The Weekly Insight Podcast – They Don’t Believe You

Before we dive in, we just wanted to offer a (belated) Happy Father’s Day to all the dads out there. As we have many dads on our team, it’s a special day. But don’t tell our kids that it’s so important because it’s a great moment to remember just how special they are to us and how – positively – they have changed our lives. We’ll keep that secret just for the dads… Nonetheless, we hope you had a wonderful day and were able to celebrate!

Last week we got to have a bit of fun with the memo. While we’d love to talk more about Roaring Kitties and meme stocks, sometimes we must get down to business. And this is one of those times. The Fed met again on Tuesday and Wednesday which meant we got a “Dot Plot”, an exciting press conference from Chairman Powell, and – just for fun – a CPI report that dropped just five hours before the Fed announced their plans.

Bluntly, Wednesday easily could have been a day when the market went off the rails. It didn’t (thankfully). And much of that was due to some good news. But it also was due to the market doing their best Ron Burgundy in response to the Fed.

Yet again, the market is more optimistic about what the Fed is going to do than the Fed is. Sound familiar? January 2023, the market anticipated rate cuts starting in May 2023. December 2023, the market anticipated seven rate cuts in 2024, starting March. Now, in June 2024, the Fed is saying one rate cut this year (and four next year, which is interesting). The market still doesn’t buy it.

Source: www.CMEGroup.com

Past performance is not indicative of future results.

The market is now pricing in five rate cuts over the next 13 months and two between now and the end of the year.

That’s led to significant optimism in the markets. The S&P 500 broke 5,400 for the first time last week and closed Friday just below its all-time high.

Past performance is not indicative of future results.

So, is it different this time? Why – when Powell & Co. actually lowered their estimates for rate cuts in 2024 – is the market all fired up? Are we just the dog at the racetrack chasing the bunny? Or is there a real reason to be optimistic about things?

The first reason for a bit of optimism comes from the CPI data we got last week. CPI was released early on Wednesday morning, just a few hours before the Fed released their projections. It should be noted that Chairman Powell said the Committee had drafted their projections prior to the CPI report being released. And it’s worth remembering that – according to Powell – CPI isn’t their measurement for inflation. It’s PCE. But it’s still worth watching.

The CPI data for May showed a decent amount of improvement from the previous few months. All-items CPI did not grow at all for the month, coming in at 0.0%. And Core CPI grew at just 0.16%, well below the expectation.

Additionally, you may remember us talking about “Super Core” CPI in the past. Super Core is Core CPI minus shelter, which has been acting…strangely…to say the least. Super Core actually fell last month. It was disinflationary. We haven’t seen that in a while. In fact, just a few months ago, journalists were suggesting that Super Core growth meant the Fed was losing the inflation battle. That’s a big turnaround.

Then, on Thursday, we got the Producers Price Index (PPI) data. It’s the other side of inflation. How much are costs growing for those making the products and selling them to consumers?

PPI has, historically, been a leading indicator of CPI. And the data for May was great. All-Items PPI dropped 0.2% month-over-month and came in at 2.2% year-over-year. Core was flat for the month and at 2.3% year-over-year.

All of this brings to light a slight change we saw in the Fed’s statement this month. For the last few months, the statement has said there “has been a lack of further progress towards the Committee’s 2% inflation objective”. Last week it highlighted “modest further progress towards…the 2% objective”. Even while cutting their expectations for rate cuts, they acknowledged inflation was improving. A few more inflation reads like this and a move to more cuts seems likely.

We can hear you now: But wait, Insight! Didn’t you just take some risk off the table a few weeks ago? If the likelihood of more cuts is improving, was that a huge mistake?

We don’t think so. First, we still have plenty of exposure to the markets. If the markets continue to rise, we’ll participate.

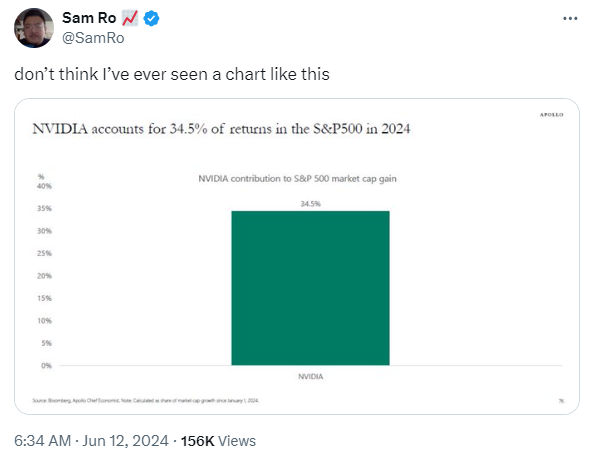

But we also know that markets are getting a little pricey. The rally has narrowed again, and names like NVIDA are leading the charge while a great deal of the rest of the market isn’t participating. One simple tweet explains that better than we could:

Source: www.X.com/SamRo

And, technically, the market is getting stretched as well. Recently, when we’ve seen the 20-day moving average stretch this far beyond the 50-day moving average, it has tended to mean a short-term correction is on the way.

And then there’s the simple fact that the Fed isn’t going to do anything until at least September. The likelihood of them changing their minds by next month’s meeting is slim-to-none. Even the market agrees with that, putting 88% odds on no rate change in July.

There isn’t an August meeting (they’re on vacation), so that means the earliest we’ll get any good news on rates is September 18th, fully three months from this week. That’s a long time to go based on simple optimism.

The market may be right not to believe Chair Powell. But it’s also a great idea to have a bit of skepticism about the next few months in the market as well. Nothing in this world is a straight line.

Sincerely,