The Weekly Insight Podcast – Is the “Shift” Coming in 2025?

And here we are. The first Weekly Insight of 2025. After all the flurry of the end of the year, the holidays, the election, etc., it’s just another week in the markets. Not a lot of glitz or glamour. Just work to be done. Let’s dive into what we’re seeing to start the new year.

Santa Claus Didn’t Call This Year

There was much “harumphing” on Wall Street over the last week about the lack of a “Santa Claus Rally”. While digging into this trend we noticed a couple of things:

- There is no clear definition of what people mean when they discuss a Santa Claus Rally! Yes, it means the expectation of positive market returns around the holiday. But an actual definition was hard to come by. Some noted it as a period starting on December 24th and lasting for seven trading days. Some started it the trading day after Christmas. But in the end, the specifics don’t matter much.

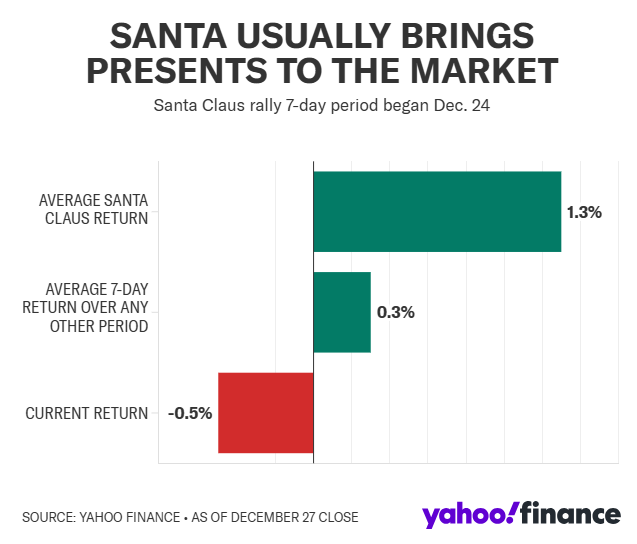

- There has been a clear trend of positive markets around the holidays. And this holiday season didn’t keep up with that trend. Using YahooFinance’s definition of the rally, you can see a clear miss.

3. Santa Claus Rally or not, the market had a GREAT year in 2024! Why are we even worked up about this? The financial media would tell you it’s something to worry about because it has some sort of predictive value about how the market will perform the following year.

So that’s the heart of it. Should we be worried if Santa Claus didn’t come to town? Is it a sign that we’re going to be getting coal in our stocking over the next year?

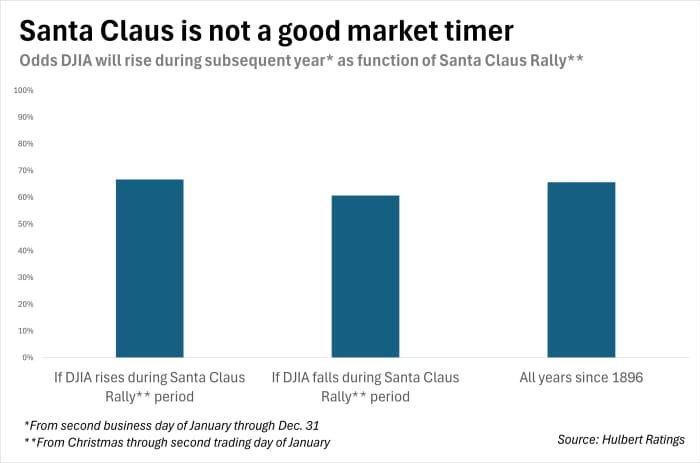

That may very well happen. But it won’t be because the stock market had a slow holiday. An article from Mark Hulbert at MarketWatch pointed out that there is no predictive value attached to the Santa Claus Rally. So, we can put that one to bed and worry about more important things!

Past performance is not indicative of future results.

Oh…and by the way: the market had a wonderful first two days of 2025 (S&P 500 up over 1.00%). That, too, has no predictive value for the rest of the year!

Earnings Season: Lower that Bar

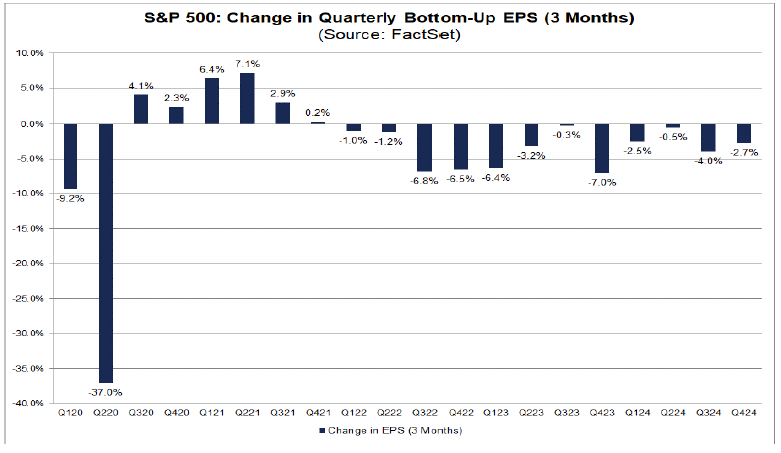

The “analysts” are at it again. On September 30th, the estimated earnings growth for the S&P500 in Q4 was 14.5%. Today, as we begin to enter earnings season, the estimate is 11.9%. Oh no! does that mean the market is underperforming? Nope. It’s just what the industry does: lower the bar for expectations. We’ve seen it happen repeatedly through history. The rare times it didn’t happen (i.e., post-COVID) was because earnings were growing so quickly, analysts couldn’t keep up.

Past performance is not indicative of future results.

Given the lofty expectations for earnings in 2025, this is something we should expect throughout the year. It shouldn’t cause us concern but should be a part of our calculus as we decide what decisions to make in the coming months.

The “Shift” Is Coming

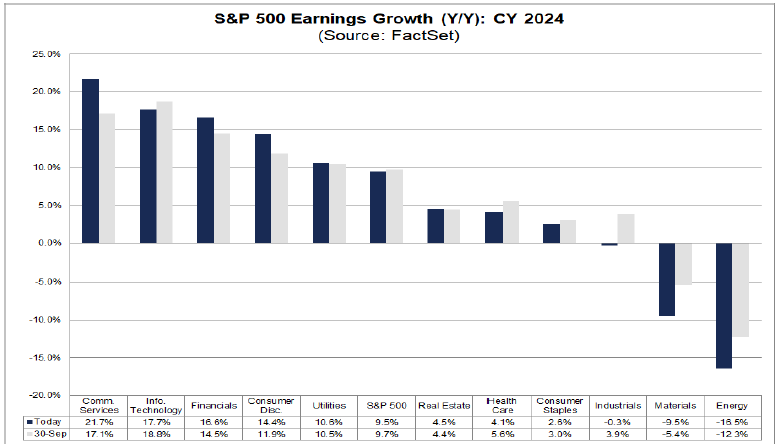

We’ve been talking for most of 2024 about the incredibly narrow nature of the market in recent months. The Magnificent Seven have been…well…magnificent. But they provided most of the performance for the S&P500 last year. Why? That’s where all the earnings growth came from. Just look at the Communications Services and Information Technology Sectors below (where the Mag 7 stocks live). They were by far the leaders in 2024.

Past performance is not indicative of future results.

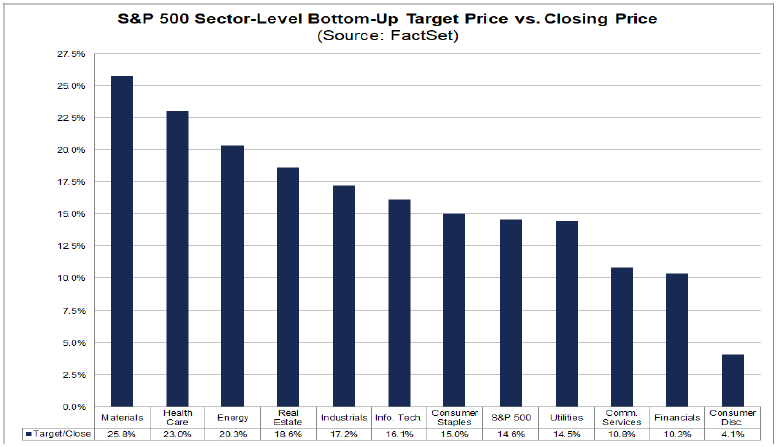

But a shift is coming. Looking at estimates for 2025, the expected price change in sectors is vastly different than what we saw in 2024. Materials, health care, and energy dominate. Yes, the Mag Seven is still likely on a path for a great year. But the rest of the market is expected to get its turn. If this is how it plays out (big “if”!) it could be a fun year in portfolios.

Past performance is not indicative of future results.

As always, there is no “set it and forget it” plan for the market in 2025. But at this moment, there are plenty of opportunities to be had in the coming months. We’ll be there with you every week of the year providing updates on exactly how it is all playing out.

Sincerely,