The Weekly Insight Podcast – The Panic That Wasn’t

Before we dive in this week, we wanted to take a moment to thank everyone who joined us at the Iowa State Fair on Saturday. We know it’s a big commitment of time to battle the crowds, but we hope you enjoyed it as much as we enjoyed seeing all of you. Having over 300 members of Team Insight all in one place for an afternoon is a ton of fun. We’re grateful for all of you!

Now let’s dig into last week. It was…interesting! Anytime you start a Monday morning with markets off more than 4%, you get the feeling it’s going to be a long week. But what really happened? And how scared should we be? Let’s go through the chronology and then take a quick peek at what’s ahead.

Sunday Night

We spent most of last week’s memo going through what happened on Friday, August 2nd. As you’ll recall, a bad jobs report caused U.S. markets to sell off, driving some pundits to begin screaming “recession!”. An obvious over-reaction (in our opinion…more on that later). But enough to get the world squirming over the weekend.

That squirming became trading on Sunday night when Asian markets opened. They hadn’t yet had a chance to react to the news in the U.S. (they were closed Friday by the time the jobs report came out), and the swings were violent. The Japanese Nikkei was the most impacted and closed down over 12% early Monday morning.

But Japanese markets weren’t down 12% because of a true economic panic. They were down 12% because of an obscure trading strategy that got caught on the wrong side of the news: the Japan Carry Trade.

What is (was) the Japan Carry Trade? It was simple: while the rest of the world has been raising interest rates to address inflation, Japan has been lowering interest rates to address deflation. As such, there was a disparity that investors could take advantage of: borrowing yen cheaply (0.50%) and using the proceeds of that loan to buy higher yielding U.S. securities that were paying 5.00% or more in interest. It was an “easy” way to make 4 percent or more on someone else’s money. Not a bad deal…until it was.

Last weekend’s swings in global markets coincided with Japan raising their interest rate while rates are falling (or soon to fall) around the rest of the globe. Investors in the Japan carry trade got caught upside down and had to unwind very quickly causing massive volatility in Japanese markets. And the wick was lit…

Monday Morning

A difficult day Friday, followed by the worst trading day in the Nikkei since 1987 on Sunday night, meant the U.S. was in prime panic mode on Monday morning. The S&P 500 was off over 4% shortly after the open and the Nasdaq was down more than 6.2%. Those seem like pretty scary numbers. Surely, if the market continued at those levels those would be historically bad days, right? Actually no. In fact, those wouldn’t even creep into the worst 20 days in the history of the respective indices.

Source: www.Wikipedia.com

Past performance is not indicative of future results.

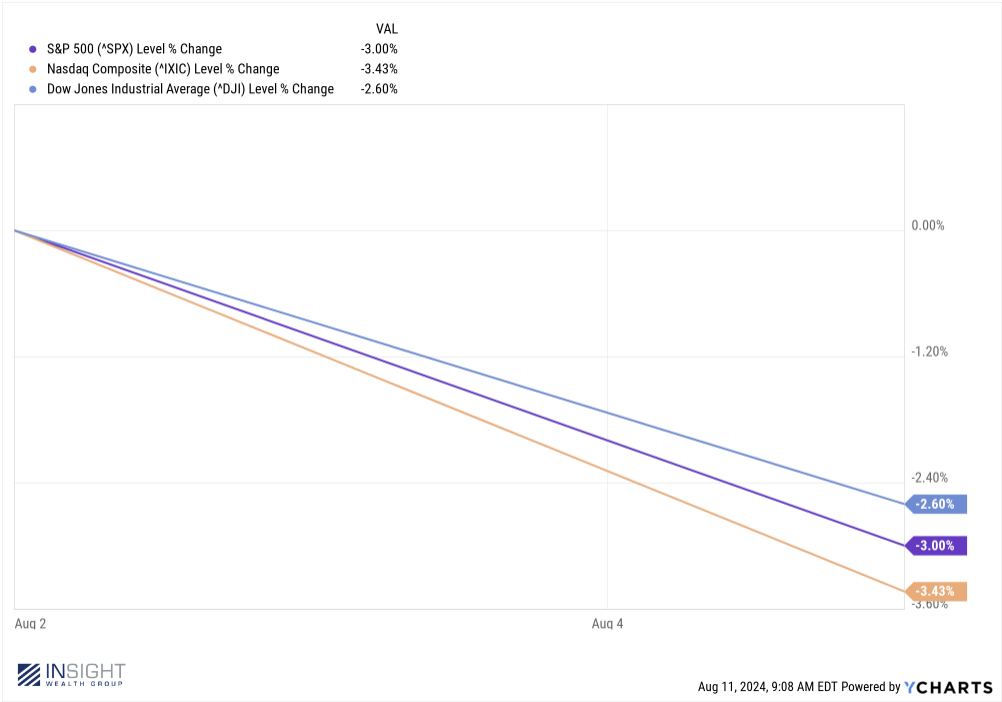

And, thankfully, all three major U.S. indices recovered a bit and had a bad day…but not a horrible one.

Past performance is not indicative of future results.

The Rest of the Week

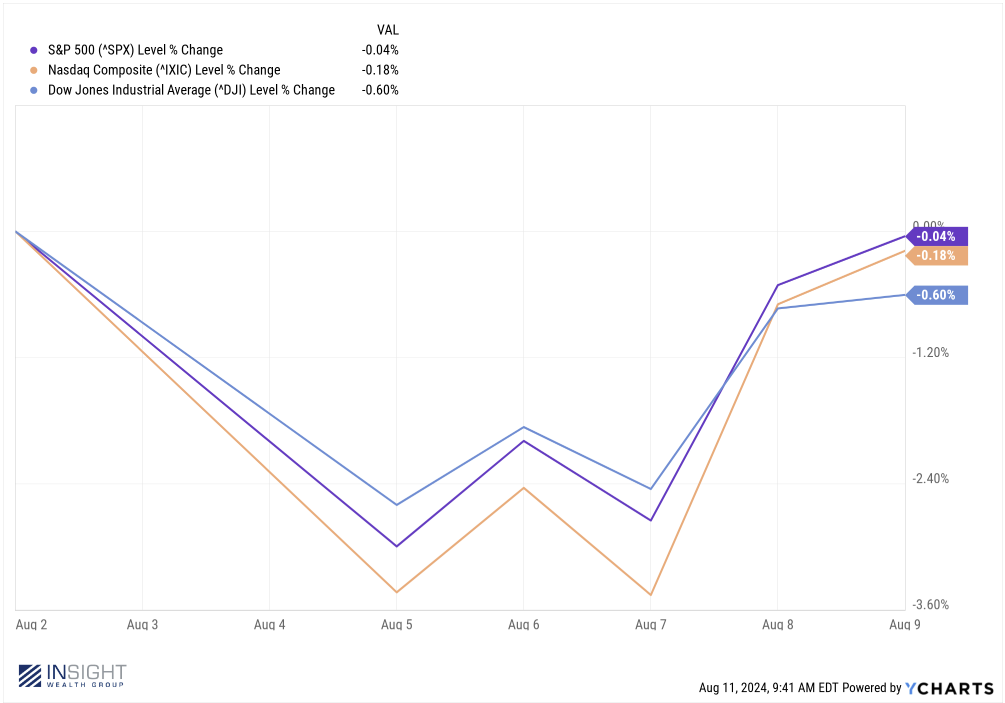

As we’ve said many times in these pages, there are two kinds of volatility: good volatility and bad volatility. The rest of the week included a bit of both. But the result – from the close of markets on Friday, August 2nd to the close on Friday, August 9th was… pretty underwhelming. Markets were largely flat.

Past performance is not indicative of future results.

Why? The economic data we got through last week was quite positive. Services PMI came in at a solid 55 (anything above 50 is expansionary). The Atlanta Fed bumped their Q3 GDP forecast from 2.5% to 2.9%. And initial jobless claims came in at 233,000 jobs, down 6.8% from the week prior. All news that would seem to counter the “world is ending” theme that was all over financial media on Monday.

And there is no economic news we’re expecting this week that should throw things off kilter. The biggest news of the week will be the CPI data on Wednesday, but the expectation is it will be a non-issue. Core CPI is expected to drop from 3.3% to 3.2% and all-items CPI is expected to remain at 3.0%. Neither would impact the Fed’s move to cut rates in September.

So, we’re back to where we started. We still believe there are three particularly important themes to the market between now and Election Day:

- The rotation from tech stocks to “everything else”

- The Fed and interest rates

- The state of the Presidential race

None of that changed last week. And it isn’t going to change for a while. The rotation will continue, the Fed isn’t meeting again until September 18th. And the Presidential race will remain close.

That means you need to expect more volatility, but it will likely mirror what we saw this week: a lot of noise with little dramatic impact. If the economy remains in a strong position, this drama will matter, but only at the margins.

In the meantime, we continue to sit on a sizeable amount of “dry powder” in portfolios. There will come an opportunity to take advantage of it, but we’re not there yet.

Sincerely,