The Weekly Insight Podcast – 5 Years Later

Five years ago today – February 24, 2020 – we wrote the first “Weekly Insight Memo”. It wasn’t meant to be a weekly memo. Just our take on COVID as the world – and the markets – were starting to get a little nervous. Much like everyone else, we didn’t have any idea what would happen over the next several months. But we did close the memo with an interesting statement:

“Although there are short-term negative reactions to epidemics/pandemics in the market, ultimately the health of the global economy and the magnitude of monetary and fiscal stimulus dictate the direction of equity markets”.

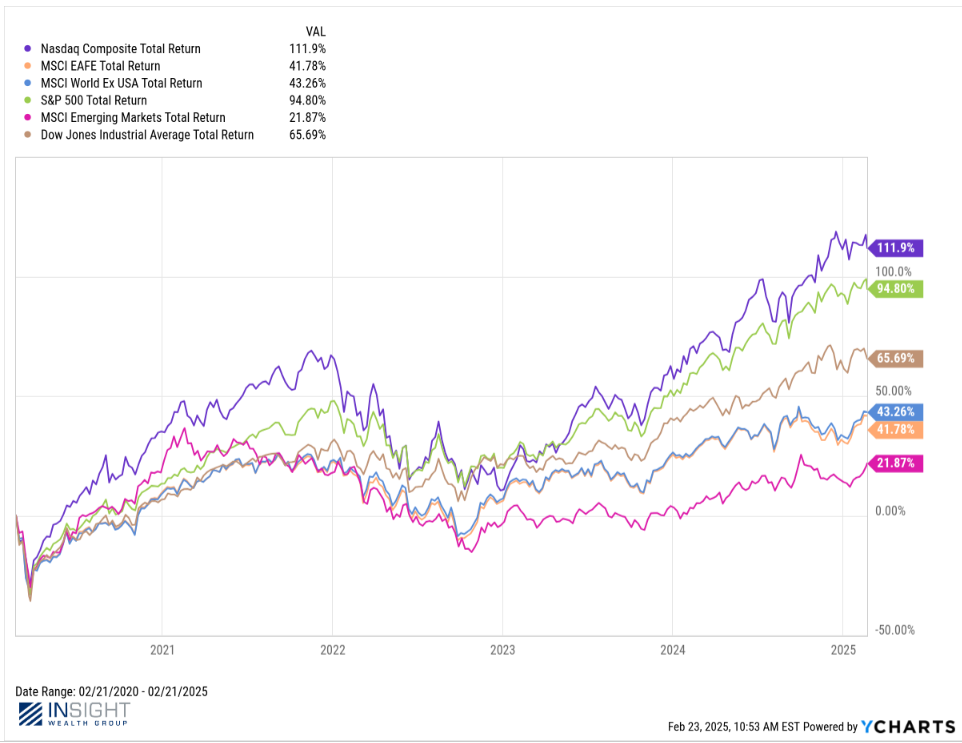

COVID was one of the most “Black Swan”-ish events we’ll experience in our lifetimes. A once a century (we hope) pandemic that killed millions of people worldwide. But despite shutting down borders and main streets across the world, the statement above was correct. And patient investors did well. One only needs to look at the common stock market indices to get the picture.

Past performance is not indicative of future results.

COVID looks like a blip on that chart. And the initial onset was. But everything that has happened since has – in many ways – been a consequence of COVID. Inflation, interest rate policies, elections. All the drama we’ve experienced ties back to those fateful days in February and March of 2020.

But five years ago today, the ultimate question Insight investors were asking was “Are we going to be okay?”. And as new drama seeps into the world, the same fundamental question is bouncing around in investors’ heads. Are we going to be okay?

So, what is our answer? It might sound familiar:

“Although there are short-term negative reactions to (insert current concern here!), ultimately the health of the global economy and the magnitude of monetary and fiscal stimulus dictate the direction of equity markets”.

Is that a cop out? Maybe. Or maybe it was a really good answer in the midst of a global panic! 😊

Or maybe, just maybe, it was the truth. In the current form of our global economy, three things matter:

- The Consumer (i.e., the driver behind the global economy)

- Monetary Policy (i.e., the Fed and other central banks)

- Fiscal Policy (i.e., what are governments doing with tax revenue)

All three of those things are in flux right now. And together they will dictate if we have a good year in the market in 2025. Let’s take a quick pulse check on all three.

The Consumer

You know the stat by now: fully 70% of the U.S. economy is made up by consumer spending. The consumer’s confidence and financial health is the largest determinant of the future direction of the economy.

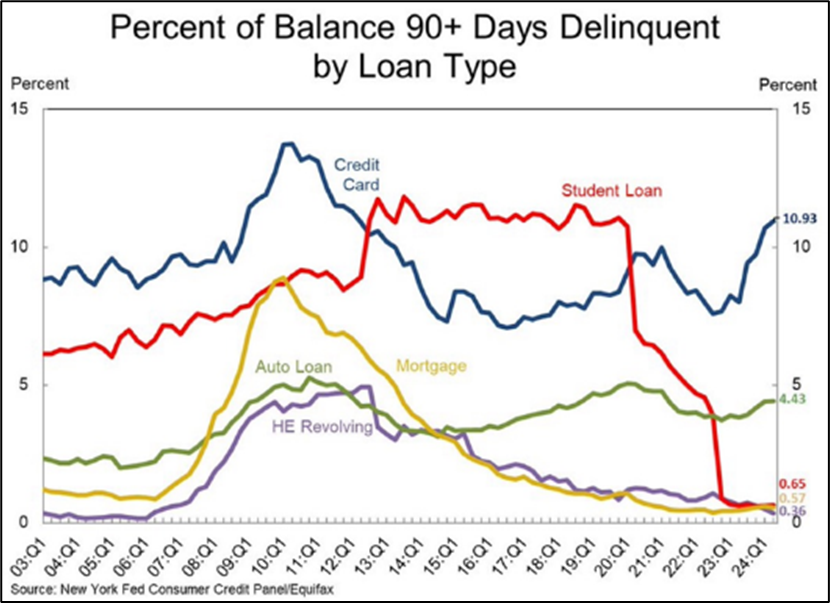

We’re seeing a decidedly mixed bag on the consumer right now. On the one hand, consumers at the lower end of the income spectrum are struggling. That’s why we’re seeing lower quality debt (i.e., credit cards and auto loans) returning to default levels we haven’t seen in many years.

Past performance is not indicative of future results.

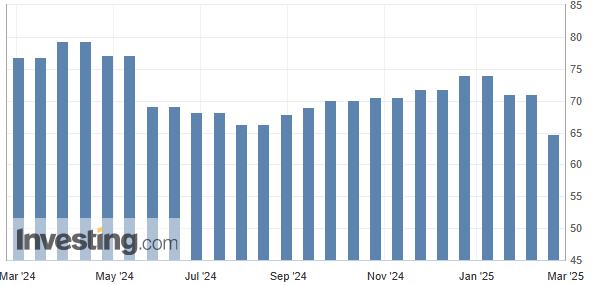

And consumer confidence is following. Last week saw consumer confidence drop to the lowest levels we’ve seen in over a year, coming in well below expectations. Sampled investors touted tariffs and inflation as their primary concerns.

Source: University of Michigan Consumer Sentiment Survey

Past performance is not indicative of future results.

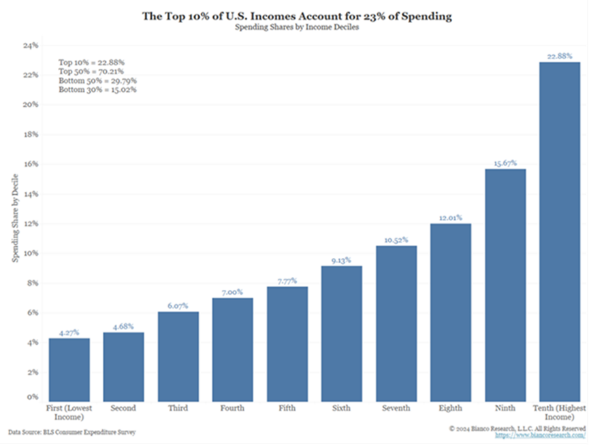

But here’s the kicker: while we all want all consumers to be doing well, it is actually a small number of consumers that actually drive the economy forward. The top 10% of consumers account for 23% of all spending. And the top 50% account for more than 70% of spending. Those are the consumers that can best bear the brunt of changes on the tariff and inflation front.

Past performance is not indicative of future results.

Monetary Policy (The Fed)

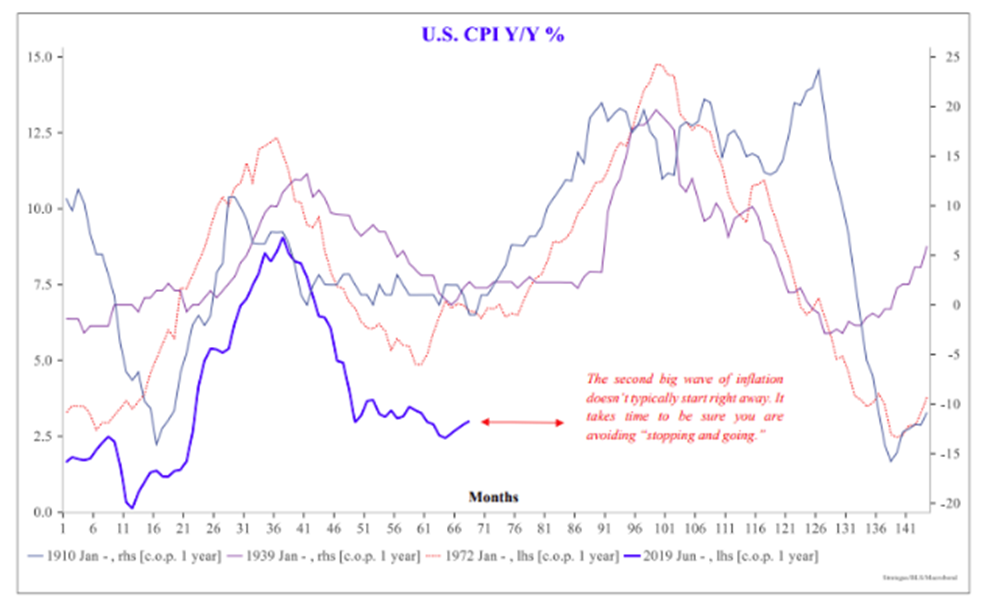

Everyone – especially President Trump – wants the Fed to keep cutting rates. Everyone, that is, except the Fed. They’re in a pickle right now. They are scared of repeating the mistakes of the Fed in the 1970s: cutting rates too soon and seeing a second wave of inflation expand beyond their control.

As they see it today, President Trump’s potential policies (tariffs, immigration, and unfunded tax cuts) have the potential to drive inflation higher. And so, they wait. But the problem is this isn’t the 1970s. Their inflation fighting efforts of the last few years had a much greater impact than any previous inflation contagion we’ve seen in the U.S. Is it possible that inflation will take off again? Of course. But it will be climbing from much lower levels than before.

Past performance is not indicative of future results.

But it is the other side of the Fed’s mandate that should concern them. Yes, they are responsible to keep inflation low. But they are also tasked by Congress to keep employment in this country strong.

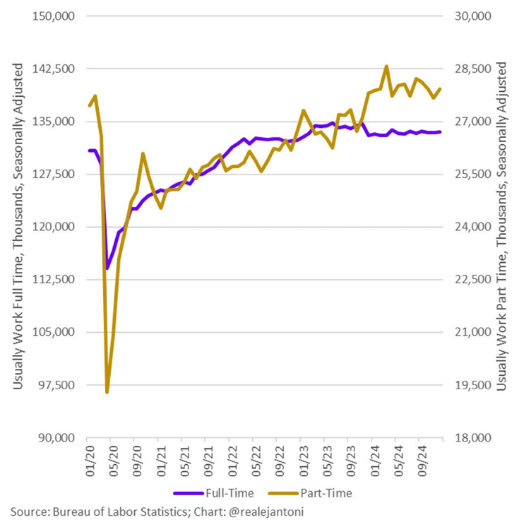

Unemployment is low today. But not for the reasons many think. We have not created a significant amount of new full-time jobs in this country for nearly two years. The growth is almost entirely coming from part-time work. And that isn’t a long-term sustainable path.

Past performance is not indicative of future results.

The end game? Inflation may end up being a moot point. The Fed might have to cut rates to protect our labor market anyway. How they handle this process over the next six months will have a significant impact on the year we have in the market.

Fiscal Policy (The Trump Administration)

And here we get into deep water. It’s likely most of you had your defense mechanisms go up the moment you read the title of this section. Our Trump supporters worried we might criticize the President. And our Trump antagonists concerned we might support him. If we’re doing our jobs, you’ll both be right! 😊

Simply put, the Trump Administration (right or wrong) is what is driving most of the angst in the market right now. But it’s not so much his policies that concern the market. It’s the lack of clarity around them.

Will tariffs drive inflation? To some degree. A study a client forwarded us this week showed that the Canadian and Mexican tariffs would increase inflation by 0.75%. The full reciprocal tariffs would drive inflation up by 2.00%. Are those numbers accurate? Hard to say at this point, largely because we don’t really know what the plan is.

The Wall Street opinion on tariffs should scare us right now. They seem to be approaching this process as “Trump’s just negotiating…he won’t really do it”. Again…maybe. We don’t know yet. And that uncertainty creates risk.

And then there’s the regulatory and government changes. DOGE, as they call it, is all over the news. We can all agree that the federal government is not an efficient beast. And rooting out waste, fraud, and abuse is a good thing.

Tell us if this sounds familiar: a campaign to cut duplicative government programs, including slashing duplicative programs at the Department of Education and reducing government spending by $33 billion in year one and $400 billion over the first decade.

Seems very DOGE-y, right? Nope. It was President Obama’s “Campaign to Cut Waste” back in 2014. You can read all about it here.

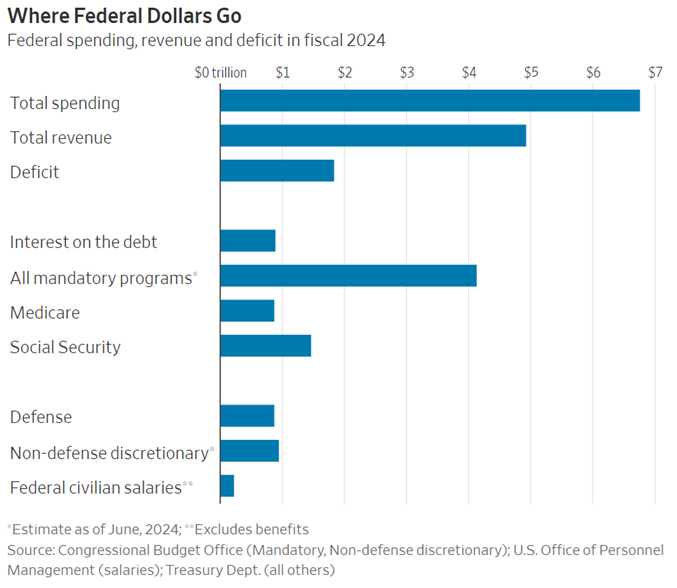

Obama, however, ran into the same problems Trump and his attack dog Elon Musk will find: the big cuts aren’t available. Why? They’re all “mandatory spending”. Which means Congress is going to have to get in on this act for it to have a meaningful impact. In fact, if you cut every non-defense discretionary budget item and fired every non-military government employee, we would still have a deficit of nearly $750 billion per year!

Past performance is not indicative of future results.

The Outlook

We hope you can see from this review that there are some bad things going on right now for consumers, the Fed, and the White House. But there are also some good things.

The local consumer? They may be feeling the strain right now. Consumers as a whole? Pretty darn good.

The Fed? They’re scared to cut rates right now. And they’re convinced President Trump is going to drive inflation higher. In the end it may not matter.

The Trump Administration? That’s where the rubber will hit the road in the coming weeks. DOGE will create headlines – but the real work needs to happen in Congress. The bigger question is what Trump will do on tariffs. Is it a negotiating tactic – as Wall Street believes – or is he really going to do it? If he does, Wall Street will have to shift gears quickly and there will likely be a hiccup in the markets. But if a global pandemic couldn’t crater this economy, changes in trade policy won’t either. We’ll just have to be patient. Just remember:

“Although there are short-term negative reactions to (insert current concern here!), ultimately the health of the global economy and the magnitude of monetary and fiscal stimulus dictate the direction of equity markets”.

Sincerely,