The Weekly Insight Podcast – Fortitude

When you push the button to take you to the latest edition of this memo (or our podcast), your action – much like everything on the internet – is recorded. And, while we can’t tell who is reading this memo, we can see the amount of traffic it generates. It’s been growing (a lot) over the years, but you can begin to pick out ebbs and flows to the readership. When the market is plugging along, and all is going well, readership tends to level off. But then you have weeks like last week (whew!) and the readership skyrockets.

That creates a bit of a conundrum. If all we wanted to do was generate clicks, it would be really easy to write a memo all about how we have “the answers” to what ails the market. When is it going to end? How far is it going to drop? What’s the perfect time to allocate cash? Start claiming you have the answer, and the Google algorithm will take it from there.

There’s just one slight problem with that: we don’t have the answers. NO ONE HAS THE ANSWERS! And anyone who tells you they do? Run away from them as fast as you can. But what we do have is hard-won insight (see what we did there… 😊) that we believe can prove valuable in times like these. Let’s dive into it.

Where Are We Now?

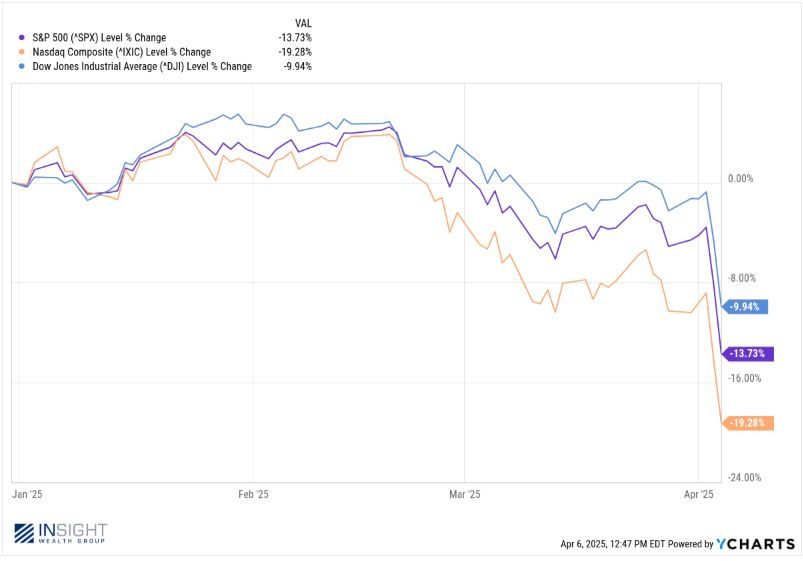

If you’ve turned on the news, booted up a computer, or glanced at your phone in the last week, you don’t need a recap. But here it is: President Trump announced a massive increase in tariffs that will probably kick off a world-wide trade war. And it also kicked the stock market directly in the shins. The S&P 500 ended the day Friday down more than 17% peak-to-trough and major indices are all significantly negative for the year.

Past performance is not indicative of future results.

The good news is we’ve been planning for bad news in portfolios. Our friends at the SEC don’t like us to tout unaudited performance data in these pages, so we’ll just encourage our clients to go look at their performance when they have time. Are we down for the week? Of course. And we understand the concern that can create. But nearly all portfolios didn’t turn negative for the year until Thursday and are down a fraction of the market’s losses. And – as we’ve been saying for months – our “dry powder” persists.

What Do These Tariffs Mean?

We’ve heard the “why” question from many clients over the last week. Why did Trump choose to implement the tariffs? What is he hoping to accomplish?

The simple answer comes directly from the President’s Executive Order:

“I…find that underlying conditions, including a lack of reciprocity in our trade relationships, disparate tariff rates and non-tariff barriers, and U.S. trading partners’ economic policies that suppress domestic wages and consumption, as indicated by large and persistent annual U.S. goods trade deficits, constitute an unusual and extraordinary threat to the national security and economy of the United States.”

Long story short: he believes current trade policies are “suppressing wages and consumption”. To change that, he wants to bring back jobs and manufacturing to the United States.

Let’s be clear: we are not economists. We’ll let them hash out how this is all going to work. But there are a couple of things which are clear:

- Driving up the costs of goods (which these tariffs will surely do) is unlikely to increase consumption (one of Trump’s stated goals).

- This is a fundamental and untested change to the global economic structure that has worked exceedingly well for America over the last 80 years. The last time we had policies like this, “economics” was a fledgling “science”. No one knows what the result will be.

- The market really doesn’t like it!

The other argument here is that Trump is “just negotiating” and using tariffs as a cudgel to get other nations to make concessions and get the U.S. a better deal. Those that adhere to this thought-process are hoping for a reversal similar to what we saw with the Canadian/Mexican tariff standoff. In this approach, the markets will be saved by a proclamation from the White House.

This isn’t an unreasonable approach. Trump has – at times – been transactional in his mindset toward trade policy. And the White House did tout over the weekend that “50 nations” have reached out to discuss their trade relations with the United States.

But it takes two to tango. And many large countries are not responding positively to this new approach. China just implemented a 34% “reciprocal tariff” (is that a reciprocal – reciprocal tariff?). Emanual Macron suggested that European companies should stop investing in the United States. European Commission President Ursula von der Leyen announced that the E.U. was “prepared to respond…to protect our interests and our businesses…”

For nearly a century, the United States commitment to free trade has been a cornerstone of the world economy. That no longer exists. And every country in the world now has to figure out how it fits into this new system.

What Does This Mean for Your Portfolio?

The answer to this question – of course – depends on what’s in your portfolio. Do you own an all equity portfolio full of tech and growth stocks? Ouch. Do you have a well balanced portfolio that took some risk off the table last year? You’re probably feeling a bit better not having the same volatility as the rest of the market. But the answer right now is still the same: hold tight.

This brings us back to the start of the memo: anyone who tells you they know what’s coming next, or when to make changes in your portfolio…they’re full of either hubris…or crap!

We are a whopping two trading days into this process. There are some that say Monday is going to be a catastrophe in the market. There are others that say Trump is going to save the day. No one yet knows.

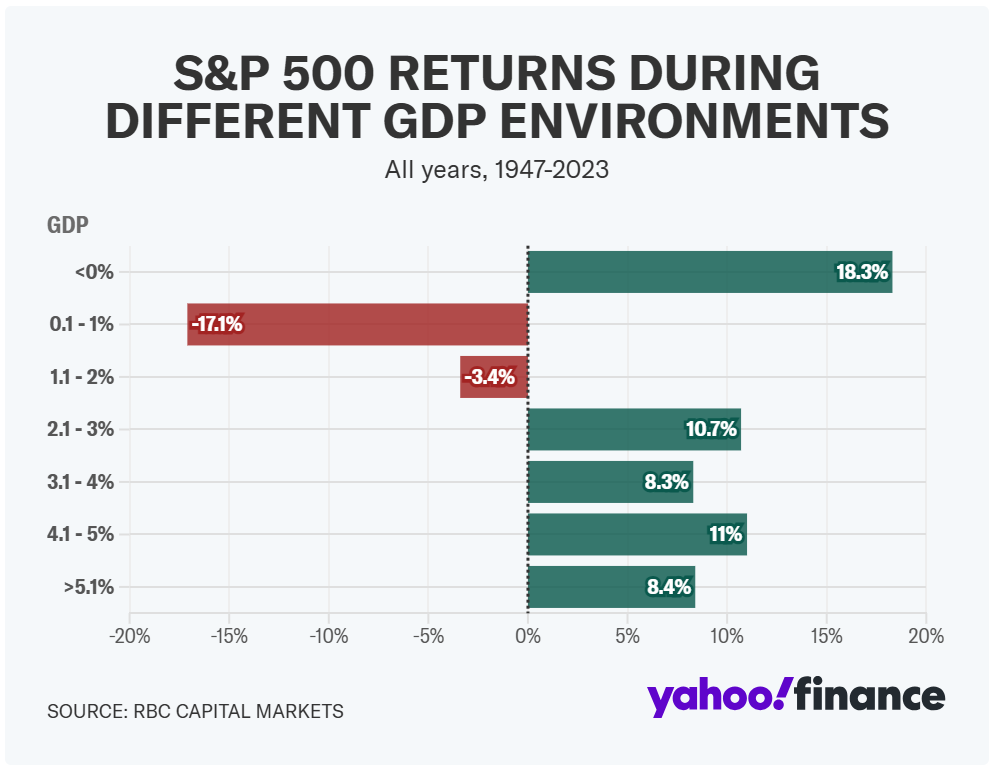

What we do know is this: selling now is a fool’s errand. We’ll bring you back to the chart we touted a few weeks ago regarding the best time to deploy money into the market:

Past performance is not indicative of future results.

If this is true, and we are entering into a period of shrinking GDP as our friends at the Atlanta Fed are touting, then our opportunities are ahead of us. But we have to weather the storm.

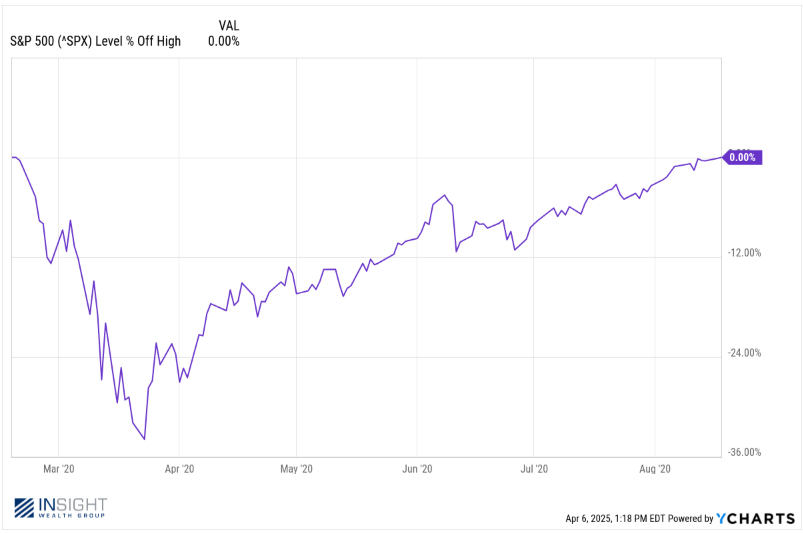

It turns out there’s a fair close parallel to this market environment from Trump’s first term. And it happened almost exactly five years ago. The S&P 500 peaked on February 18, 2020. By March 23rd it was off almost 34% from its high. By August 18th – six months after the high – it had recovered all of its losses.

Past performance is not indicative of future results.

We all know that peak-to-trough period was panic inducing. But the only people who were truly damaged in that process were those that sold into the drop. Why? They weren’t around for the recovery. They tried to time the market. And it didn’t work out. It never does.

The decisions that matter in this moment are the ones that have already been made. Yes, you may have wondered what your team at Insight was doing taking risk off the table in a great year like 2024. But it’s that very move which put us in a much better position in this moment.

Oh, and just for fun, we’re entering earnings season this week. As frustrated as the market has been in the last few days, we’re going to get the opportunity directly from companies about how they’ve been preparing for this and what they expect the impact to be. That may prove different than the media speculation.

So have patience. This is yet another panic inducing moment. But history is an excellent guide. If we can have the fortitude to withstand this moment, there will be opportunities on the other side.

Sincerely,