The Weekly Insight Podcast – The Waiting Game

This year has just been action packed, hasn’t it? It seems every week there is something for us to blather on about. But as we discussed last week in this space, there is a lot of noise but the real facts that matter are still the real facts that matter. How is the economy doing? What policy changes in Washington will actually be implemented and how will they impact said economy? How are companies and consumers responding to those two big questions?

There’s a constant trickle of economic data (more on that later). But, as is often the case, the world is waiting on answers to a couple of really big questions before it can move on to determine the impact.

The first of those questions is what will the tariffs actually be? The second question is when will the Fed finally cut rates again? The third is what will happen with Washington’s tax bill? There is one simple problem with all three of those questions: none will be answered for a month or more.

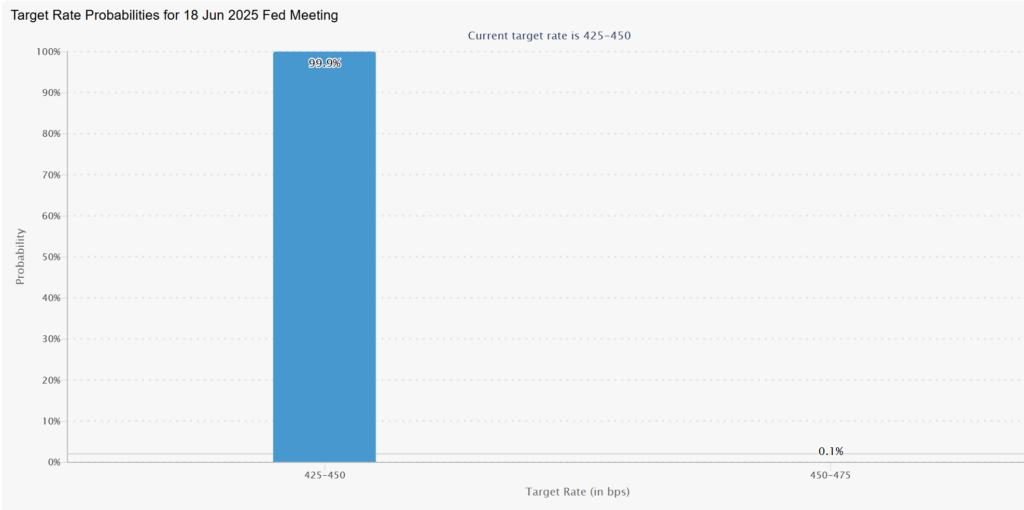

The Fed is meeting next week. Given the aggressiveness in which other central banks continue to cut rates, one could be convinced the Fed is soon to act. The market doesn’t believe so. You may recall us mentioning in the past that the Fed has never made a change (except during a crisis) that wasn’t already priced in with 80% certainty or better by the market. As of last Friday, there was a 0.00% chance of a rate cut. We’re not sure who the trader is betting on a 25 basis point rate increase, but let’s hope he doesn’t know something we don’t!

Source: CMEGroup.com

Past performance is not indicative of future results.

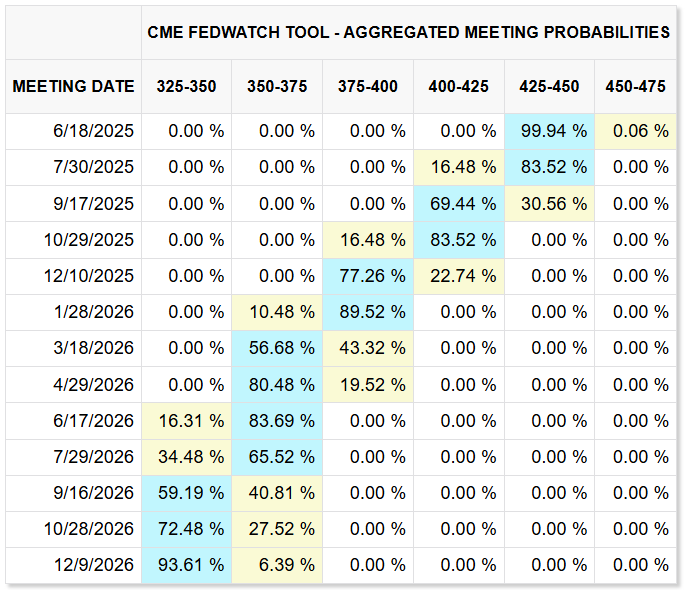

In fact, we don’t get to a majority consensus on the next rate cut until September 17th, with a second cut to follow in December. That is a long way off, so a lot can change in the meantime. But asset managers waiting for a rate cut to make decisions sure look like they’ll be disappointed.

Source: CMEGroup.com

Past performance is not indicative of future results.

Then there is the question of the tariffs. We’ve addressed this before in these pages, but the simple answer is this: we won’t be getting any answers this month. The deadline for the broad reciprocal tariff discussion is Tuesday, July 8th. The deadline for the China extension is Sunday, August 10th. In all likelihood, we’ll see more delays. But we won’t have any hard and fast answers for another month.

Finally, there is the Big Beautiful Bill. Will it pass? We don’t know. What will tax rates be next year? Ditto. We do know there’s going to be a lot of noise about it in the coming weeks. And whatever bill passed the House (let us know if you’ve made it through all 1,000+ pages!) won’t be the bill that passes the Senate. We can’t make any decisions based on the information we have.

So where does that leave us as we enter June? No news on the three big topics, combined with no earnings news until July as well, means this will likely be a quiet month for big market moving news. So, sit back and enjoy our summer, right? Not quite.

As we’ve all learned well, the lack of an answer can often mean the small stories (or at least ones that should be small!) have an exaggerated impact. One only needs to look at last week. A virtual shouting match between the President of the United States and the richest man in the world (at least he was…) lead the markets to be down nearly a percent on Thursday. Did it affect our economy? No. But it was something for the world to be enamored with for 24 hours.

The next day was another excellent example of how quickly the worm can turn when there isn’t much to focus on. A good – or at least better than expected – jobs report came out. The U.S. created 139,000 new jobs and the unemployment rate remained steady at 4.2%. The result? The S&P 500 was up by over 1% and closed the week above 6,000 for the first time since February 21st.

Past performance is not indicative of future results.

So right now, we just need to remain focused on the facts we have – the solid, hardcore facts. And we’ve seen some fairly positive facts in the last few weeks:

- Consumers didn’t just climb out of the basement last month – they leapt. Consumer Confidence ended May at 98, up from an April reading of 85.7 and well above the expectation of 87.1.

- Core PCE – the Fed’s “preferred gauge of inflation” fell from 2.7% year-over-year in March to 2.5% in April, continuing a downward trend.

- The number of job openings in the U.S. rose last month from 7.2 million to nearly 7.4 million. The expectation was that the number would drop.

- The Atlanta Fed’s GDPNow forecast is now predicting 3.8% GDP growth in Q2.

It can be hard to put together one of these memos when, frankly, not a lot of really important stuff is going on. We imagine it’s the same for all of those news organizations and social media influencers that need to drum up clicks. So just remember, in a month like this – when not much is going on – don’t let them stress you out about things that don’t really matter. We’ll have plenty of time to worry about the big things later.

Sincerely,