The Weekly Insight Podcast – Patience

It was almost five years ago that this weekly memo was conceived. Those who have been with us from the beginning know it started with a desire – after a particularly bad day in the market – to get some information out to our clients about COVID. This memo – written on February 20, 2020 – was naïve at best. There was so much we didn’t know about the pandemic at the time.

But as the situation changed – almost daily – it became clear we needed to continue to communicate with clients about what COVID meant for portfolios. One memo turned into fifteen over the next four months – a time when the S&P 500 experienced a more than 30% correction and then quickly rebounded.

It was during that time we learned an important lesson as a firm: informed clients are patient clients. And it was our clients’ patience that led to one of the most remarkable things we’ve experienced as advisors: none of our clients panicked! You held fast. And by doing so, you avoided one of the worst mistakes investors can make. The result was clients well positioned to take advantage of the next few years of positive market returns.

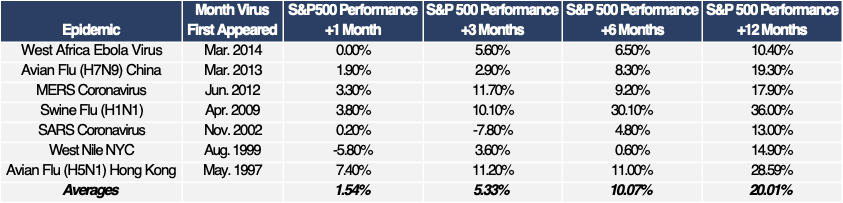

It’s interesting as we look back on that first memo. In it, we included a chart outlining the impact of previous epidemics on the S&P 500. The point was that they didn’t truly have a negative impact over the long-term. Here’s the chart:

Past performance is not indicative of future results.

COVID was a pandemic, not an epidemic (see…naïve!) By mid-March, it looked like this data was worthless. Especially as it related to the 1-month and 3-month data. Even by June, with the market much better, but still down 4% from the start, it looked like we missed it. But check out the 12-month numbers. In the end, the trend prevailed.

Past performance is not indicative of future results.

Which brings us to today. It is, to be fair, a much less dramatic time in the world. Economies aren’t shuttering. People aren’t dying from a horrible virus. Kids aren’t home from school. So, what we’re about to discuss is significantly less serious. But we’ve entered yet another period where patience is going to be especially important.

Last week was a volatile one in markets. The S&P closed the week down 1.95% – which isn’t the worst thing we’ve seen. But when you look at the peak on Monday to the close on Friday, it was down more than 3.15%. The NASDAQ was even worse. It was down 4.2% peak to Friday’s close. And remember – that’s in just three trading days (markets closed on Thursday).

None of these are stunningly bad numbers. But the “why” might signal we’re in for a bit of a tough haul over the next few weeks.

The why shouldn’t surprise our readers. It’s the continuation of our long-discussed inflation/interest rate battle. Let’s look at a couple of factors that are impacting things:

1. The Jobs Report

The worst day in the market was Friday and there was one big cause: a surprisingly good jobs report. Where the market was expecting the economy to create 164,000 new jobs, it created 256,000. Regular readers know that the path to lower inflation – and lower interest rates – won’t be paved by blow-out jobs reports. The economy needs to slow down a bit.

2. Inflation Concerns Surrounding Trump Policies

Love him or hate him, Donald Trump is going to impact the market. Will that impact be inflationary? That’s what has the market on edge. His potential tariff plans would be inflationary. Tax cuts? Likely inflationary. The problem is no one yet knows what’s going to happen. And uncertainty breeds concern in the stock market.

3. The Fed

The Fed released their minutes from their December meeting this week. And they didn’t sound like a group focused on cutting rates. Their concerns bely a continued concern around inflation and indicate the likelihood of future rate cuts is coming down.

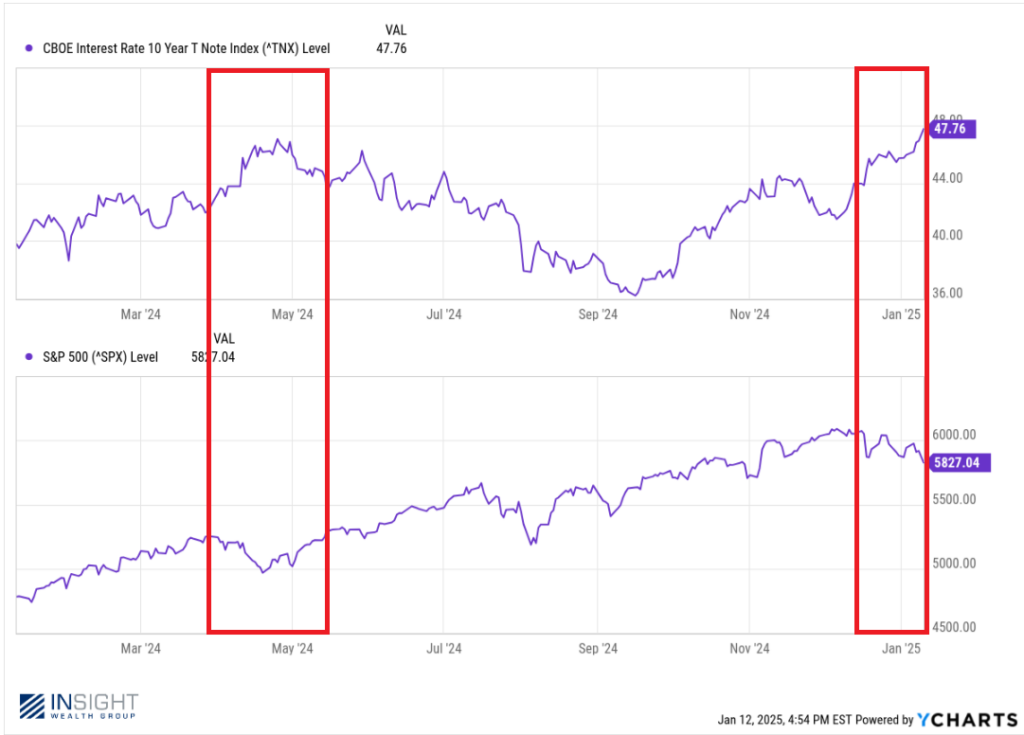

That all ends up being reflected in yields and is most notable in the yield for 10-year U.S. Treasuries. They spiked this week to a level we’ve been watching closely: higher than 4.70%. They closed on Friday at 4.776%.

Why is this level important? It’s a level we’ve seen before. And it was treasuries rising to this level last April that caused a 6% sell-off in equities. It looks a lot like what we’re seeing right now in the markets. And it may indicate the next month or so will be choppy.

Past performance is not indicative of future results.

But it’s not the end of the world. It’s certainly much less concerning than COVID!

This is a time to be patient. And remember that we are battling over semantics at this point. Is inflation a bit high? Sure. But it’s sub-3%. Was that jobs report awful? No! More Americans are working!

There is no disaster looming. But the market is looking like it may be taking a breather after a tremendous run. The good news? It may give us an opportunity to put dry powder to work in portfolios. If anything, it will necessitate a few more of these memos clogging your inbox.

Sincerely,