The Weekly Insight Podcast – Shifting Expectations

Last week in these pages, we talked a bit about the sugar rush that the market got coming off the election results a few weeks ago. As we said, “Markets go on runs. And then markets need a breather. That breather may be around the corner”.

As it turns out, “a breather” is not a technical term as it relates to investment analytics. But it’s safe to say we saw what it looks like in real-time last week in the market. First it was three consecutive days of…not much. Then it was followed by a couple of negative days on some very specific news we’ll talk about in a moment.

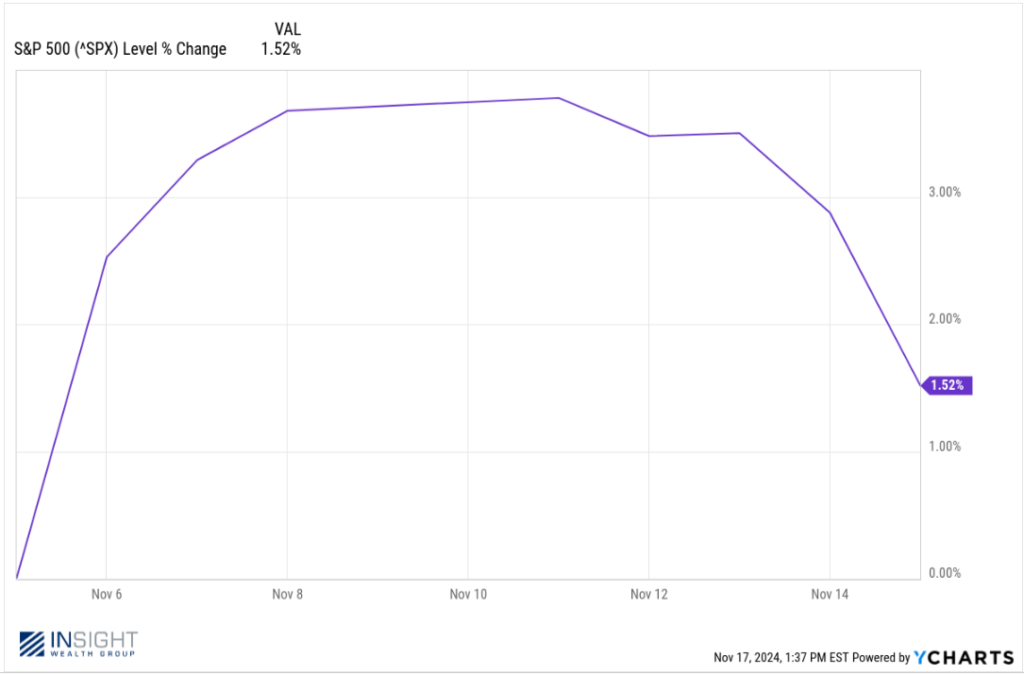

But in the end, the breather wasn’t particularly negative. The market ended the week down just a bit more than 2% but is still up 1.52% since we received the results on election night.

Past performance is not indicative of future results.

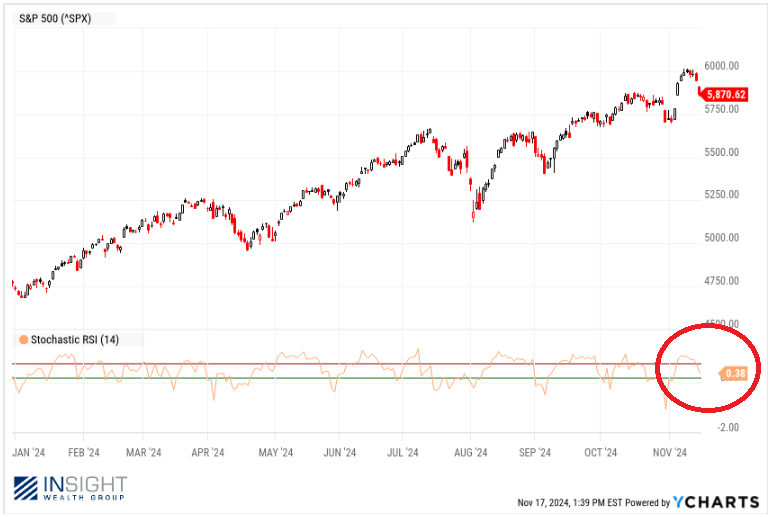

The good news is the slightly overbought nature of the market has quickly reversed. You’ll recall us mentioning Stochastic RSI last week as a technical measure of whether a market is overbought or oversold. As a refresher, anything over 1 is overbought and anything below 0.2 is oversold. What had been a stochastic RSI of 1.07 just over a week ago is now at 0.38 after trading closed on Friday. The market is up over 1.5% in less than two weeks, and we’re not overbought. That’s a good place to be.

Past performance is not indicative of future results.

After all the election drama for the last few months, it was nice to see the volatility in the market created by something much more…normal. That’s right, it was our old friends the Fed, inflation, and interest rates that were impacting the moves we saw in the back half of the week.

It started Thursday morning with the October CPI data. The results were unremarkable. In fact, there was no change in the Core CPI numbers, no change in the month-over-month CPI numbers, and an expected move up from 2.4% to 2.6% for year-over-year CPI. Every number came in exactly as the so-called experts expected.

But no movement is not what the world wants when it comes to inflation. The world wants inflation to continue to drop to justify the Fed continuing to cut interest rates. And that leads us to the other big economic event on Thursday: Fed Chairman Jerome Powell’s comments to the Dallas Regional Chamber of Commerce.

It’s important to start by acknowledging all the incredibly positive comments Powell made about the economy. According to him, “the recent performance of our economy has been remarkably good, by far the best of any major economy in the world”. He highlighted our GDP growth, consumer spending, wage growth, and strong household balance sheets. And he’s not wrong. This economy – as a whole – is chugging along.

It is that very strength that gives him the confidence to say he’s not in any rush to lower rates. As he said, “The economy is not sending any signals that we need to be in a hurry to lower rates. The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully”.

That statement is not what the market wants to hear. It wants rate cuts now and more rate cuts quickly. To some degree, the Fed has complied with that desire. 0.75% in cuts in the last two meetings is a significant move downward.

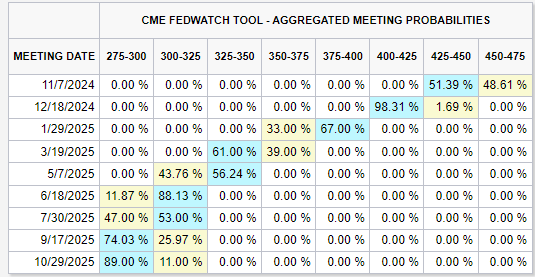

But you’ll recall us showing the chart below just over six weeks ago. The market had extremely aggressive assumptions about rate cuts. They expected rates to be down to 4.00 – 4.25% by the end of the year and 3.00 – 3.25% by June.

Source: www.CMEGroup.com (as of September 30, 2024)

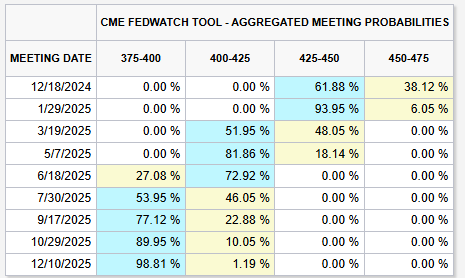

After Powell’s comments on Thursday, the market isn’t confident we can get to 4.25 – 4.50% by the end of the year (just 62% odds). And now doesn’t expect us to get to 4.00 – 4.25% (with any certainty) until June. The expectation for the end of 2025 is just 3.75% – 4.00%. That is a big, big switch.

Source: www.CMEGroup.com

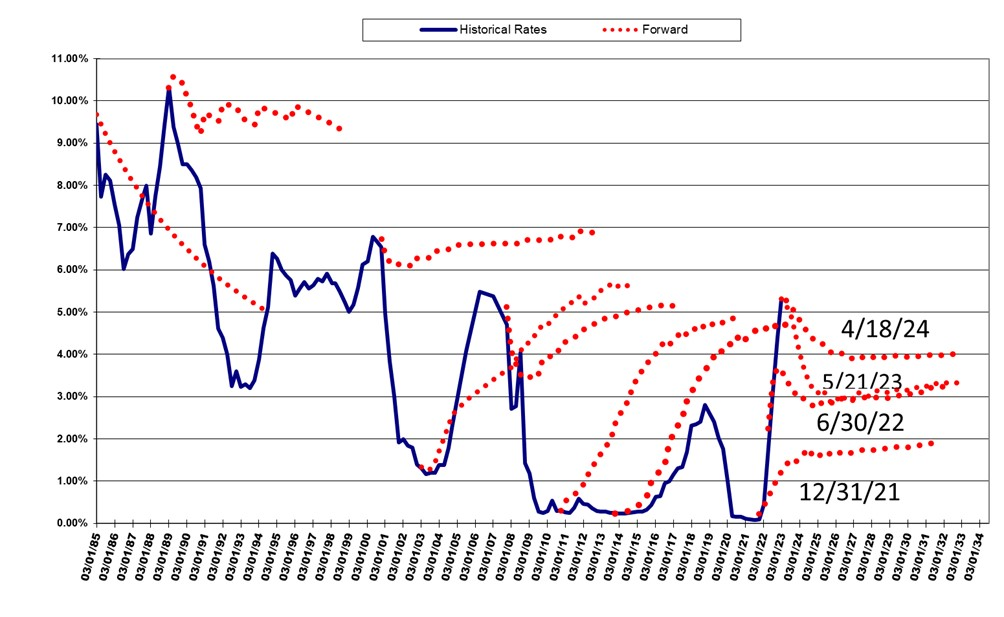

This is an excellent moment to point something out: the “market” is really, really bad at predicting interest rate policy. Just look at this chart below which compares the future expectations of rates at a given time with what actually ended up happening. It’s not a good track record.

Source: www.SouthStateCorrespondent.com

This tracks with what we’ve been talking about for some time. It’s not the accuracy of the predictions, but instead the impact of those predictions being wrong. We felt that a bit this week as the market continued to pull the reigns in on their expectations. It had a tangible impact on the markets.

But we’ve now eaten much of the shift from “super aggressive” to “maybe they’ll cut rates again”. That means there is less risk of a conservative Fed scaring the market in the coming months. And instead, we can focus on the economy and valuations – things that are far easier to manage than “expectations”. And right now, both look solid. Especially after a little “breather” last week. It seems like there are plenty of opportunities ahead.

Sincerely,