The Weekly Insight Podcast – Correlation and Causation, McRib Style

We’ve probably mentioned this before in these pages, but our firm has a significant amount of appreciation for the Golden Arches. McDonald’s – an American staple by any standard – was also one of the first employers for all three of our founding partners. Say what you will about American fast food, but we can say with great confidence that our time behind the counter and behind the grill at Mickey-Ds was fundamental to our understanding of work ethic, operating a business, and caring for customers.

Admittedly we’re biased – but it’s also a big reason we love to hire young people who have worked in foodservice. There has, in our minds, been a strong correlation between young people who have that experience and quality team members.

Last week was a big week for McDonald’s lovers: the McRib is back. Admittedly, your author really can’t stand the McRib sandwich. But it’s a big deal for some people. We won’t say who – but there might have been a car full of folks from Insight headed to the neighborhood McDonald’s at lunch on Tuesday.

We’ve always found the McRib story to be a fascinating one. And it’s one much more about markets than it is about food. It starts with a chef from Luxembourg by the name of Rene Armand. He was the executive chef for McDonald’s in the lates 1970s and early 1980s and was the inventor of the Chicken McNugget which proved to be tremendously popular. So popular, in fact, that it created a shortage of chickens in the United States and left McDonald’s scrambling to fill the needs of its franchisees.

Given the clear desire for proteins in addition to beef patties, Armand started looking to other options and realized a pork patty could provide a different and appealing option. The McRib was born.

But the life of the McRib has been different than the life of other items like the McNugget. And while it’s never been publicly acknowledged, our guess – and that of many others – is the “on again, off again” nature of the McRib has everything to do with “scarcity marketing” (how many times have they said the McRib is going to be “gone forever”?) and McDonald’s meat buyers playing an arbitrage on the price of pork.

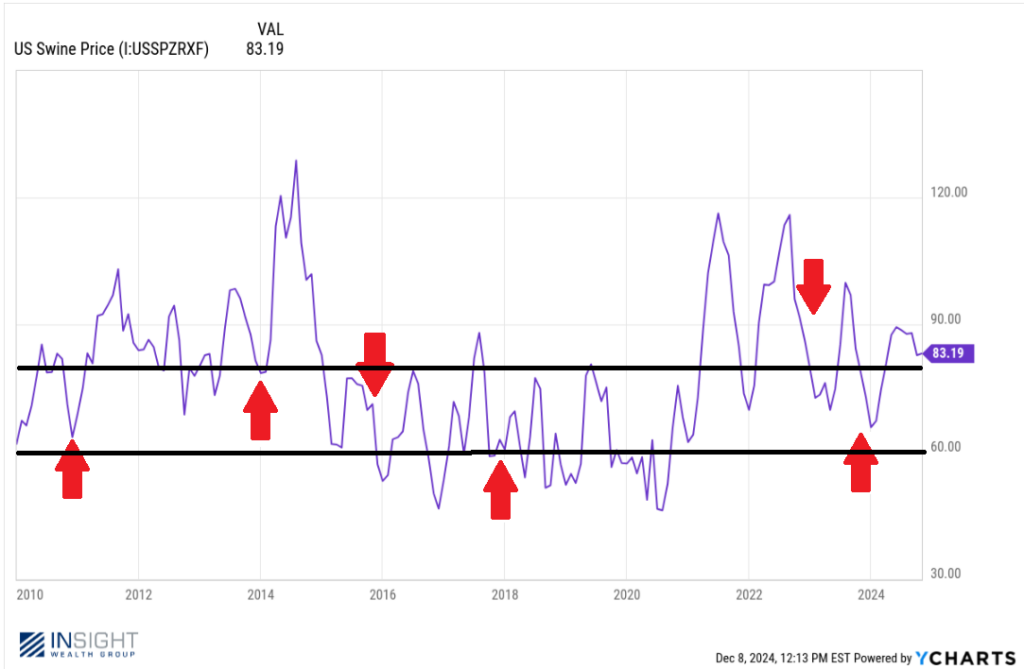

Just look at the release dates over the last 15 years and their correlations to dips in the price of pork. More importantly, look at the fairly tight band of prices that ties to the times the McRib is available. There is clearly an economic strategy at play.

There is a compelling argument that the price of pork directly impacts the decision of McDonald’s to re-release the McRib. That is causation at play (and the reason we’ll never believe them when they say the McRib is never coming back).

But we saw another interesting stat about the McRib this week – something market watchers are calling The McRib Effect. It was first identified by Nick Maggiulli, COO of Ritholtz Wealth Management back in 2018. He found that between 2010 and 2023, the daily average return of the S&P 500 when the McRib wasn’t available was +0.04%. But when the McRib was available, that return spiked to +0.10%. That’s a significant difference. In fact, if you annualize it, McRib markets beat non-McRib markets by 19% annually!

So, should we change strategies? Is it time to focus our investment research on when McDonald’s is going to end the current McRib promotion? Instead of “Sell in May and Go Away” is it now “Sell Away when McRib Goes Away”?

Not at all. And we certainly don’t want to imply that Maggiulli came to any similar conclusion. Instead, he wisely points out that there is a stark difference between correlation and causation. And the McRib is doing nothing to cause positive stock market performance.

But it is coming at a time of year during which the market has historically performed quite well. You’ll note that every release since 2010 has happened late in the year:

- 2010: October

- 2013: December

- 2015: October

- 2017: November

- 2020: December

- 2022: November

- 2023: October

- 2024: December

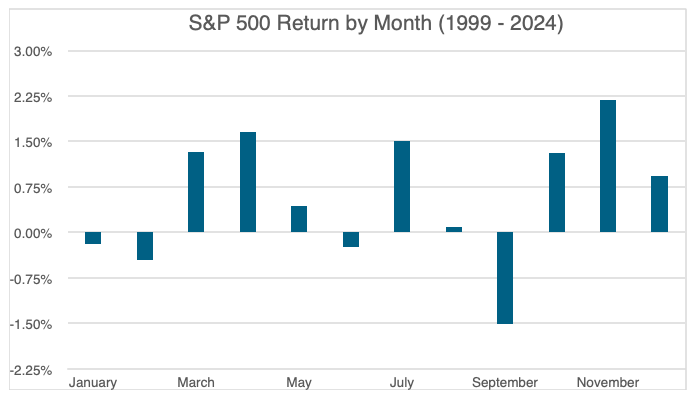

One only needs to look at the monthly returns of the S&P 500 over the last 25 years to see that the last quarter of the year – now forever known as the McRib Quarter – is by far the best performing quarter in the S&P 500.

Source: YCharts

Past performance is not indicative of future results.

And so, correlation isn’t causation. At least not with the McRib. But you can enjoy a tasty sandwich as you appreciate the extraordinarily strong returns we’ve seen in the first two months of Q4. But just remember that seasonality in the markets works both ways.

Sincerely,