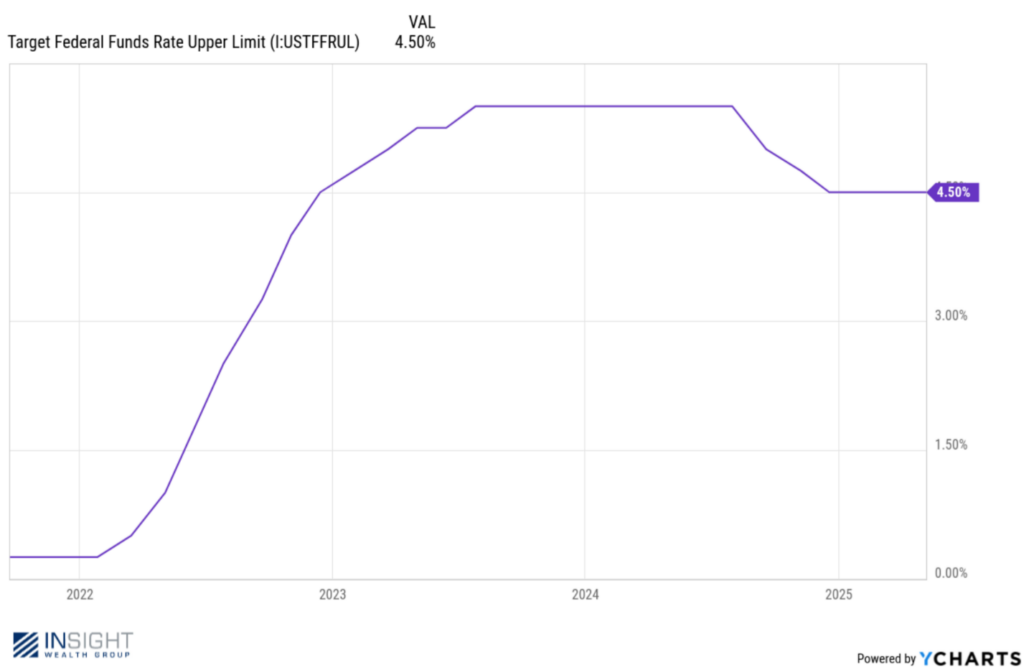

By the end of 2022, Federal Funds Rates were at 4.50%! Just nine months after the September rate projection was made, rates were already higher than the Fed predicted they would be fully three years later.

Past performance is not indicative of future results.

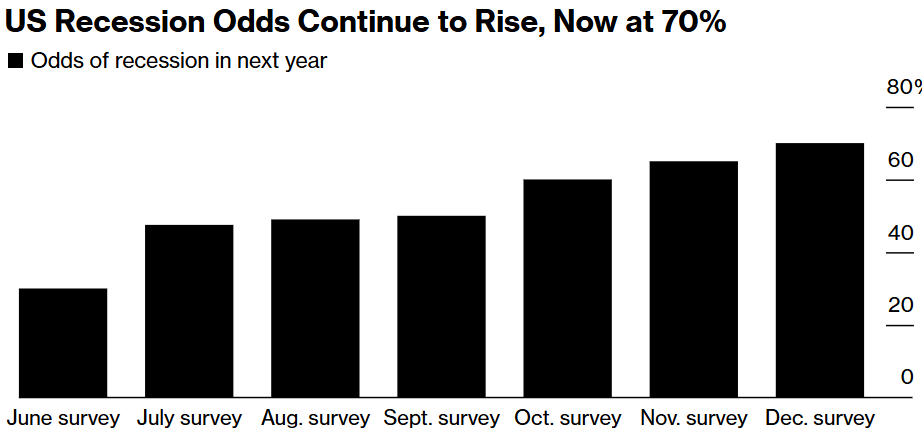

Private economists aren’t any better. Take, for example, the Bloomberg poll of economists from December 2022. At the time, fully 70 percent of economists polled predicted a recession sometime in 2023. They estimated GDP would grow a paltry 0.3% in 2023 and projected a 0.7% annualized drop in Q2.

Past performance really, really don’t predict future results!

GDP in 2023 grew from $26.01 trillion to $27.72 trillion. That’s a 6.6% growth rate. Yeah…they missed that mark.

Which brings us to today. You know all of the chatter that has been happening for the last few months. We’ve devoted a lot of this space to the discussion of tariffs and what that might mean for the economy. The broad economic consensus is this: tariffs lead to inflation which will likely lead to a recession.

There is still plenty of tariff debate to happen – most importantly the July 8th deadline for the negotiation of retaliatory tariffs – but we shouldn’t forget that massive new tariffs have already been implemented. China is at (a newly negotiated) 55%, many countries have the baseline tariff of 10%, there are 50% tariffs on steel and aluminum, etc., etc.

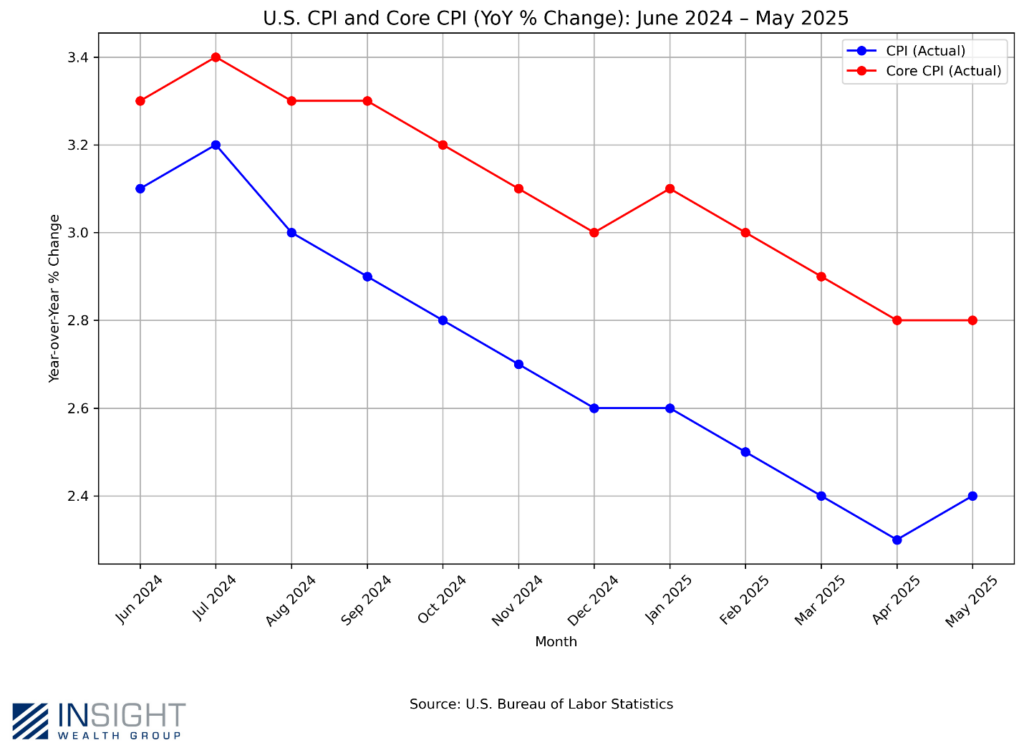

Most economists have expected that to show up in the economic data. We got an updated read on CPI last week and there is zero sign of inflation being caused by the new tariffs.

Past performance is not indicative of future results.

So where is all of the inflation? Why haven’t costs gone up in line with the costs of our imports? That’s a question many economists – including those at the Fed – are racing to solve right now. We’d posit a couple of reasons why:

First, this was a wildly telegraphed move. Anyone who was surprised by President Trump’s focus on tariffs wasn’t really paying attention. He repeatedly called Tariffs “the most beautiful word in the dictionary” and cited universal tariffs of 10 – 20% as his plan.

Companies took note. You may recall that we had negative GDP in Q1. It wasn’t because our economy was faltering. It was because imports count against GDP. And American companies were importing like crazy to get ahead of the tariffs. Reason #1 for a lack of inflation is we’re living off that inventory.

Reason #2 is a bit more…theoretical. We’d call it the Walmart Effect. You may recall that in the middle of May, Walmart put out a fairly significant warning to the market. In a call with analysts, they noted that tariffs will have an impact. While they said some of those price increases are already showing up, the largest impact would happen later this summer when back-to-school shopping season starts.

Just a day later, President Trump personally went after Walmart on Truth Social. He noted that the company was plenty profitable and suggested that Walmart and China should “EAT THE TARIFFS, and not charge valued customers ANYTHING”. He ended the post by telling Walmart “I’ll be watching”.

Companies aren’t dumb. That type of attention isn’t good for business. And so, we’d suggest, they are – for now – eating a bit of this. That will eventually show up in earnings. But the hope is neither will the tariffs and they can muddle through during this interim period.

But these are subjective and interpretive understandings of this situation. The science of economics can’t solve for the public relations strategies of large corporations. And it can’t tell us how long this situation can drag on before there is an eventual resolution. So, while we certainly understand President Truman’s frustration with “on the one hand” economists, the truth may be those are the most honest economists. Anyone who tells you they know exactly how issues like this will resolve is guessing at best or lying at worst. Understanding nuance at a time like this is crucial.

Sincerely,